Region:Global

Author(s):Shubham

Product Code:KRAB0558

Pages:80

Published On:August 2025

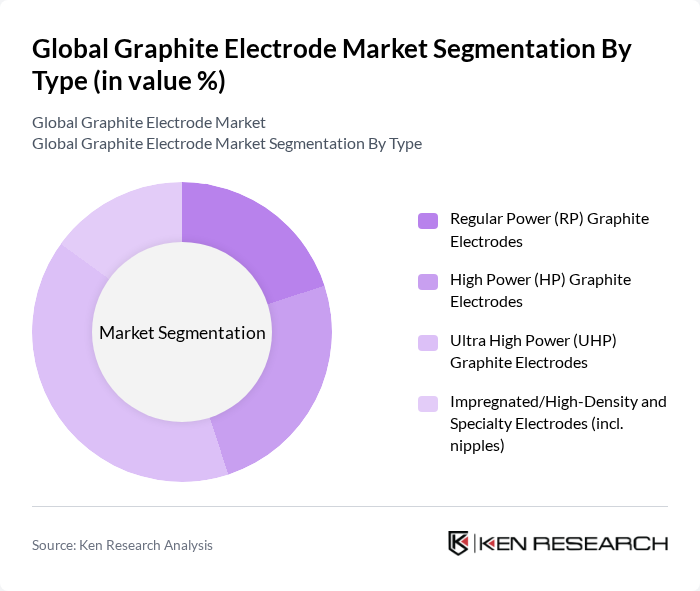

By Type:The market is segmented into Regular Power (RP) Graphite Electrodes, High Power (HP) Graphite Electrodes, Ultra High Power (UHP) Graphite Electrodes, and Impregnated/High-Density and Specialty Electrodes (including nipples). Among these,UHP Graphite Electrodesdominate usage in primary steelmaking via EAF due to higher current-carrying capacity, lower consumption rates, and suitability for high-productivity furnaces. Growing EAF steel penetration and quality requirements in automotive-grade and specialty steels have increased UHP adoption .

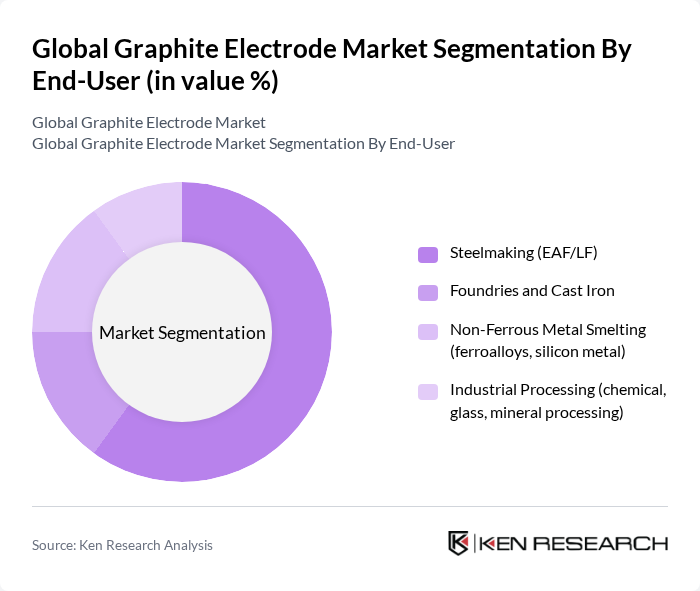

By End-User:The market is segmented into Steelmaking (EAF/LF), Foundries and Cast Iron, Non-Ferrous Metal Smelting (ferroalloys, silicon metal), and Industrial Processing (chemical, glass, mineral processing). TheSteelmaking (EAF/LF)segment remains the largest end-user, supported by expanding EAF steel share, scrap-based decarbonization, and ongoing infrastructure and automotive demand that underpin electrode consumption in EAF and ladle furnace operations .

The Global Graphite Electrode Market is characterized by a dynamic mix of regional and international players. Leading participants such asGrafTech International Ltd.,Resonac Holdings Corporation(formerly Showa Denko K.K.),Tokai Carbon Co., Ltd.,SGL Carbon SE,HEG Limited,Graphite India Limited,Fangda Carbon New Material Co., Ltd.,Nantong Yangzi Carbon Co., Ltd.,Jilin Carbon Co., Ltd.,Fushun Jinli Carbon Co., Ltd.,SEC Carbon, Ltd.,Carbone Savoie S.A.S.,Asbury Carbons, Inc.,Tokai COBEX GmbH,Graphite Cova GmbHcontribute to innovation, geographic expansion, and service delivery in this space .

The future of the graphite electrode market in the None region appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt electric arc furnace technology, the demand for high-performance electrodes is expected to rise. Additionally, the integration of digital technologies in production processes will enhance efficiency and reduce costs, positioning the market for robust growth in the coming years, particularly as environmental concerns shape industry standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Power (RP) Graphite Electrodes High Power (HP) Graphite Electrodes Ultra High Power (UHP) Graphite Electrodes Impregnated/High-Density and Specialty Electrodes (incl. nipples) |

| By End-User | Steelmaking (EAF/LF) Foundries and Cast Iron Non-Ferrous Metal Smelting (ferroalloys, silicon metal) Industrial Processing (chemical, glass, mineral processing) |

| By Application | Electric Arc Furnaces (EAF) Ladle Furnaces (LF) Submerged Arc Furnaces (SAF) Re-melting/Refining and Other Thermal Processes |

| By Distribution Channel | Direct (OEM and Key Accounts) Authorized Distributors/Traders Long-term Supply Contracts Spot/Short-term Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | RP/HP Standard Price Range UHP Mid Price Range UHP Premium/Specialty Price Range |

| By Quality Grade | RP (Regular Power) HP (High Power) UHP (Ultra High Power) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Steel Production Facilities | 150 | Production Managers, Operations Directors |

| Graphite Electrode Manufacturers | 100 | Sales Managers, Technical Directors |

| End-Users in Foundries | 80 | Procurement Managers, Plant Engineers |

| Research Institutions | 50 | Research Scientists, Industry Analysts |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

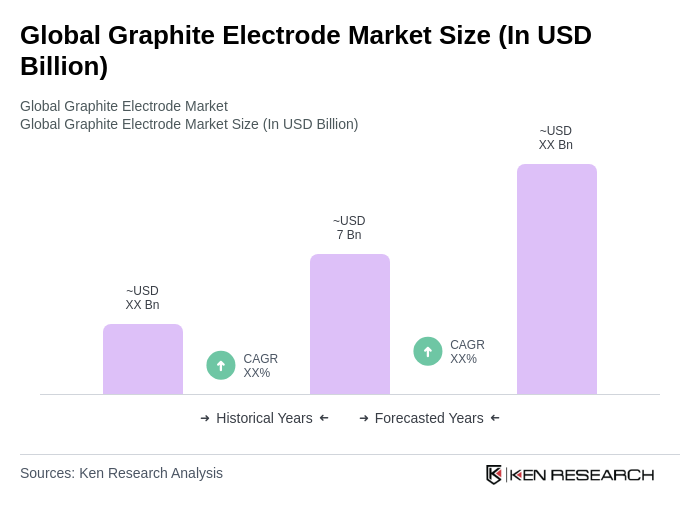

The Global Graphite Electrode Market is valued at approximately USD 7 billion, based on a five-year historical analysis. This figure reflects the specific market for graphite electrodes, distinct from the broader graphite market that includes other applications.