Region:Global

Author(s):Shubham

Product Code:KRAB0702

Pages:87

Published On:August 2025

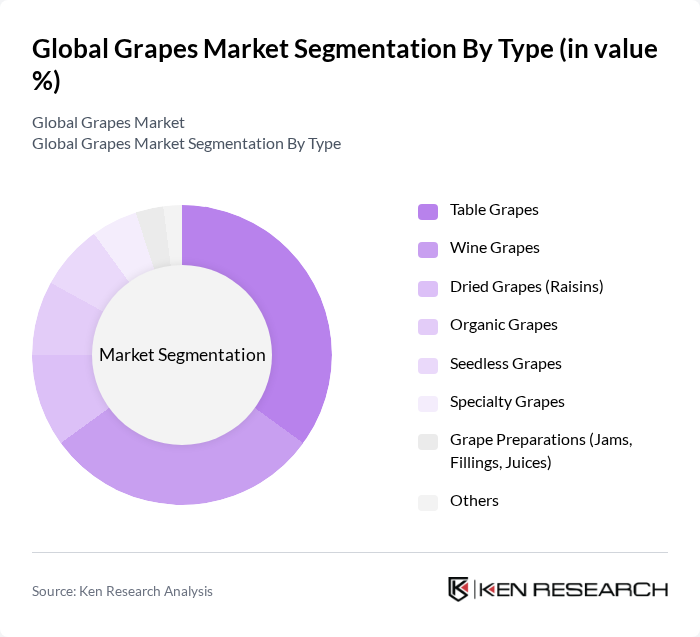

By Type:The market is segmented into table grapes, wine grapes, dried grapes (raisins), organic grapes, seedless grapes, specialty grapes, grape preparations (jams, fillings, juices), and others.Table grapesandwine grapesremain the dominant segments, driven by consumer preferences for fresh consumption and wine production. The demand for organic grapes continues to rise, fueled by health-conscious consumers seeking natural and chemical-free options. Premiumization of seedless and specialty varieties is increasingly evident, with proprietary cultivars commanding higher price premiums and extended shelf life .

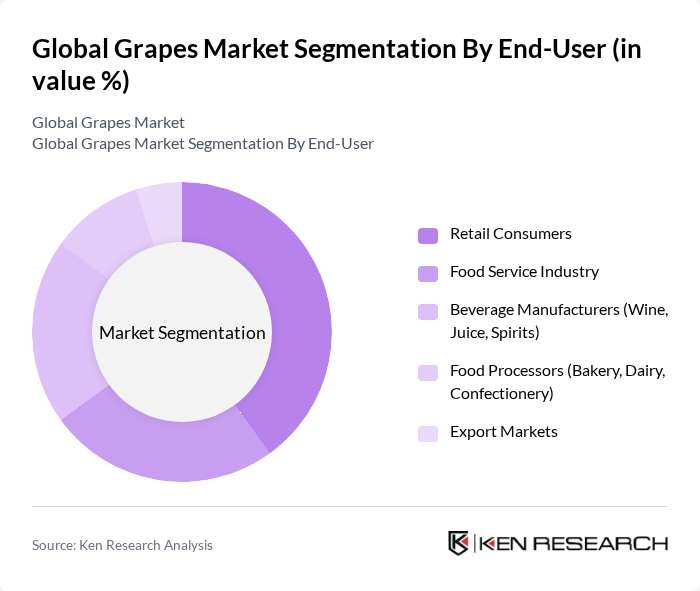

By End-User:The end-user segmentation includes retail consumers, food service industry, beverage manufacturers (wine, juice, spirits), food processors (bakery, dairy, confectionery), and export markets.Retail consumersrepresent the largest segment, reflecting the increasing consumption of fresh grapes as a healthy snack. Beverage manufacturers are significant contributors, driven by the expanding wine industry and rising demand for grape-based beverages. Food processors and export markets also play vital roles in the value chain, with innovations in grape-derived ingredients and international trade flows .

The Global Grapes Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Wonderful Company, Sun World International LLC, Grapery Inc., Del Monte Foods, Inc., Dole Food Company, Inc., Fresh Del Monte Produce Inc., California Table Grape Commission, Capespan Group Limited, E&J Gallo Winery, Constellation Brands, Inc., Bronco Wine Company, Trinchero Family Estates, Jackson Family Wines, Banrock Station, Chateau Ste. Michelle, Grupo Peñaflor, Treasury Wine Estates, ZUEGG S.p.A., AGRANA Beteiligungs-AG, Hero Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the grape market appears promising, driven by increasing health awareness and the demand for organic products. Innovations in agricultural technology are expected to enhance yield and quality, while the expansion of e-commerce platforms will facilitate broader market access. As consumers increasingly seek sustainable and health-oriented options, the grape industry is likely to adapt, focusing on organic and value-added products to meet evolving preferences and capture emerging market segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Table Grapes Wine Grapes Dried Grapes (Raisins) Organic Grapes Seedless Grapes Specialty Grapes Grape Preparations (Jams, Fillings, Juices) Others |

| By End-User | Retail Consumers Food Service Industry Beverage Manufacturers (Wine, Juice, Spirits) Food Processors (Bakery, Dairy, Confectionery) Export Markets |

| By Sales Channel | Direct Sales Online Retail Supermarkets and Hypermarkets Specialty Stores |

| By Distribution Mode | Wholesale Distribution Retail Distribution Direct-to-Consumer |

| By Price Range | Premium Grapes Mid-Range Grapes Budget Grapes |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Geographic Origin | Domestic Grapes Imported Grapes Organic Origin Grapes By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Table Grape Producers | 100 | Farm Owners, Agricultural Managers |

| Wine Grape Growers | 70 | Vineyard Managers, Winemakers |

| Dried Grape Manufacturers | 50 | Production Supervisors, Quality Control Managers |

| Retailers of Grapes | 80 | Store Managers, Category Buyers |

| Exporters of Grapes | 60 | Export Managers, Logistics Coordinators |

The Global Grapes Market is valued at approximately USD 104 billion, reflecting a significant growth trend driven by increasing consumer demand for fresh fruits, health consciousness, and the rising popularity of wine consumption worldwide.