Region:Global

Author(s):Geetanshi

Product Code:KRAA0160

Pages:91

Published On:August 2025

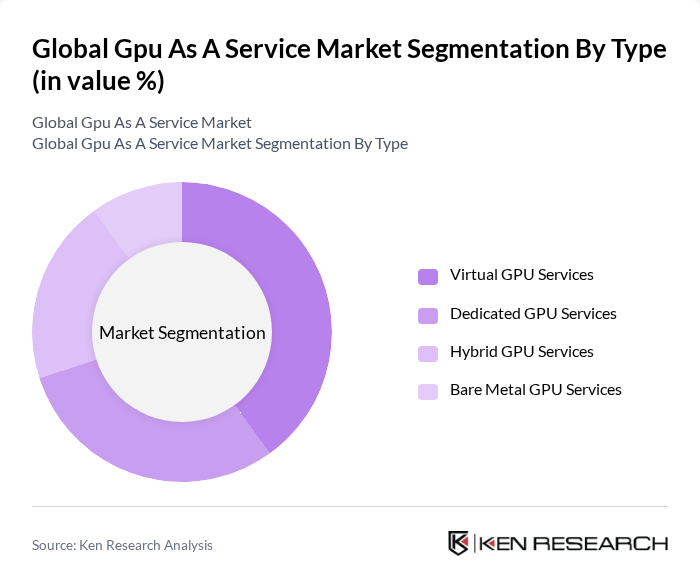

By Type:The GPU as a Service market can be segmented into four main types: Virtual GPU Services, Dedicated GPU Services, Hybrid GPU Services, and Bare Metal GPU Services. Each of these sub-segments addresses different customer requirements: Virtual GPU Services are popular for their flexibility and cost-effectiveness, Dedicated GPU Services are preferred for high-performance and latency-sensitive tasks, Hybrid GPU Services offer a balance between scalability and control, and Bare Metal GPU Services provide direct access to physical hardware for maximum performance .

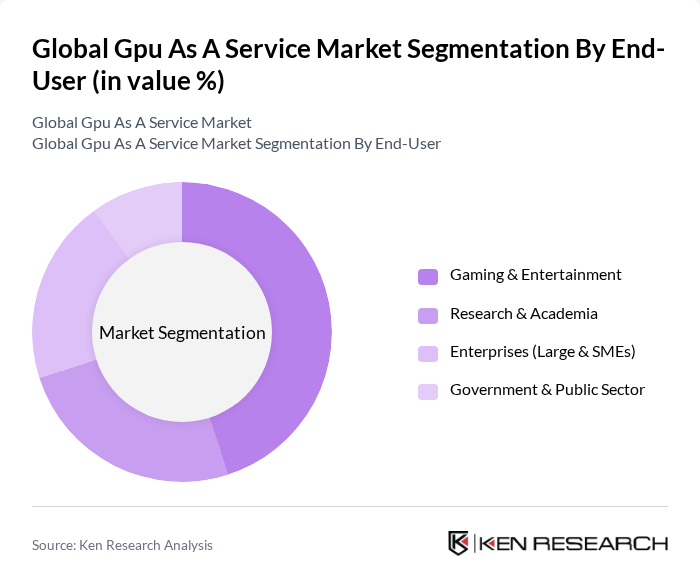

By End-User:The end-user segmentation includes Gaming & Entertainment, Research & Academia, Enterprises (Large & SMEs), and Government & Public Sector. The Gaming & Entertainment sector is currently the leading segment, driven by the increasing demand for high-quality graphics, real-time rendering, and cloud gaming platforms. Research & Academia is also experiencing rapid growth due to the need for advanced computational resources for AI, scientific modeling, and data analysis. Enterprises are leveraging GPUaaS for scalable AI, analytics, and digital transformation, while the Government & Public Sector is adopting GPUaaS for secure, high-performance computing in public initiatives .

The Global GPU as a Service market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure, IBM Cloud, Oracle Cloud Infrastructure (OCI), Alibaba Cloud, DigitalOcean, Vultr, Linode (Akamai), Paperspace, OVHcloud, Rackspace Technology, Scaleway, CoreWeave, Lambda Labs, Genesis Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of GPUaaS is poised for significant transformation, driven by technological advancements and evolving user needs. As organizations increasingly adopt hybrid cloud solutions, the integration of AI into GPU services will enhance performance and accessibility. Furthermore, the focus on sustainability will lead to the development of energy-efficient GPU solutions, aligning with global environmental goals. These trends indicate a robust growth trajectory for GPUaaS, positioning it as a critical component in the digital transformation of various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual GPU Services Dedicated GPU Services Hybrid GPU Services Bare Metal GPU Services |

| By End-User | Gaming & Entertainment Research & Academia Enterprises (Large & SMEs) Government & Public Sector |

| By Application | Artificial Intelligence & Machine Learning Data Analytics & Big Data Graphics & Video Rendering Scientific Computing & Simulation Cloud Gaming |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Healthcare & Life Sciences Automotive & Transportation Financial Services & Fintech Media & Entertainment Manufacturing Others |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Pay-as-you-go Subscription-based Reserved Instances Spot/Pricing Auctions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise GPU Utilization | 100 | CTOs, IT Managers |

| Cloud Service Provider Insights | 60 | Product Managers, Business Development Leads |

| AI and Machine Learning Applications | 50 | Data Scientists, AI Researchers |

| Gaming Industry GPU Usage | 40 | Game Developers, Technical Directors |

| Healthcare Data Processing | 40 | Healthcare IT Specialists, Data Analysts |

The Global GPU as a Service market is valued at approximately USD 8.8 billion, driven by the increasing demand for high-performance computing and advancements in artificial intelligence and machine learning.