Region:Global

Author(s):Shubham

Product Code:KRAA2642

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of hair loss treatment products, including Minoxidil-based treatments, Finasteride-based treatments, hair growth shampoos and conditioners, hair oils and serums, hair transplant products and kits, nutritional supplements, laser therapy devices, and others such as herbal or plant-based treatments and prescription drugs. Among these, Minoxidil-based treatments are particularly popular due to their proven effectiveness and wide availability. Finasteride-based treatments also hold a significant share, especially among male consumers. The increasing trend towards natural and organic products has led to a rise in the popularity of hair oils and serums, while laser therapy devices are gaining traction due to advancements in technology and growing consumer acceptance of non-invasive solutions .

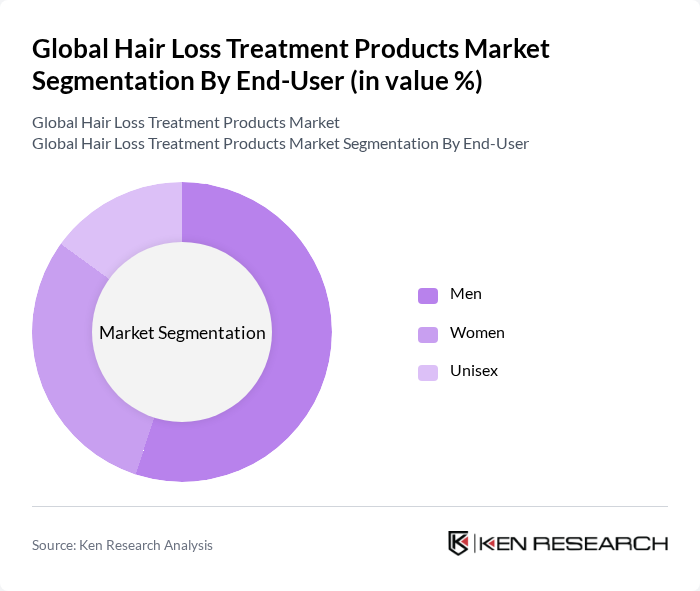

By End-User:The end-user segmentation includes men, women, and unisex products. The male segment dominates the market due to a higher prevalence of hair loss issues among men, coupled with a greater willingness to invest in treatment solutions. Women are increasingly becoming a significant consumer base, driven by rising awareness and the availability of products specifically formulated for female hair loss. Unisex products are also gaining traction as they cater to a broader audience, appealing to both genders. This segmentation reflects the distinct consumer preferences and treatment approaches in the market .

The Global Hair Loss Treatment Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Johnson & Johnson, Merck & Co., Inc., Unilever PLC, L'Oréal S.A., Shiseido Company, Limited, Taisho Pharmaceutical Co., Ltd., Pierre Fabre S.A., Bosley Inc., Lexington International LLC (HairMax), Church & Dwight Co., Inc. (Viviscal), Nutraceutical Wellness Inc. (Nutrafol), DS Healthcare Group Inc., Aveda Corporation, Pura D'or contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hair loss treatment products market appears promising, driven by ongoing innovations and changing consumer preferences. As the demand for personalized solutions increases, companies are likely to invest in research and development to create tailored products. Additionally, the rise of e-commerce platforms will facilitate broader access to hair loss treatments, enabling consumers to explore various options conveniently. This evolving landscape suggests a dynamic market poised for growth, with significant opportunities for both established and emerging players.

| Segment | Sub-Segments |

|---|---|

| By Type | Minoxidil-based treatments Finasteride-based treatments Hair growth shampoos and conditioners Hair oils and serums Hair transplant products and kits Nutritional supplements Laser therapy devices Others (e.g., herbal/plant-based treatments, prescription drugs) |

| By End-User | Men Women Unisex |

| By Distribution Channel | Online retail (e-commerce, brand websites, online pharmacies) Pharmacies & drug stores Supermarkets and hypermarkets Specialty stores (beauty, wellness, clinics) Direct sales (clinics, salons, direct-to-consumer) Others (convenience stores, multi-level marketing) |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Product Formulation | Topical solutions (foams, sprays, serums, lotions) Oral medications (tablets, capsules, supplements) Devices and equipment (laser combs, helmets, etc.) |

| By Price Range | Premium Mid-range Budget |

| By Brand Loyalty | Established brands Emerging brands Private labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Hair Loss Treatment Users | 120 | Individuals aged 25-65 who have purchased hair loss products |

| Dermatologists and Trichologists | 40 | Medical professionals specializing in hair and scalp health |

| Retailers of Hair Loss Products | 60 | Store managers and buyers from pharmacies and beauty supply stores |

| Online E-commerce Platforms | 50 | Managers and marketing professionals from online beauty retailers |

| Hair Loss Treatment Manufacturers | 40 | Product development and marketing teams from leading brands |

The Global Hair Loss Treatment Products Market is valued at approximately USD 3.6 billion, reflecting a significant growth driven by increasing awareness of hair loss issues and rising disposable incomes among consumers.