Region:Global

Author(s):Rebecca

Product Code:KRAA1441

Pages:90

Published On:August 2025

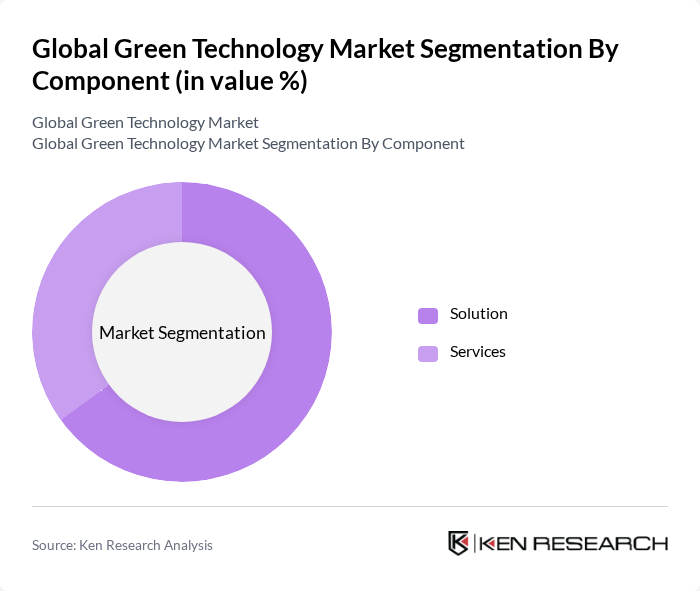

By Component:The components of the Global Green Technology Market are categorized into Solutions and Services. Solutions encompass the technologies and products that facilitate green practices, including renewable energy systems, energy-efficient equipment, and environmental monitoring tools. Services include consulting, installation, integration, and maintenance related to green technologies. The Solutions segment is currently leading the market due to the increasing adoption of renewable energy technologies, digital resource management, and energy-efficient products.

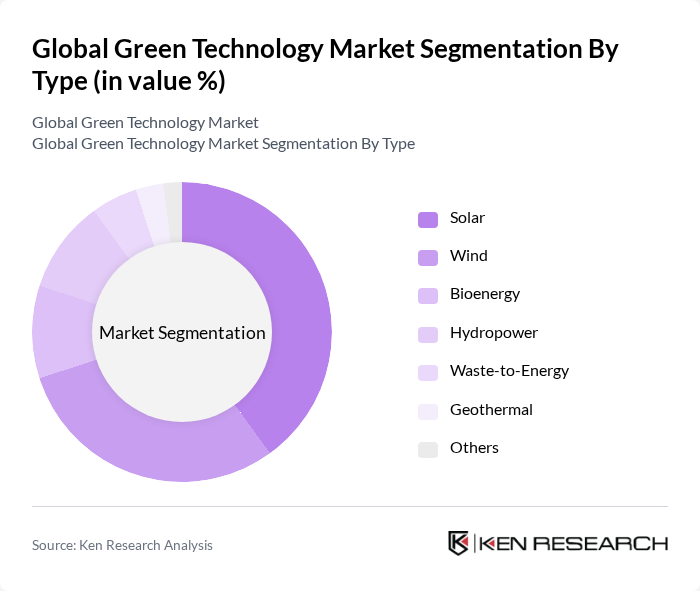

By Type:The market is segmented by Type into Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Geothermal, and Others. Among these, Solar technology is the dominant segment, driven by decreasing costs of solar panels, government incentives, and increasing consumer demand for renewable energy sources. The Wind segment also shows significant growth due to advancements in turbine technology, favorable wind conditions in various regions, and supportive regulatory frameworks. Bioenergy and hydropower continue to play important roles in the renewable mix, while waste-to-energy and geothermal technologies are gaining traction as part of circular economy and sustainable resource initiatives.

The Global Green Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Vestas Wind Systems A/S, First Solar, Inc., NextEra Energy, Inc., Enphase Energy, Inc., Canadian Solar Inc., Ørsted A/S, Brookfield Renewable Partners L.P., SunPower Corporation, ABB Ltd., General Electric Company, Schneider Electric SE, Tesla, Inc., Iberdrola, S.A., EDP Renováveis S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the green technology market appears promising, driven by increasing investments in sustainable energy solutions and a growing emphasis on corporate responsibility. As more companies commit to net-zero emissions in future, the demand for innovative green technologies is expected to rise. Additionally, advancements in energy storage and smart grid technologies will enhance the efficiency and reliability of renewable energy systems, paving the way for broader adoption across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Component | Solution Services |

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Geothermal Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Internet of Things (IoT) Artificial Intelligence (AI) & Analytics Digital Twin Cloud Computing Blockchain Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind Biomass Gasification |

| By Application | Carbon Footprint Management Green Building Air and Water Pollution Monitoring Weather Monitoring and Forecasting Fire Detection Crop Monitoring Soil Condition/Moisture Monitoring Forest Monitoring Sustainable Mining and Exploration Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Installations | 120 | Project Managers, Installation Technicians |

| Wind Energy Projects | 90 | Operations Managers, Environmental Engineers |

| Bioenergy Production | 60 | Research Scientists, Production Supervisors |

| Energy Storage Solutions | 50 | Product Development Managers, Sales Directors |

| Green Technology Policy Impact | 70 | Policy Analysts, Sustainability Consultants |

The Global Green Technology Market is valued at approximately USD 22 billion, driven by increasing investments in renewable energy, digital solutions for resource optimization, and government initiatives promoting sustainability.