Region:Global

Author(s):Geetanshi

Product Code:KRAA0097

Pages:90

Published On:August 2025

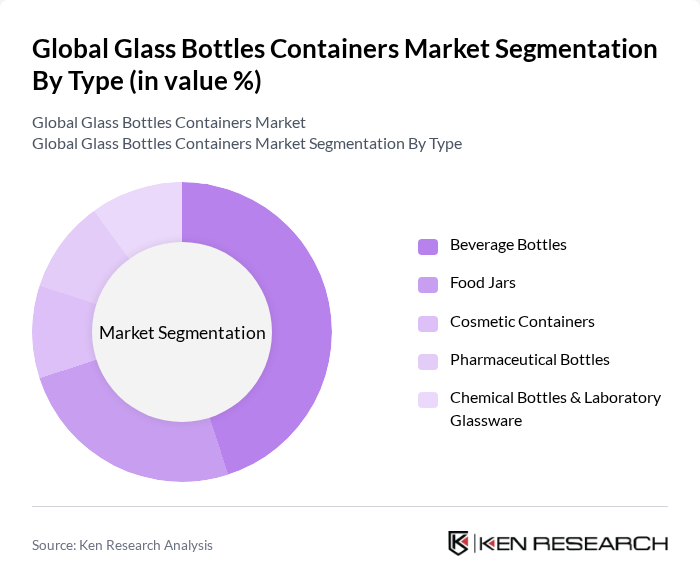

By Type:The market is segmented into various types of glass containers, including Beverage Bottles, Food Jars, Cosmetic Containers, Pharmaceutical Bottles, and Chemical Bottles & Laboratory Glassware. Among these, Beverage Bottles dominate the market due to rising consumption of bottled beverages, including soft drinks, juices, and alcoholic drinks. The trend toward premiumization in the beverage sector has led to increased demand for aesthetically pleasing and functional glass bottles. Food Jars and Pharmaceutical Bottles follow, driven by the need for safe and sustainable packaging solutions in the food and healthcare industries .

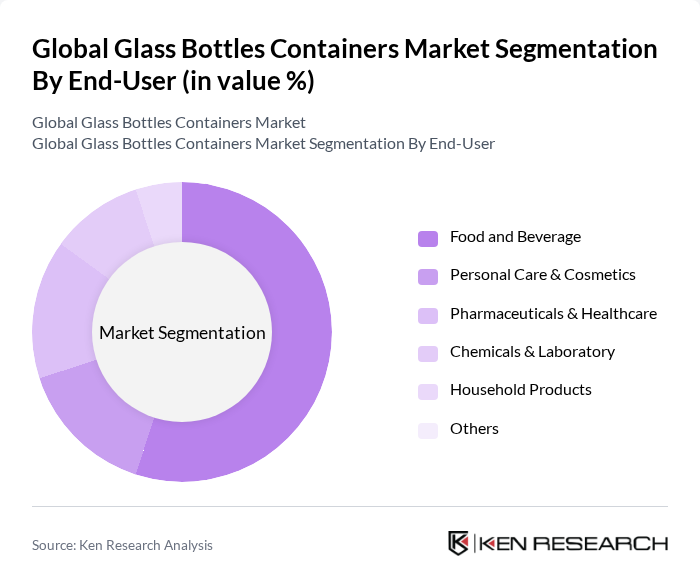

By End-User:The end-user segmentation includes Food and Beverage, Personal Care & Cosmetics, Pharmaceuticals & Healthcare, Chemicals & Laboratory, Household Products, and Others. The Food and Beverage sector is the largest consumer of glass containers, driven by increasing demand for packaged food and beverages. The trend toward healthier and organic products has also led to a rise in the use of glass packaging, as it is perceived as a safer and more sustainable option. The Pharmaceuticals & Healthcare segment is also significant, as glass is preferred for its inert properties and ability to maintain product integrity .

The Global Glass Bottles Containers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Owens-Illinois, Inc. (O-I Glass, Inc.), Ardagh Group S.A., Verallia S.A., Saint-Gobain S.A., Crown Holdings, Inc., Amcor plc, Schott AG, Nihon Yamamura Glass Co., Ltd., Gerresheimer AG, Constellation Brands, Inc., Vidrala S.A., Allied Glass Containers Ltd., Bormioli Rocco S.p.A., Piramal Glass Private Limited, Vetropack Holding Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the glass bottles market appears promising, driven by increasing consumer demand for sustainable packaging and the ongoing shift towards eco-friendly materials. As the beverage industry continues to expand, particularly in emerging markets, glass bottles are likely to gain further traction. Additionally, advancements in recycling technologies and the development of refillable glass solutions will enhance the market's sustainability profile, positioning it favorably against alternative packaging materials in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beverage Bottles Food Jars Cosmetic Containers Pharmaceutical Bottles Chemical Bottles & Laboratory Glassware |

| By End-User | Food and Beverage Personal Care & Cosmetics Pharmaceuticals & Healthcare Chemicals & Laboratory Household Products Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Retail Packaging Industrial Packaging Bulk Packaging Specialty & Premium Packaging Others |

| By Design | Standard Bottles Custom Shapes Decorative Bottles Functional & Smart Designs Others |

| By Size | Small Bottles (<200ml) Medium Bottles (200ml–1L) Large Bottles (>1L) Bulk Containers Others |

| By Sustainability Features | Recyclable Glass Reusable Glass Eco-friendly Coatings Lightweight Glass Low-Carbon Manufacturing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 60 | Packaging Managers, Product Development Leads |

| Pharmaceutical Glass Bottles | 45 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Cosmetic & Personal Care Bottles | 40 | Brand Managers, Supply Chain Coordinators |

| Industrial Glass Containers | 40 | Procurement Managers, Operations Directors |

| Recycling and Sustainability Initiatives | 40 | Sustainability Managers, Environmental Compliance Officers |

The Global Glass Bottles Containers Market is valued at approximately USD 71.5 billion, reflecting a significant demand for sustainable packaging solutions across various sectors, including food and beverage, cosmetics, and pharmaceuticals.