Region:Global

Author(s):Shubham

Product Code:KRAD0654

Pages:95

Published On:August 2025

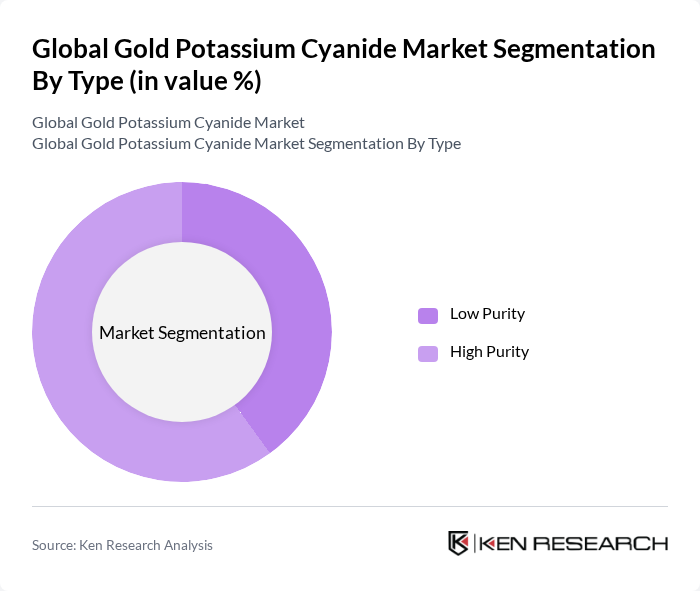

By Type:The market is segmented into Low Purity and High Purity categories. High Purity gold potassium cyanide is the dominant grade in electronics and fine jewelry electroplating due to superior deposit quality, conductivity, and consistency required for micro-connectors and premium finishes. Low Purity material is used in less critical decorative or industrial contexts where ultra-fine deposit control is not essential. As electronics interconnects continue to miniaturize and luxury jewelry quality standards rise, High Purity demand is increasing in share and value contribution .

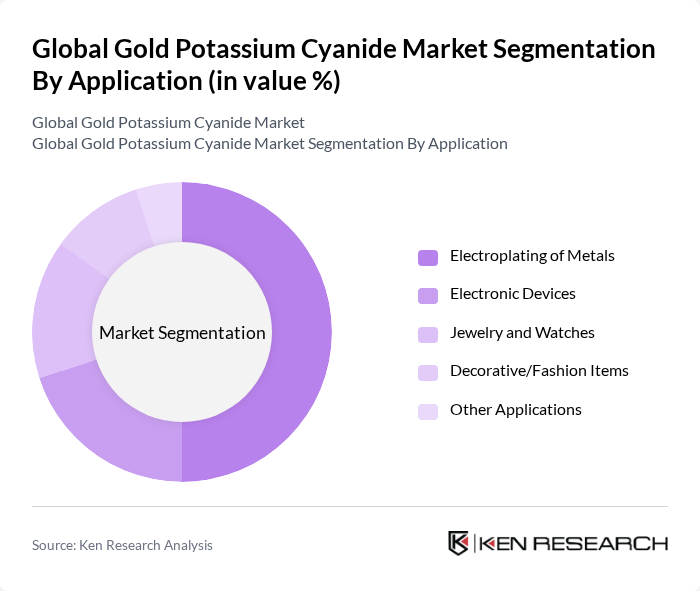

By Application:The applications of gold potassium cyanide include Electroplating of Metals, Electronic Devices, Jewelry and Watches, Decorative/Fashion Items, and Other Applications. Electroplating is the largest segment, supported by widespread use of gold-plated connectors, contacts, and finishes in electronics and premium jewelry. Increasing use of high-reliability interconnects and corrosion-resistant coatings sustains volumes in electronics and precision components, while customization and premiumization trends maintain steady jewelry demand .

The Global Gold Potassium Cyanide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Heimerle + Meule GmbH, Umicore N.V., Met-Mex Peñoles, S.A.B. de C.V. (Química del Rey), Heraeus Holding GmbH, Johnson Matthey plc, Metalor Technologies SA, SPECTRA GPC Chem (India) Pvt. Ltd., Faggi Enrico S.p.A., Ishifuku Metal Industry Co., Ltd., AUROMET S.p.A. (Italy), Nihon Kohden Kogyo Co., Ltd. (NKC), Chimet S.p.A., Tanaka Kikinzoku Kogyo K.K. (Tanaka Precious Metals), SAXONIA Galvanik GmbH, and Bangalore Refinery (BRPL) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the gold potassium cyanide market appears promising, driven by technological advancements and a growing emphasis on sustainable practices. As mining companies increasingly adopt digital solutions and automation, operational efficiencies are expected to improve. Additionally, the rising focus on environmental sustainability will likely lead to the development of safer cyanide alternatives, which could reshape the market landscape. Overall, the industry is poised for transformation, balancing profitability with environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Low Purity High Purity |

| By Application | Electroplating of Metals Electronic Devices Jewelry and Watches Decorative/Fashion Items Other Applications |

| By End-User | Electronics Manufacturers Jewelry Manufacturers Electroplating Job Shops Industrial Component Manufacturers |

| By Distribution Channel | Direct Sales (Manufacturers to End-Users) Authorized Distributors Online/Procurement Portals |

| By Packaging Type | Bulk Packaging (Drums/IBC) Standard Industrial Packs Custom/Returnable Packaging |

| By Region | North America Europe Asia-Pacific Middle East & Africa South & Central America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Industry Stakeholders | 120 | Mining Engineers, Operations Managers |

| Chemical Manufacturing Firms | 90 | Production Managers, Quality Control Analysts |

| Regulatory Bodies and Environmental Agencies | 50 | Compliance Officers, Environmental Scientists |

| Gold Trading and Investment Firms | 70 | Investment Analysts, Portfolio Managers |

| Research Institutions and Academia | 60 | Research Scientists, Professors in Chemical Engineering |

The Global Gold Potassium Cyanide Market is valued at approximately USD 1.05 billion, reflecting steady growth driven by demand in gold electroplating for electronics and jewelry, particularly in miniaturized applications and premium finishes.