Region:Global

Author(s):Geetanshi

Product Code:KRAD0028

Pages:85

Published On:August 2025

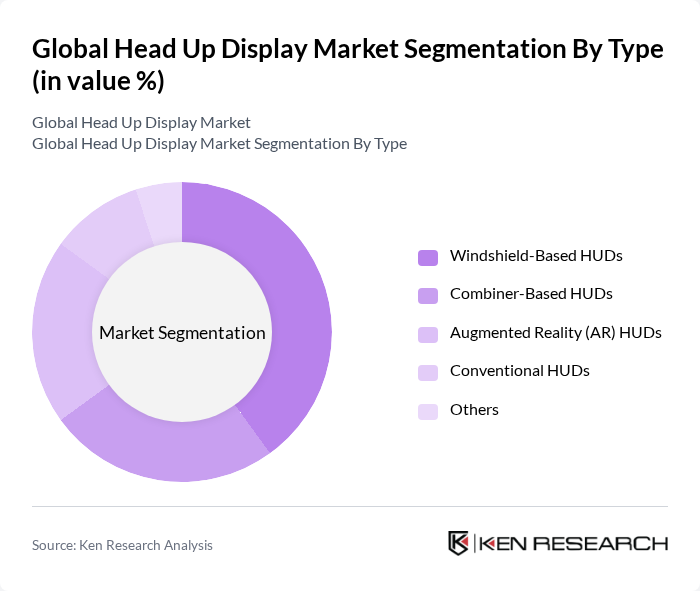

By Type:The market is segmented into various types of head-up displays, including Windshield-Based HUDs, Combiner-Based HUDs, Augmented Reality (AR) HUDs, Conventional HUDs, and Others. Each type serves different applications and user preferences, with varying levels of technological sophistication and integration. Windshield-Based HUDs are integrated directly into the vehicle windshield, providing seamless information display. Combiner-Based HUDs use a separate transparent panel to project data. Augmented Reality HUDs overlay contextual information onto the real-world view, enhancing navigation and hazard detection. Conventional HUDs display basic driving data, while Others include emerging and niche HUD technologies .

The Windshield-Based HUDs segment is currently dominating the market due to their seamless integration into vehicle designs and enhanced visibility for drivers. These systems project essential information directly onto the windshield, allowing drivers to maintain focus on the road while accessing navigation, speed, and safety alerts. The increasing consumer preference for advanced safety features, the adoption of smart vehicles, and the integration of AR capabilities further bolster the demand for windshield-based HUDs, making them the leading subsegment in the market .

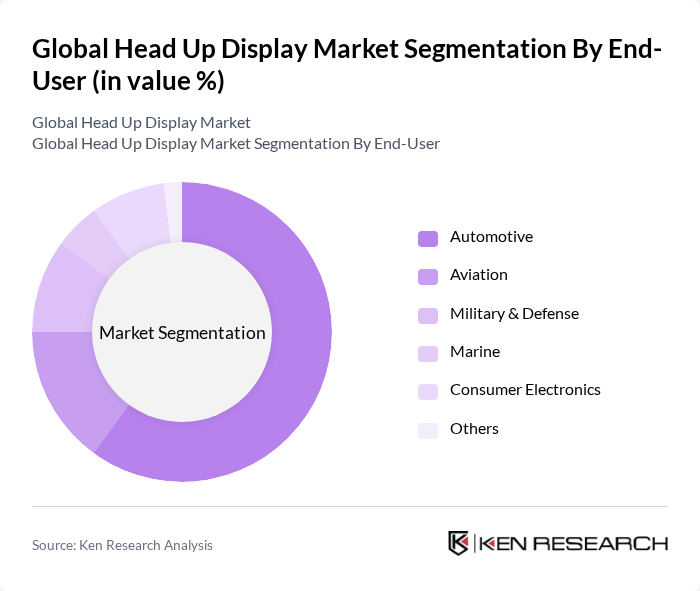

By End-User:The market is segmented by end-user applications, including Automotive, Aviation, Military & Defense, Marine, Consumer Electronics, and Others. Automotive applications focus on driver safety and convenience, Aviation utilizes HUDs for pilot situational awareness, Military & Defense deploys HUDs for tactical information, Marine uses HUDs for navigation, and Consumer Electronics integrates HUDs into wearables and gaming devices. Each segment has unique requirements and applications for HUD technology, influencing market dynamics and growth .

The Automotive segment is the largest end-user of HUD technology, accounting for a significant portion of the market. This dominance is attributed to the increasing integration of HUDs in modern vehicles as part of advanced driver assistance systems (ADAS) and the growing demand for immersive, connected driving experiences. Automotive manufacturers are rapidly adopting HUDs to enhance driver safety, situational awareness, and overall user experience, solidifying its position as the leading end-user segment .

The Global Head Up Display Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, Denso Corporation, Garmin Ltd., Panasonic Holdings Corporation, Visteon Corporation, Nippon Seiki Co., Ltd., Harman International Industries, Inc., Aptiv PLC, Hyundai Mobis Co., Ltd., Valeo SA, Aisin Corporation, ZF Friedrichshafen AG, Thales Group, BAE Systems plc, WayRay AG, Foryou Corporation, Yazaki Corporation, Huawei Technologies Co., Ltd., Futurus Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the head-up display market appears promising, driven by the ongoing transition towards electric and autonomous vehicles. As manufacturers increasingly prioritize user experience, HUDs will evolve to incorporate more interactive features and connectivity with mobile devices. Additionally, the integration of lightweight materials in HUD manufacturing will enhance efficiency and reduce costs, making these systems more accessible. The focus on safety and innovation will likely propel the market forward, fostering new developments and applications in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Windshield-Based HUDs Combiner-Based HUDs Augmented Reality (AR) HUDs Conventional HUDs Others |

| By End-User | Automotive Aviation Military & Defense Marine Consumer Electronics Others |

| By Component | Display Unit Projector/Projection Unit Video Generator Software Sensors Others |

| By Application | Navigation Speed Monitoring Safety Alerts & Collision Warnings Entertainment & Infotainment Driver Assistance Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Online Retail Distributors Others |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive HUD Integration | 120 | Automotive Engineers, Product Development Managers |

| Aerospace HUD Applications | 90 | Pilots, Aviation Safety Officers |

| Consumer Electronics HUD Usage | 60 | Tech Product Managers, UX Designers |

| Military HUD Systems | 50 | Defense Contractors, Military Pilots |

| Smart City HUD Implementations | 40 | Urban Planners, Smart Technology Consultants |

The Global Head Up Display Market is valued at approximately USD 6.4 billion, driven by the increasing demand for advanced driver assistance systems (ADAS) and the integration of artificial intelligence in vehicles for enhanced safety and navigation.