Region:Global

Author(s):Shubham

Product Code:KRAC0861

Pages:98

Published On:August 2025

By Type:The hafnium market can be segmented into various types, including hafnium metal, hafnium oxide, hafnium carbide, hafnium alloys, and hafnium compounds. Each of these subsegments plays a crucial role in different applications, withhafnium metalbeing widely used in aerospace and nuclear industries due to its high melting point, exceptional neutron absorption, and corrosion resistance. Hafnium oxide is increasingly utilized in advanced semiconductor devices for its dielectric properties. Hafnium carbide is valued for its ultra-high temperature resistance in aerospace and industrial applications. Alloys and compounds are used in specialty coatings and superalloys.

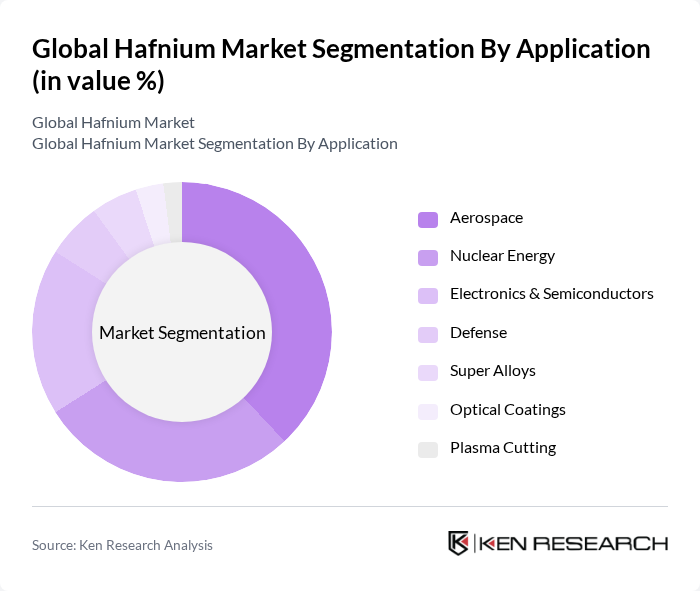

By Application:The hafnium market is segmented based on applications, including aerospace, nuclear energy, electronics & semiconductors, defense, super alloys, optical coatings, and plasma cutting. Theaerospace sectoris a significant consumer of hafnium due to its high-temperature resistance and strength, making it ideal for turbine blades, rocket nozzles, and other critical components. Nuclear energy relies on hafnium for control rods because of its neutron absorption capabilities. Electronics and semiconductors increasingly use hafnium oxide in advanced chip manufacturing. Superalloys, optical coatings, and plasma cutting represent specialized industrial applications.

The Global Hafnium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Framatome Inc., Alkane Resources Ltd., American Elements, Nanjing Youtian Metal Technology Co., Ltd., ACI Alloys Inc., Global Advanced Metals, H.C. Starck GmbH, ATI Inc. (Allegheny Technologies Incorporated), Chemours Company, Advanced Metallurgical Group N.V. (AMG), Tantalum Mining Corporation of Canada Ltd., China Nuclear JingHuan Zirconium & Hafnium Co., Ltd., Materion Corporation, Nanjing Hanrui Cobalt Co., Ltd., Western Zirconium (a division of Westinghouse Electric Company) contribute to innovation, geographic expansion, and service delivery in this space.

The hafnium market is poised for significant evolution, driven by technological advancements and increasing applications across various industries. As aerospace and nuclear sectors expand, the demand for hafnium is expected to rise, supported by innovations in extraction and processing technologies. Furthermore, the growing emphasis on sustainable materials and recycling initiatives will likely reshape the market landscape, fostering a more resilient and environmentally conscious industry. Strategic partnerships will also play a crucial role in navigating challenges and capitalizing on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Hafnium Metal Hafnium Oxide Hafnium Carbide Hafnium Alloys Hafnium Compounds |

| By Application | Aerospace Nuclear Energy Electronics & Semiconductors Defense Super Alloys Optical Coatings Plasma Cutting |

| By End-User | Aerospace Manufacturers Semiconductor Companies Defense Contractors Nuclear Energy Providers Research Institutions |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 60 | Materials Engineers, Procurement Managers |

| Electronics Manufacturing | 50 | Product Development Engineers, Supply Chain Analysts |

| Nuclear Energy Sector | 40 | Safety Officers, Project Managers |

| Research Institutions | 40 | Research Scientists, Laboratory Managers |

| Hafnium Recycling Initiatives | 40 | Sustainability Managers, Operations Directors |

The Global Hafnium Market is valued at approximately USD 395 million, driven by increasing demand in aerospace, nuclear applications, and electronics. This valuation is based on a five-year historical analysis reflecting the market's growth trajectory.