Region:Global

Author(s):Shubham

Product Code:KRAD0664

Pages:86

Published On:August 2025

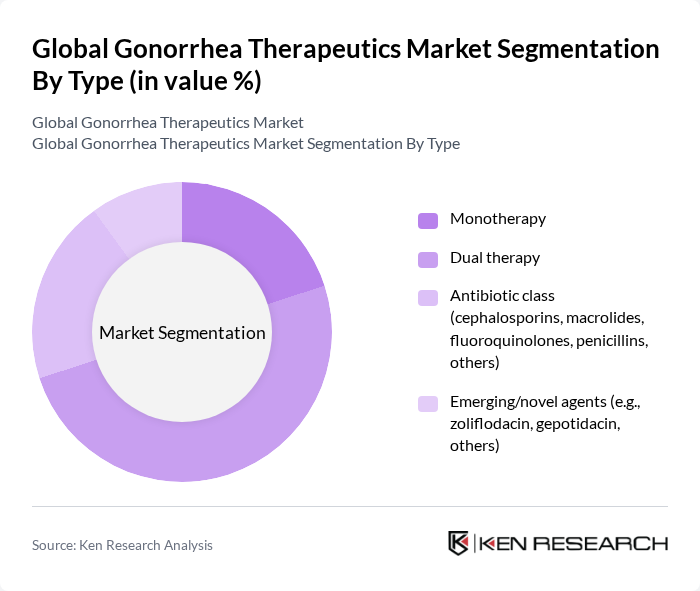

By Type:The market is segmented into various types, including monotherapy, dual therapy, antibiotic classes (cephalosporins, macrolides, fluoroquinolones, penicillins, others), and emerging/novel agents (e.g., zoliflodacin, gepotidacin, others). Clinical guidance in major markets currently centers on ceftriaxone-based monotherapy for uncomplicated infections to address resistance stewardship, while dual therapy is reserved based on site or resistance considerations; late-stage novel agents such as zoliflodacin and gepotidacin are advancing and expected to influence future practice upon approval .

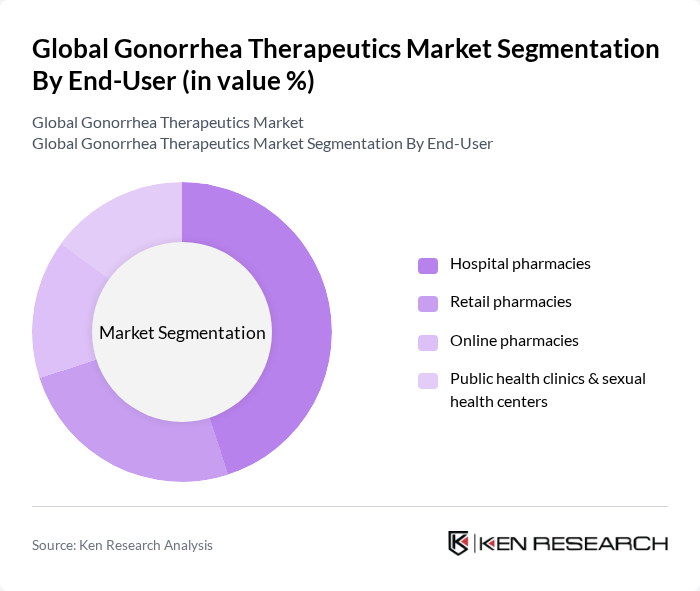

By End-User:The end-user segmentation includes hospital pharmacies, retail pharmacies, online pharmacies, and public health clinics & sexual health centers. Hospital pharmacies dominate this segment given their role in managing complicated cases, injectable ceftriaxone administration, and stewardship programs aligned with public health initiatives; government and public health funding to address antimicrobial resistance also supports institutional channels .

The Global Gonorrhea Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline plc (GSK), Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Merck & Co., Inc. (MSD), Entasis Therapeutics (Innoviva Specialty Therapeutics), GARDP (Global Antibiotic Research & Development Partnership), Innoviva, Inc., GlaxoSmithKline plc & Shinogi & Co., Ltd. (gepotidacin partners), Hovione Capital/Iterum Therapeutics plc, Spero Therapeutics, Inc., Qpex Biopharma, Inc. (INFEX Therapeutics collaboration), F. Hoffmann-La Roche Ltd (diagnostics interface), Sanofi, Viatris Inc. (including legacy Mylan for azithromycin), Shionogi & Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of gonorrhea therapeutics in None is poised for transformation, driven by ongoing research and technological advancements. The integration of personalized medicine and telehealth solutions is expected to enhance treatment accessibility and effectiveness. Additionally, increased collaboration between pharmaceutical companies and healthcare organizations will likely foster innovation in therapeutic development. As public health initiatives continue to evolve, a stronger focus on preventive measures and education will further support the fight against gonorrhea, ultimately improving health outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Monotherapy Dual therapy Antibiotic class (cephalosporins, macrolides, fluoroquinolones, penicillins, others) Emerging/novel agents (e.g., zoliflodacin, gepotidacin, others) |

| By End-User | Hospital pharmacies Retail pharmacies Online pharmacies Public health clinics & sexual health centers |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online pharmacies Government procurement & NGO programs |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Gonococcal Infection | Uncomplicated gonococcal infection Gonococcal arthritis Gonococcal meningitis and endocarditis |

| By Route of Administration | Injectable Oral |

| By Care Setting | Outpatient Emergency care Inpatient |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 140 | Infectious Disease Specialists, General Practitioners |

| Pharmaceutical Sales Representatives | 100 | Sales Managers, Territory Representatives |

| Patients Undergoing Treatment | 80 | Individuals diagnosed with gonorrhea, Treatment Adherence Participants |

| Pharmacy Managers | 70 | Pharmacists, Pharmacy Operations Managers |

| Public Health Officials | 60 | Health Policy Advisors, Epidemiologists |

The Global Gonorrhea Therapeutics Market is valued at approximately USD 1.3 billion, reflecting a consistent demand driven by the increasing burden of gonorrhea infections and the utilization of treatment options across various regions.