Region:Global

Author(s):Geetanshi

Product Code:KRAA1183

Pages:80

Published On:August 2025

By Type:The glider aircraft market is segmented into various types, including sailplanes, motor gliders, training gliders, competition gliders, vintage and classic gliders, hang gliders, ultralight gliders, and others. Among these, sailplanes and motor gliders are the most popular due to their versatility and ease of use. Sailplanes are favored for recreational flying and represent the dominant segment, while motor gliders are increasingly used for training purposes and benefit from technological advancements in propulsion. The demand for training gliders is also on the rise as more individuals seek to obtain their pilot licenses .

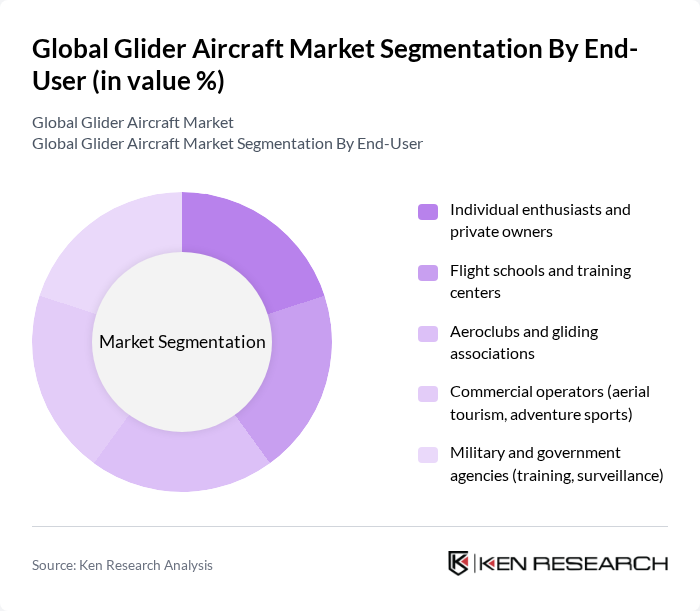

By End-User:The end-user segmentation of the glider aircraft market includes individual enthusiasts, flight schools, aeroclubs, commercial operators, and military agencies. Individual enthusiasts and flight schools are the primary consumers, as they drive demand for training and recreational gliding. The rise in adventure tourism has also led to increased interest from commercial operators, who offer gliding experiences to tourists. Military agencies utilize gliders for training and surveillance, though their share remains below 15% of total market applications .

The Global Glider Aircraft Market is characterized by a dynamic mix of regional and international players. Leading participants such as DG Flugzeugbau GmbH, Schempp-Hirth Flugzeugbau GmbH, Alexander Schleicher GmbH & Co. KG, Jonker Sailplanes (Pty) Ltd, Pipistrel d.o.o., HPH Ltd. (HPH Sailplanes), Allstar PZL Glider Sp. z o.o., AMS Flight d.o.o., Stemme AG, Lange Aviation GmbH, Aero East Europe d.o.o., LET Aircraft Industries (L-13 Blanik), Alisport Srl, Ximango (Aeromot Aeronaves e Motores S.A.), SZD Allstar (Poland) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the glider aircraft market appears promising, driven by technological advancements and a growing emphasis on sustainability. As electric propulsion systems become more viable, manufacturers are likely to invest in research and development, leading to innovative designs and improved performance. Additionally, the increasing popularity of aerial tourism presents new avenues for growth, as more individuals seek unique flying experiences. The combination of these trends is expected to foster a dynamic market environment, encouraging both investment and consumer interest in glider aircraft.

| Segment | Sub-Segments |

|---|---|

| By Type | Sailplanes (conventional gliders) Motor gliders (self-launching and sustainer types) Training gliders (two-seat trainers) Competition gliders (high-performance) Vintage and classic gliders Hang gliders and ultralight gliders Others (experimental, research) |

| By End-User | Individual enthusiasts and private owners Flight schools and training centers Aeroclubs and gliding associations Commercial operators (aerial tourism, adventure sports) Military and government agencies (training, surveillance) |

| By Application | Recreational flying Pilot training and education Competitive gliding and sports events Aerial photography and surveying Research and development |

| By Material | Composite materials (carbon fiber, fiberglass) Aluminum alloys Wood and fabric Steel (for structural components) |

| By Distribution Channel | Direct sales (manufacturer to customer) Authorized dealerships and distributors Online sales platforms |

| By Price Range | Entry-level/budget gliders Mid-range gliders Premium/high-performance gliders |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Glider Manufacturing Sector | 100 | Production Managers, R&D Engineers |

| Flight Training Organizations | 80 | Chief Instructors, Operations Managers |

| Gliding Clubs and Associations | 70 | Club Presidents, Safety Officers |

| Aerospace Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Glider Accessory Suppliers | 60 | Sales Managers, Product Development Leads |

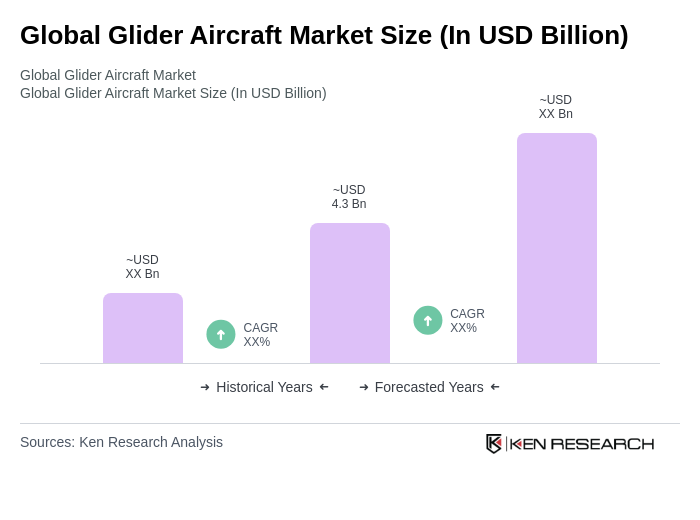

The Global Glider Aircraft Market is valued at approximately USD 4.3 billion, reflecting a five-year historical analysis. This growth is attributed to increased interest in recreational flying and advancements in glider technology.