Region:Global

Author(s):Shubham

Product Code:KRAC0754

Pages:95

Published On:August 2025

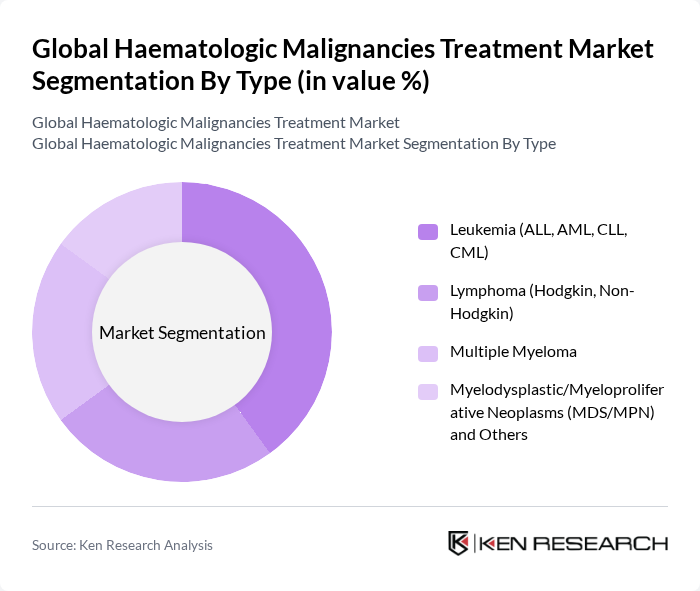

By Type:The market is segmented into various types of hematologic malignancies, including leukemia, lymphoma, multiple myeloma, and myelodysplastic/myeloproliferative neoplasms. Among these, leukemia, particularly acute lymphoblastic leukemia (ALL) and acute myeloid leukemia (AML), is a major clinical focus area and a significant driver of therapy demand, with intensive use of targeted agents (e.g., TKIs in CML), antibody-drug conjugates, and transplant/CAR-T in selected settings .

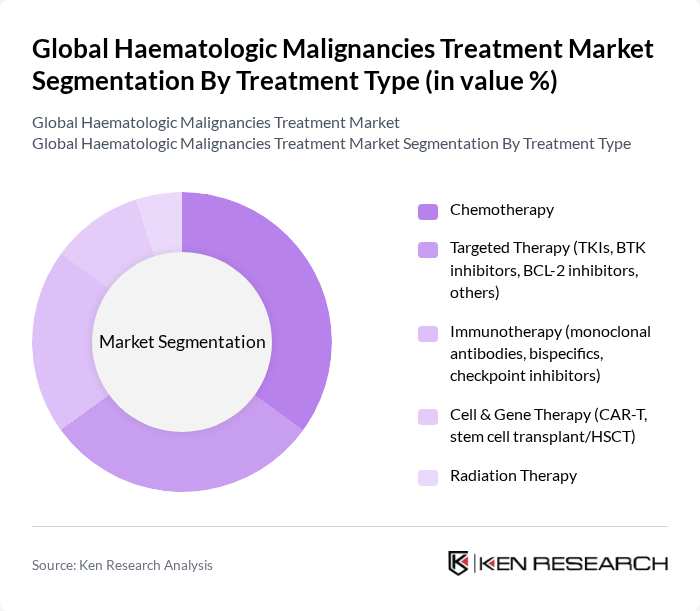

By Treatment Type:The treatment options for hematologic malignancies include chemotherapy, targeted therapy, immunotherapy, cell & gene therapy, and radiation therapy. Chemotherapy remains widely used across leukemias and lymphomas; however, targeted therapies (e.g., BTK and BCL?2 inhibitors, TKIs) and immunotherapies (monoclonal antibodies, bispecific T?cell engagers, checkpoint inhibitors) are expanding rapidly due to improved outcomes and more personalized regimens. Cell and gene therapies, notably CAR?T, along with hematopoietic stem cell transplantation, continue to scale with additional approvals and manufacturing capacity growth .

