Region:Global

Author(s):Geetanshi

Product Code:KRAB0149

Pages:88

Published On:August 2025

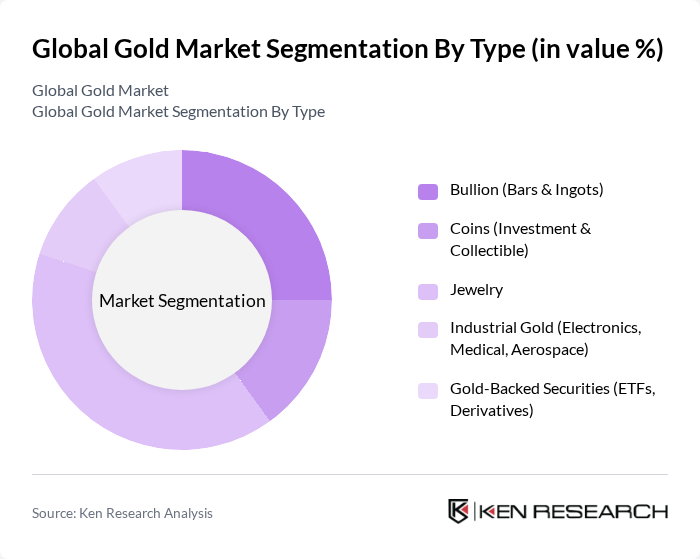

By Type:The market is segmented into Bullion (Bars & Ingots), Coins (Investment & Collectible), Jewelry, Industrial Gold (Electronics, Medical, Aerospace), and Gold-Backed Securities (ETFs, Derivatives). Among these, Jewelry remains the dominant segment, driven by cultural significance and consumer preferences in regions like Asia and the Middle East. Demand for Bullion and Gold-Backed Securities has also seen significant growth, particularly among investors seeking to hedge against inflation and economic instability .

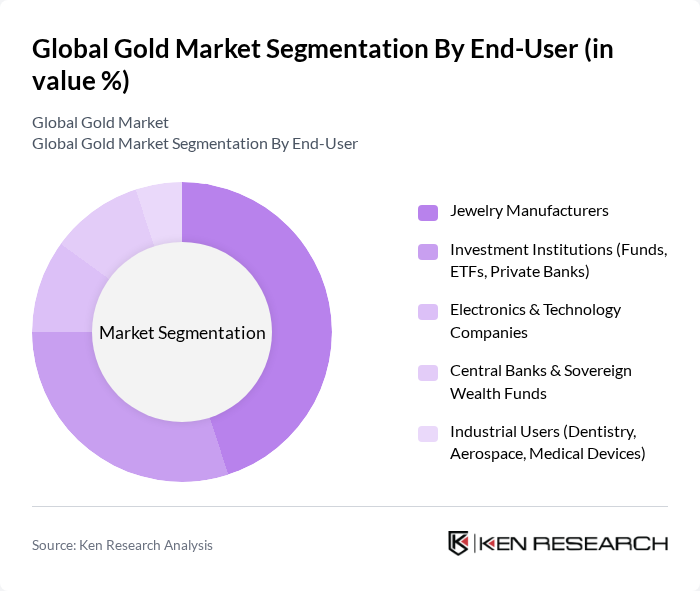

By End-User:The end-user segmentation includes Jewelry Manufacturers, Investment Institutions (Funds, ETFs, Private Banks), Electronics & Technology Companies, Central Banks & Sovereign Wealth Funds, and Industrial Users (Dentistry, Aerospace, Medical Devices). The Jewelry Manufacturers segment leads the market, fueled by the cultural importance of gold jewelry in various regions, particularly in Asia. Investment Institutions are also significant players, as they increasingly allocate funds to gold as a hedge against market volatility .

The Global Gold Market is characterized by a dynamic mix of regional and international players. Leading participants such as Barrick Gold Corporation, Newmont Corporation, AngloGold Ashanti Limited, Gold Fields Limited, Kinross Gold Corporation, Agnico Eagle Mines Limited, Royal Gold, Inc., Wheaton Precious Metals Corp., Harmony Gold Mining Company Limited, Sibanye Stillwater Limited, Eldorado Gold Corporation, PJSC Polyus, Alamos Gold Inc., Franco-Nevada Corporation, and Equinox Gold Corp. contribute to innovation, geographic expansion, and service delivery in this space.

As the global economy navigates uncertainties, the gold market is poised for continued relevance. The integration of technology in mining and trading, alongside a growing emphasis on sustainability, will shape the industry's future. Additionally, the rise of digital gold platforms is expected to attract younger investors, further diversifying the market. With emerging markets driving demand and ethical sourcing becoming a priority, the gold sector is likely to adapt and thrive in a changing economic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bullion (Bars & Ingots) Coins (Investment & Collectible) Jewelry Industrial Gold (Electronics, Medical, Aerospace) Gold-Backed Securities (ETFs, Derivatives) |

| By End-User | Jewelry Manufacturers Investment Institutions (Funds, ETFs, Private Banks) Electronics & Technology Companies Central Banks & Sovereign Wealth Funds Industrial Users (Dentistry, Aerospace, Medical Devices) |

| By Application | Investment & Wealth Preservation Industrial Use (Electronics, Catalysts, Medical) Jewelry Production Dental & Medical Applications |

| By Sales Channel | Online Retail & Digital Gold Platforms Physical Retail Stores & Dealers Auctions & Exchanges Direct Institutional Sales |

| By Distribution Mode | Direct Distribution (Producer to End-User) Wholesale Distribution (Aggregators, Dealers) E-commerce & Digital Platforms |

| By Price Range | Premium Gold (High Purity, Branded, Certified) Standard/Mid-Range Gold Budget/Low-Cost Gold (Lower Purity, Scrap, Recycled) |

| By Market Segment | Retail Market Institutional Market Central Bank & Government Purchases Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Jewelry Retailers | 100 | Store Managers, Buyers, and Sales Executives |

| Gold Mining Companies | 60 | CEOs, Operations Managers, and Geologists |

| Investment Firms | 50 | Portfolio Managers, Analysts, and Financial Advisors |

| Gold Refiners | 40 | Production Managers, Quality Control Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers, and Economic Analysts |

The Global Gold Market is valued at approximately USD 2.5 trillion, driven by demand for gold as a safe-haven asset and increasing consumer interest in gold jewelry and investment products.