Region:Global

Author(s):Shubham

Product Code:KRAD0650

Pages:100

Published On:August 2025

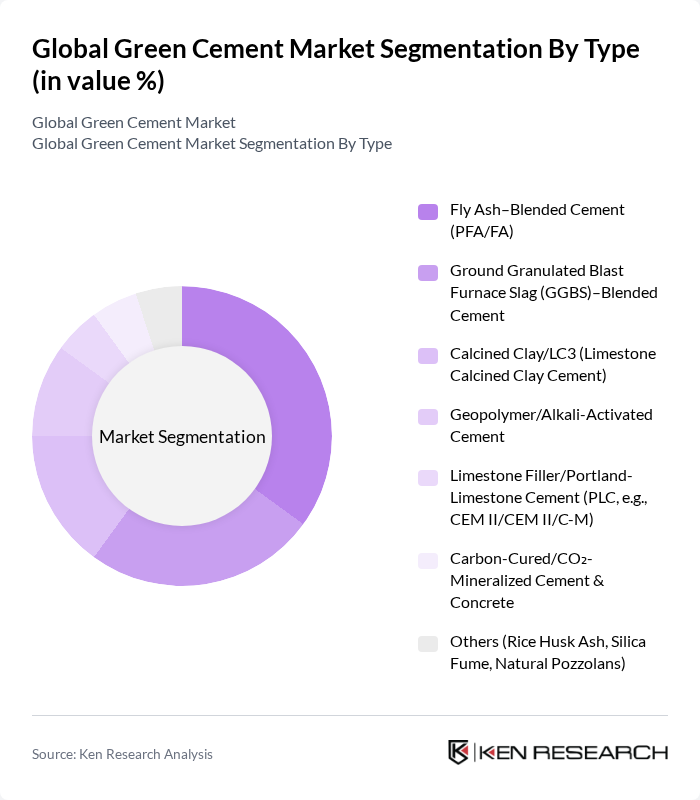

By Type:The green cement market is segmented into various types, including Fly Ash–Blended Cement, Ground Granulated Blast Furnace Slag–Blended Cement, Calcined Clay/LC3, Geopolymer/Alkali-Activated Cement, Limestone Filler/Portland-Limestone Cement, Carbon-Cured Cement, and Others. Among these, Fly Ash–Blended Cement is currently the leading subsegment due to its widespread acceptance and cost-effectiveness in reducing carbon emissions during production.

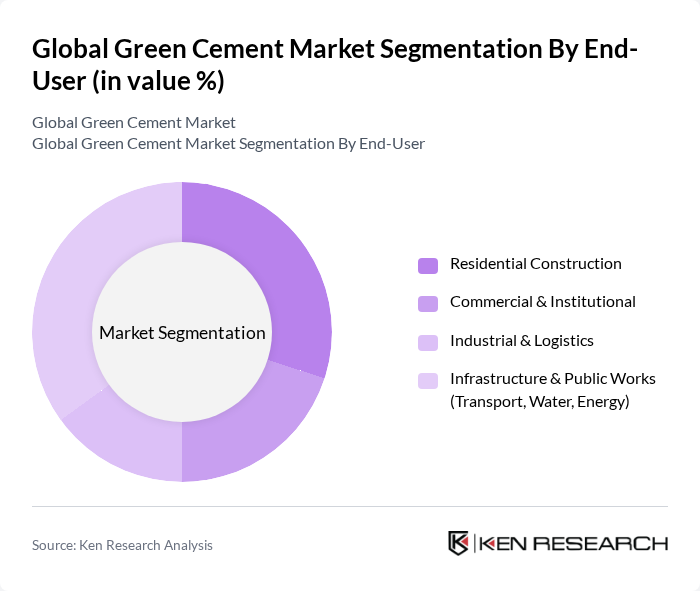

By End-User:The market is segmented by end-user applications, including Residential Construction, Commercial & Institutional, Industrial & Logistics, and Infrastructure & Public Works. The Infrastructure & Public Works segment is the dominant category, driven by significant government investments in sustainable infrastructure projects and the increasing need for eco-friendly materials in public works.

The Global Green Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Holcim Ltd., Heidelberg Materials AG, CEMEX, S.A.B. de C.V., CRH plc, Boral Limited, Martin Marietta Materials, Inc., UltraTech Cement Limited, SCG (The Siam Cement Public Company Limited), Ambuja Cements Limited, Dalmia Bharat Limited, Ash Grove Cement Company, Eagle Materials Inc., Taiheiyo Cement Corporation, Tarmac Trading Limited, Ecocem Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the green cement market appears promising, driven by increasing regulatory pressures and a societal shift towards sustainability. As governments enforce stricter emission reduction targets, the demand for eco-friendly construction materials is expected to rise. Additionally, advancements in carbon capture technologies and the integration of recycled materials into cement production will likely enhance the market's growth potential, positioning green cement as a cornerstone of sustainable construction practices in the global region.

| Segment | Sub-Segments |

|---|---|

| By Type | Fly Ash–Blended Cement (PFA/FA) Ground Granulated Blast Furnace Slag (GGBS)–Blended Cement Calcined Clay/LC3 (Limestone Calcined Clay Cement) Geopolymer/Alkali-Activated Cement Limestone Filler/Portland-Limestone Cement (PLC, e.g., CEM II/CEM II/C-M) Carbon-Cured/CO?-Mineralized Cement & Concrete Others (Rice Husk Ash, Silica Fume, Natural Pozzolans) |

| By End-User | Residential Construction Commercial & Institutional Industrial & Logistics Infrastructure & Public Works (Transport, Water, Energy) |

| By Application | Ready?Mix Concrete (RMC) Precast & Prefabricated Elements Masonry, Mortars & Plasters Soil Stabilization & Pavements Repair & Retrofit (Low-Carbon Binders) |

| By Distribution Channel | Direct Sales to Developers/Contractors Cement & Concrete Distributors Digital/Online Procurement Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies & Grants (Low-Carbon Materials) Tax Incentives/Exemptions (e.g., Carbon Tax Relief) Carbon Credits/Certificates (ETS, CCU/CCR Mechanisms) Green Building Certifications (LEED, BREEAM, DGNB) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Adoption of Green Cement | 150 | Project Managers, Sustainability Managers |

| Manufacturing Insights from Cement Producers | 100 | Production Managers, R&D Directors |

| Regulatory Impact on Cement Production | 80 | Policy Makers, Environmental Compliance Officers |

| Market Trends in Sustainable Construction | 120 | Architects, Urban Planners |

| Consumer Preferences for Eco-friendly Materials | 90 | Homeowners, Real Estate Developers |

The Global Green Cement Market is valued at approximately USD 38.5 billion, reflecting a significant growth trend driven by increasing environmental regulations and the demand for sustainable construction materials.