Region:Global

Author(s):Dev

Product Code:KRAA1610

Pages:81

Published On:August 2025

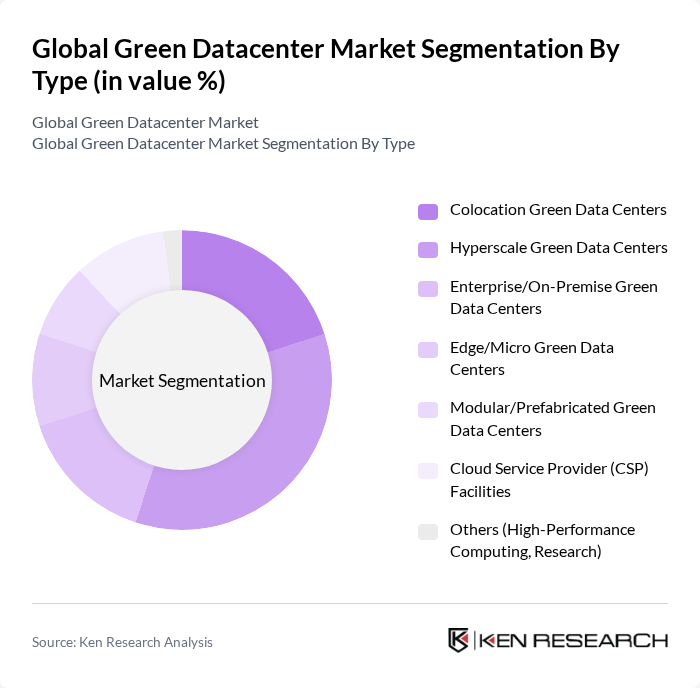

By Type:The market is segmented into various types, including Colocation Green Data Centers, Hyperscale Green Data Centers, Enterprise/On-Premise Green Data Centers, Edge/Micro Green Data Centers, Modular/Prefabricated Green Data Centers, Cloud Service Provider (CSP) Facilities, and Others (High-Performance Computing, Research). Among these,Hyperscale Green Data Centersare leading due to rapid scaling and efficiency gains needed to meet cloud, AI, and data?intensive workloads; hyperscalers are accelerating renewable energy PPAs, advanced liquid cooling, and modular designs to reduce PUE/WUE and operating cost .

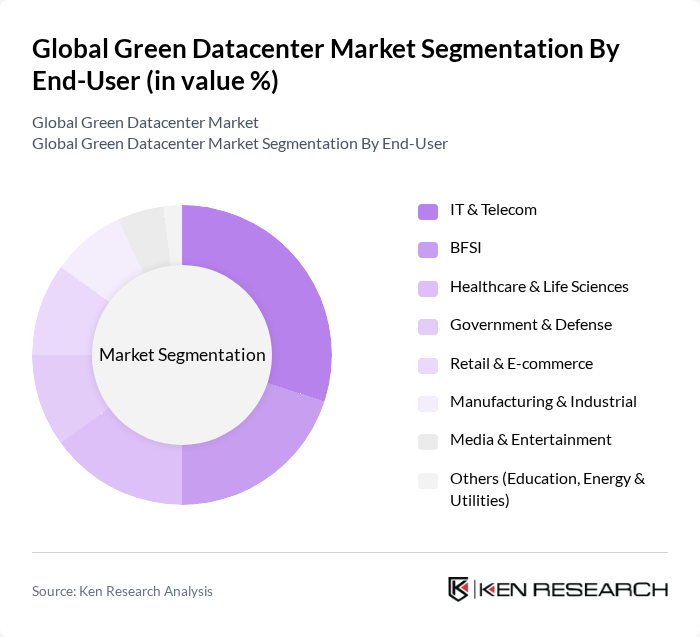

By End-User:The end-user segmentation includes IT & Telecom, BFSI, Healthcare & Life Sciences, Government & Defense, Retail & E-commerce, Manufacturing & Industrial, Media & Entertainment, and Others (Education, Energy & Utilities). TheIT & Telecomsector is the dominant end-user, underpinned by pervasive cloud adoption, 5G rollouts, and data?intensive applications that drive utilization of energy?efficient, high?density infrastructure in both hyperscale and colocation environments .

The Global Green Datacenter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM, Equinix, Inc., Digital Realty, NTT DATA (including NTT Global Data Centers), Alibaba Cloud, Oracle, Rackspace Technology, Interxion (Digital Realty), CyrusOne, Iron Mountain Data Centers, Global Switch, Telehouse (KDDI), Switch, Inc., OVHcloud, EdgeConneX, NextDC, Yondr Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the green datacenter market appears promising, driven by increasing regulatory pressures and technological advancements. As organizations prioritize sustainability, the adoption of energy-efficient solutions is expected to accelerate. Furthermore, the integration of artificial intelligence for energy management will enhance operational efficiency. The shift towards modular designs and edge computing will also play a pivotal role in shaping the market landscape, ensuring that green datacenters remain competitive and relevant in a rapidly evolving digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Green Data Centers Hyperscale Green Data Centers Enterprise/On?Premise Green Data Centers Edge/Micro Green Data Centers Modular/Prefabricated Green Data Centers Cloud Service Provider (CSP) Facilities Others (High-Performance Computing, Research) |

| By End-User | IT & Telecom BFSI Healthcare & Life Sciences Government & Defense Retail & E?commerce Manufacturing & Industrial Media & Entertainment Others (Education, Energy & Utilities) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Energy-Efficient IT (High?efficiency Servers, Storage, Virtualization) Advanced Cooling (Liquid/Immersion, Rear?Door Heat Exchangers, Free Cooling) Power Infrastructure (High?Efficiency UPS, DCIM, Smart PDUs) Renewable & Low?Carbon Power (On/Off?site PPAs, Solar/Wind/Hydro Integration, Fuel Cells) Water & Heat Management (Adiabatic/Water?free Cooling, Heat Reuse/Recovery) Building & Design (Modular Design, Efficient Airflow, Sustainable Materials) Others (AI?driven Energy Management, Grid Interactivity) |

| By Application | Compute?Intensive (AI/HPC) Cloud & Colocation Workloads Storage & Backup Edge/IoT Deployments Disaster Recovery/Business Continuity |

| By Investment Source | Private/Hyperscaler Capex Colocation/REIT Investments Enterprise IT Capex Public Funding & Green Bonds Public?Private Partnerships (PPP) |

| By Policy Support | Energy Efficiency Standards (e.g., PUE targets, EU Code of Conduct) Carbon & Renewable Policies (RECs, PPAs, Carbon Pricing) Tax Incentives & Subsidies Sustainability Certifications (LEED, BREEAM, ISO 50001) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Green Data Center Operations | 120 | IT Managers, Sustainability Officers |

| Energy Efficiency Initiatives | 100 | Facility Managers, Energy Consultants |

| Cloud Service Providers | 80 | Data Center Operations Managers, Technical Directors |

| Renewable Energy Integration | 70 | Energy Procurement Managers, Environmental Managers |

| Data Center Design and Architecture | 90 | Architects, Design Engineers |

The Global Green Datacenter Market is valued at approximately USD 7075 billion, reflecting significant growth driven by the adoption of energy-efficient designs, renewable energy sourcing, and advanced cooling technologies in data center construction.