Region:Global

Author(s):Shubham

Product Code:KRAA1927

Pages:100

Published On:August 2025

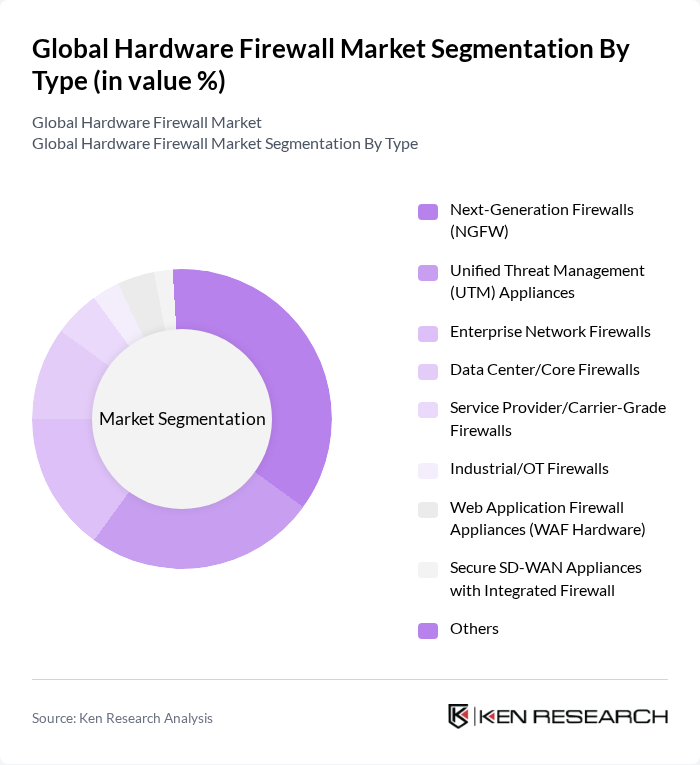

By Type:The market is segmented into various types of hardware firewalls, including Next-Generation Firewalls (NGFW), Unified Threat Management (UTM) Appliances, Enterprise Network Firewalls, Data Center/Core Firewalls, Service Provider/Carrier-Grade Firewalls, Industrial/OT Firewalls, Web Application Firewall Appliances (WAF Hardware), Secure SD-WAN Appliances with Integrated Firewall, and Others. Among these, Next-Generation Firewalls (NGFW) are leading the market due to their advanced features such as deep packet inspection, intrusion prevention, and application awareness, which are essential for modern cybersecurity needs.

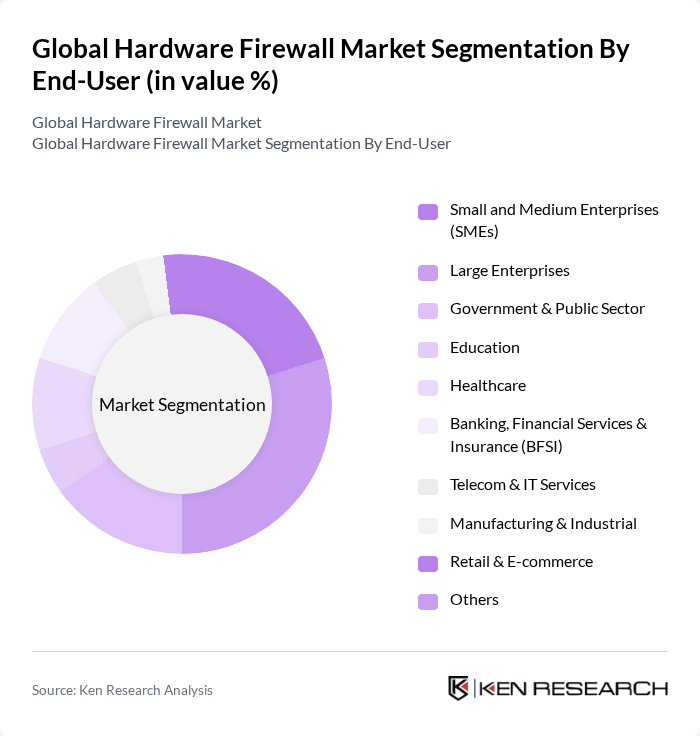

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Education, Healthcare, Banking, Financial Services & Insurance (BFSI), Telecom & IT Services, Manufacturing & Industrial, Retail & E-commerce, and Others. The BFSI sector is the dominant end-user due to stringent regulatory requirements and the critical need for data protection, driving significant investments in hardware firewalls.

The Global Hardware Firewall Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Sophos Ltd., Barracuda Networks, Inc., Juniper Networks, Inc., SonicWall Inc., WatchGuard Technologies, Inc., Hillstone Networks Co., Ltd., Huawei Technologies Co., Ltd., Stormshield (Airbus Defence and Space Cyber), Sangfor Technologies Inc., Forcepoint LLC, F5, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

As the cybersecurity landscape continues to evolve, the hardware firewall market is expected to adapt to emerging threats and technological advancements. The integration of artificial intelligence and machine learning into firewall solutions will enhance threat detection and response capabilities. Additionally, the shift towards subscription-based models will provide organizations with flexible and scalable security options. In future, the focus on zero trust security frameworks will further drive innovation, ensuring that hardware firewalls remain a vital component of comprehensive cybersecurity strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Next-Generation Firewalls (NGFW) Unified Threat Management (UTM) Appliances Enterprise Network Firewalls Data Center/Core Firewalls Service Provider/Carrier-Grade Firewalls Industrial/OT Firewalls Web Application Firewall Appliances (WAF Hardware) Secure SD-WAN Appliances with Integrated Firewall Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Education Healthcare Banking, Financial Services & Insurance (BFSI) Telecom & IT Services Manufacturing & Industrial Retail & E-commerce Others |

| By Deployment Mode | On-Premises (Appliance/Rack-Mounted/Blade) Cloud-Managed Hardware Hybrid |

| By Distribution Channel | Direct Sales Distributors Online/Marketplace Value-Added Resellers (VARs) & System Integrators |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level/Branch Firewalls Mid-Range/Enterprise Edge Firewalls High-End/Chassis & Data Center Firewalls |

| By Service Type | Managed Firewall Services Professional Services (Design/Integration) Support, Maintenance & Subscription Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Hardware Firewall Usage | 120 | IT Security Managers, Network Architects |

| Healthcare Sector Cybersecurity Practices | 90 | Compliance Officers, IT Directors |

| Retail Industry Firewall Implementation | 80 | Operations Managers, IT Administrators |

| Manufacturing Sector Network Security | 70 | Plant IT Managers, Cybersecurity Analysts |

| Government Agency Firewall Strategies | 60 | IT Policy Makers, Security Consultants |

The Global Hardware Firewall Market is valued at approximately USD 20.3 billion, reflecting significant growth driven by increasing cyber threats, regulatory compliance needs, and the adoption of cloud-based services.