Region:Global

Author(s):Shubham

Product Code:KRAB0549

Pages:93

Published On:August 2025

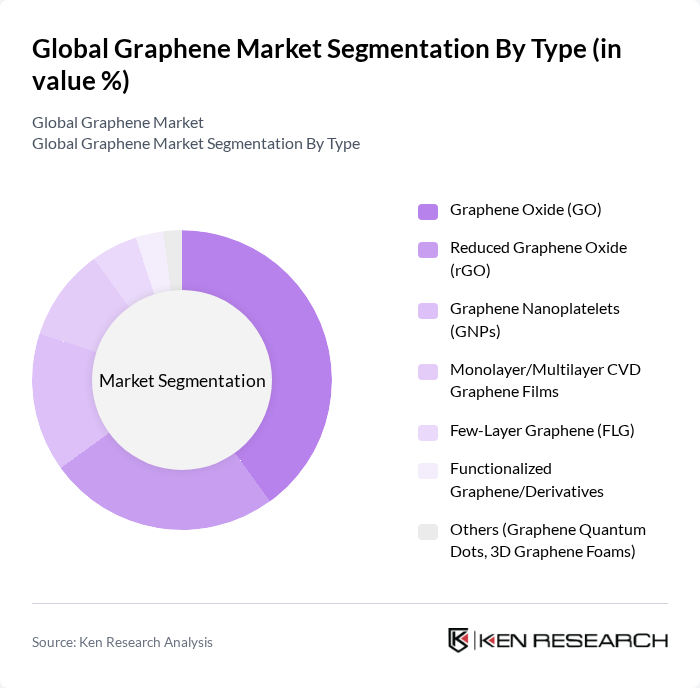

By Type:The market is segmented into various types of graphene, each with unique properties and applications. The leading subsegment is Graphene Oxide (GO), widely used in energy storage electrodes, membranes, coatings, and composites due to its dispersibility, tunable oxygen functional groups, and scalability; GO has led by volume share among graphene products. Reduced Graphene Oxide (rGO) follows closely, favored for its balance of performance and cost. Other types, such as Graphene Nanoplatelets (GNPs) and Monolayer/Multilayer CVD Graphene Films, are also gaining traction in specialized applications.

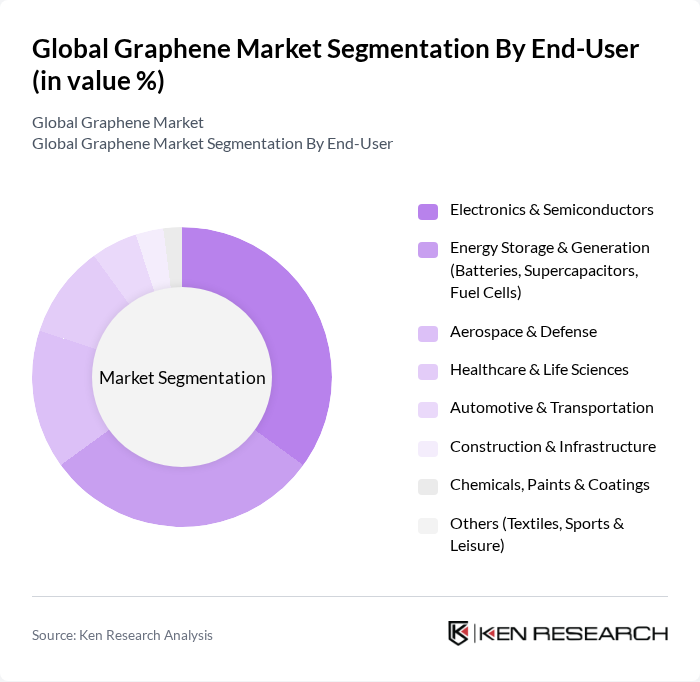

By End-User:The end-user segmentation highlights the diverse applications of graphene across various industries. The Electronics & Semiconductors sector is the largest consumer, driven by the demand for high-performance materials in devices. Energy Storage & Generation follows, with graphene's role in enhancing battery performance. Other significant sectors include Aerospace & Defense and Healthcare, where graphene's unique properties are leveraged for innovative solutions.

The Global Graphene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Graphenea S.A., Haydale Graphene Industries plc, First Graphene Ltd, XG Sciences, Inc., Applied Graphene Materials plc, NanoXplore Inc., Directa Plus S.p.A., G6 Materials Corp., CVD Equipment Corporation, Thomas Swan & Co. Ltd., Versarien plc, Global Graphene Group (Angstron Materials), Talga Group Ltd, The Sixth Element (Changzhou) Materials Technology Co., Ltd., ACS Material, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the graphene market appears promising, driven by ongoing technological advancements and increasing applications across various sectors. As production methods become more cost-effective, the integration of graphene in industries such as electronics, energy storage, and healthcare is expected to expand significantly. Furthermore, the focus on sustainable practices will likely enhance the appeal of graphene, positioning it as a key material in the transition towards greener technologies and innovative solutions in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Graphene Oxide (GO) Reduced Graphene Oxide (rGO) Graphene Nanoplatelets (GNPs) Monolayer/Multilayer CVD Graphene Films Few-Layer Graphene (FLG) Functionalized Graphene/Derivatives Others (Graphene Quantum Dots, 3D Graphene Foams) |

| By End-User | Electronics & Semiconductors Energy Storage & Generation (Batteries, Supercapacitors, Fuel Cells) Aerospace & Defense Healthcare & Life Sciences Automotive & Transportation Construction & Infrastructure Chemicals, Paints & Coatings Others (Textiles, Sports & Leisure) |

| By Application | Conductive Inks & Pastes Polymer/Metal/Ceramic Composites Sensors & Wearables Energy Devices (Li-ion/Silicon Anodes, Supercapacitors, PEM fuel cells) Coatings & Paints (Anti-corrosion, EMI Shielding, Thermal) Biomedical (Drug Delivery, Tissue Engineering, Diagnostics) Filtration & Water Treatment Others (Thermal Management, 3D Printing, Lubricants) |

| By Distribution Channel | Direct B2B (Manufacturer-to-OEM/Integrator) Online (Company Webstores, Marketplaces) Specialty Distributors Research Chemical Suppliers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Research Grade (High Price) Industrial Grade (Mid Price) Commodity/Volume Grade (Low Price) Others |

| By Technology | Chemical Vapor Deposition (CVD) Liquid Phase Exfoliation (LPE) Mechanical/Scotch Tape Exfoliation Oxidation–Reduction (Hummers/rHummers) Epitaxial Growth on SiC Others (Plasma, Electrochemical, Shear Exfoliation) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Industry Applications | 100 | Product Development Engineers, R&D Managers |

| Energy Storage Solutions | 80 | Battery Technology Experts, Energy Analysts |

| Composite Materials Sector | 70 | Materials Scientists, Manufacturing Engineers |

| Biomedical Applications | 60 | Biomedical Researchers, Regulatory Affairs Specialists |

| Coatings and Inks Market | 90 | Product Managers, Coatings Chemists |

The Global Graphene Market is valued at approximately USD 450 million, driven by the increasing demand for advanced materials across various industries, including electronics, energy storage, and healthcare, due to graphene's unique properties like high electrical conductivity and mechanical strength.