The Global Haematologic Malignancies Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Bristol Myers Squibb Company, Novartis AG, F. Hoffmann-La Roche Ltd, Gilead Sciences, Inc. (incl. Kite Pharma), Celgene Corporation (a Bristol Myers Squibb company), Takeda Pharmaceutical Company Limited, Merck & Co., Inc. (MSD), Johnson & Johnson (Janssen Biotech), Sanofi S.A., AbbVie Inc., AstraZeneca PLC, Bayer AG, Pfizer Inc., Regeneron Pharmaceuticals, Inc., BeiGene, Ltd., Incyte Corporation, TG Therapeutics, Inc., Jazz Pharmaceuticals plc, Seagen Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of haematologic malignancies treatment is poised for significant transformation, driven by technological advancements and a focus on personalized medicine. As the market evolves, the integration of digital health solutions will enhance patient monitoring and treatment adherence. Additionally, the rise of immunotherapy and targeted therapies will likely redefine treatment paradigms, improving patient outcomes. The emphasis on patient-centric care will further shape the landscape, ensuring that therapies are tailored to individual needs and preferences, ultimately enhancing the quality of life for patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Leukemia (ALL, AML, CLL, CML) Lymphoma (Hodgkin, Non-Hodgkin) Multiple Myeloma Myelodysplastic/Myeloproliferative Neoplasms (MDS/MPN) and Others |

| By Treatment Type | Chemotherapy Targeted Therapy (TKIs, BTK inhibitors, BCL-2 inhibitors, others) Immunotherapy (monoclonal antibodies, bispecifics, checkpoint inhibitors) Cell & Gene Therapy (CAR-T, stem cell transplant/HSCT) Radiation Therapy |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Pharmacies |

| By End-User | Hospitals & Cancer Centers Specialty Clinics/Hematology-Oncology Clinics Homecare Settings Academic & Research Institutes |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients |

| By Pricing Tier | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncologist Insights | 120 | Medical Oncologists, Hematologists |

| Healthcare Administrator Feedback | 90 | Hospital Administrators, Oncology Department Heads |

| Patient Experience Surveys | 140 | Patients undergoing treatment for blood cancers |

| Pharmaceutical Sales Data | 60 | Sales Representatives, Market Access Managers |

| Clinical Trial Insights | 70 | Clinical Researchers, Trial Coordinators |

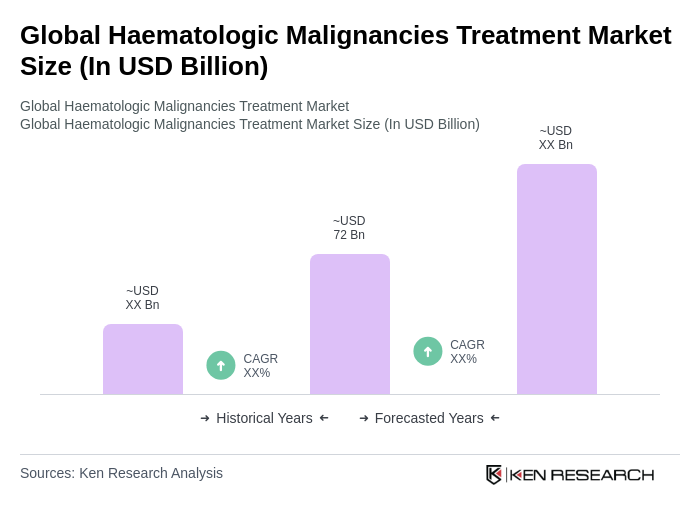

The Global Haematologic Malignancies Treatment Market is valued at approximately USD 72 billion, reflecting a consistent trend in the low-to-mid USD 70 billion range, driven by the adoption of targeted, immuno-, and cell-based therapies alongside traditional chemotherapy regimens.