Region:Global

Author(s):Rebecca

Product Code:KRAA2170

Pages:97

Published On:August 2025

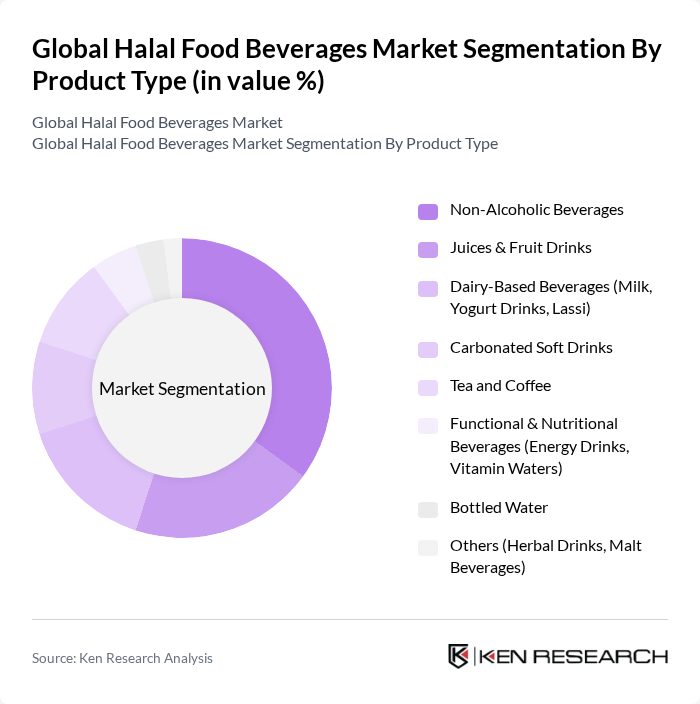

By Product Type:The product type segmentation encompasses a broad array of halal beverages catering to varied consumer needs. The market features a diverse range of offerings, including non-alcoholic beverages, juices, dairy-based drinks, carbonated soft drinks, tea and coffee, functional beverages, bottled water, and others. Non-alcoholic beverages remain especially popular due to their compliance with halal dietary laws and the growing trend toward healthier consumption habits .

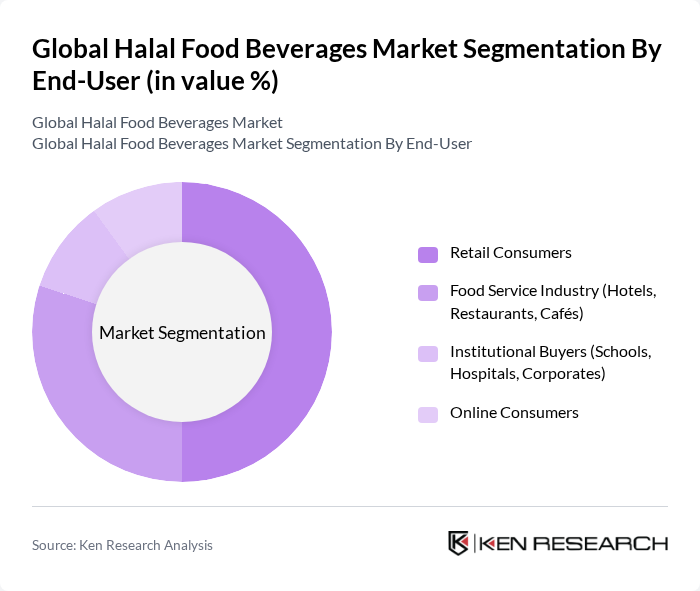

By End-User:The end-user segmentation identifies the principal consumer segments driving demand for halal beverages, including retail consumers, the food service industry, institutional buyers, and online consumers. Retail consumers constitute the largest segment, propelled by the widespread availability of halal products in supermarkets and convenience outlets, as well as the increasing emphasis on health-conscious purchasing behavior .

The Global Halal Food Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., PepsiCo, Inc., The Coca-Cola Company, Unilever PLC, Danone S.A., Almarai Company, Royal FrieslandCampina N.V., Al Ain Dairy, American Foods Group, LLC, Midamar Corporation, Cargill, Inc., Al Haramain Group, Al Watania Food, Al Safi Danone, and Saffron Road Foods contribute to innovation, geographic expansion, and service delivery in this space .

The future of the halal food beverages market appears promising, driven by demographic shifts and evolving consumer preferences. As the Muslim population continues to grow, there will be an increasing demand for halal-certified products. Additionally, the trend towards health and wellness will likely propel innovation in product offerings, with a focus on organic and natural ingredients. Companies that adapt to these trends and invest in digital marketing strategies will be well-positioned to capture emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Non-Alcoholic Beverages Juices & Fruit Drinks Dairy-Based Beverages (Milk, Yogurt Drinks, Lassi) Carbonated Soft Drinks Tea and Coffee Functional & Nutritional Beverages (Energy Drinks, Vitamin Waters) Bottled Water Others (Herbal Drinks, Malt Beverages) |

| By End-User | Retail Consumers Food Service Industry (Hotels, Restaurants, Cafés) Institutional Buyers (Schools, Hospitals, Corporates) Online Consumers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Specialty Stores (Halal Stores, Ethnic Stores) Food Service Distributors |

| By Packaging Type | Bottles (Glass, PET) Cans Tetra Packs/Cartons Pouches Bulk Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Religious Affiliation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Halal Beverage Retailers | 100 | Store Managers, Category Buyers |

| Halal Certification Bodies | 50 | Certification Officers, Compliance Managers |

| Consumers of Halal Beverages | 150 | Health-Conscious Consumers, Ethnic Community Members |

| Food and Beverage Manufacturers | 75 | Product Development Managers, Quality Assurance Specialists |

| Market Analysts and Researchers | 40 | Industry Analysts, Market Research Directors |

The Global Halal Food Beverages Market is valued at approximately USD 1,200 billion, driven by factors such as the increasing Muslim population, consumer awareness regarding food safety, and the demand for halal-certified products across various regions.