Global Headwear Market Overview

- The Global Headwear Market was valued at USD 30 billion, based on a five-year historical analysis. This growth is primarily driven by increasing fashion consciousness, the rise of outdoor activities, and the growing popularity of sports events. The market has seen a surge in demand for various types of headwear, including caps, beanies, and sun hats, as consumers seek both functionality and style in their accessories.

- Key players in this market include the United States, China, India, Japan, and Germany, which dominate due to their strong retail infrastructure, high disposable incomes, and a culture that embraces fashion and sports. The U.S. is particularly influential, with a robust sports culture and a significant presence of global brands, while China’s vast population and growing middle class contribute to its market strength.

- In 2023, the European Union implemented regulations aimed at promoting sustainable practices in the fashion industry, including headwear. These regulations require brands to disclose the environmental impact of their products and encourage the use of sustainable materials, thereby pushing manufacturers to innovate and adopt eco-friendly practices in their production processes.

Global Headwear Market Segmentation

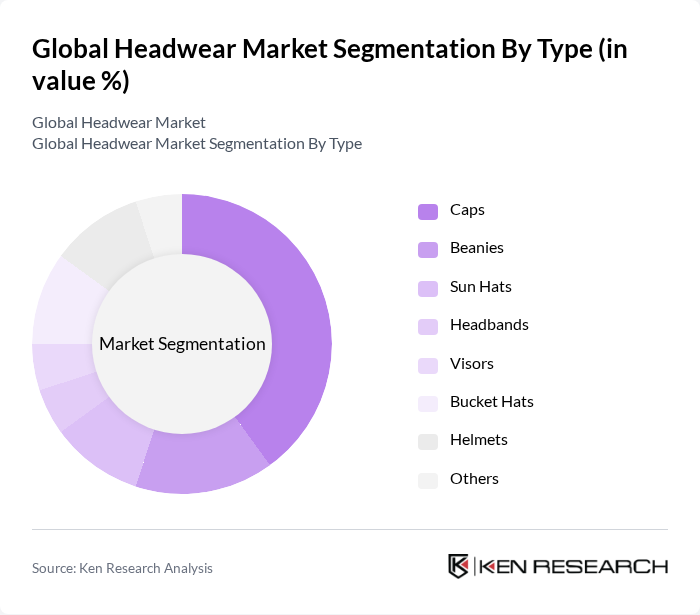

By Type:The headwear market can be segmented into various types, including caps, beanies, sun hats, headbands, visors, bucket hats, helmets, and others. Among these, caps are the most popular due to their versatility and widespread appeal across different demographics. Beanies and sun hats also hold significant market shares, particularly in colder and warmer climates, respectively. The demand for helmets is driven by safety regulations in sports and industrial applications.

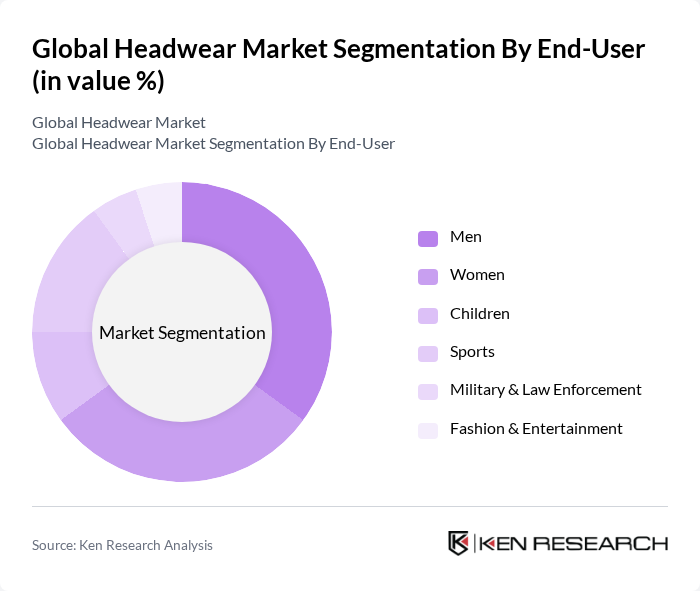

By End-User:The end-user segmentation includes men, women, children, sports enthusiasts, military and law enforcement personnel, and the fashion and entertainment sector. Men and women represent the largest consumer bases, driven by fashion trends and personal style preferences. The sports segment is also significant, as headwear is essential for athletes and fans alike, while military and law enforcement demand functional and durable options.

Global Headwear Market Competitive Landscape

The Global Headwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as New Era Cap Co., Inc., Adidas AG, Nike, Inc., Under Armour, Inc., Puma SE, Columbia Sportswear Company, Kangol Limited, Flexfit, Inc., Goorin Bros., Inc., Stetson Hats, The North Face, Inc., Quiksilver, Inc. (Boardriders, Inc.), Billabong International Limited, Lids Holdings, LLC, Outdoor Research, LLC, The Gap, Inc., Topgolf Callaway Brands Corp., New Balance, Inc., Pipolaki, Superdry plc contribute to innovation, geographic expansion, and service delivery in this space.

Global Headwear Market Industry Analysis

Growth Drivers

- Increasing Fashion Consciousness:The global headwear market is significantly driven by rising fashion consciousness among consumers. In future, the global apparel market is projected to reach $1.5 trillion, with headwear being a vital accessory. The demand for stylish and trendy headwear is evident, as 60% of consumers aged 18-34 prioritize fashion in their purchases. This demographic shift towards fashion-forward choices is expected to boost headwear sales, particularly in urban areas where style trends rapidly evolve.

- Rising Outdoor Activities and Sports Participation:Participation in outdoor activities and sports is on the rise, contributing to the growth of the headwear market. In future, approximately 50% of the global population is expected to engage in outdoor sports, with activities like hiking and cycling gaining popularity. This trend is supported by a 20% increase in outdoor gear sales, indicating a growing market for functional headwear that offers protection and style. Brands are capitalizing on this trend by introducing innovative designs tailored for active lifestyles.

- Growth in E-commerce Platforms:The expansion of e-commerce platforms is revolutionizing the headwear market, providing consumers with greater access to diverse products. In future, online retail sales are projected to reach $6.4 trillion globally, with headwear being a significant category. The convenience of online shopping, coupled with targeted marketing strategies, has led to a 30% increase in online headwear sales. This shift is particularly pronounced among younger consumers who prefer the ease of purchasing through digital channels, driving overall market growth.

Market Challenges

- Intense Competition:The headwear market faces intense competition, with numerous brands vying for consumer attention. In future, over 1,000 headwear brands are expected to operate globally, leading to price wars and reduced profit margins. This saturation makes it challenging for new entrants to establish a foothold. Established brands must continuously innovate and differentiate their products to maintain market share, which can strain resources and impact overall profitability in a highly competitive landscape.

- Fluctuating Raw Material Prices:Fluctuating prices of raw materials pose a significant challenge to the headwear market. In future, cotton prices are projected to rise by 15%, impacting production costs for many headwear manufacturers. Additionally, synthetic materials like polyester are also subject to price volatility due to global supply chain issues. These fluctuations can lead to increased production costs, forcing brands to either absorb the costs or pass them on to consumers, potentially affecting sales and market stability.

Global Headwear Market Future Outlook

The future of the headwear market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to invest in eco-friendly materials and production processes. Additionally, the integration of smart technology in headwear, such as UV protection and moisture-wicking fabrics, is expected to attract health-conscious consumers. The continued growth of online retail will further enhance accessibility, allowing brands to reach a broader audience and adapt to changing market dynamics effectively.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant growth opportunities for headwear brands. With a projected increase in disposable income, countries like India and Brazil are expected to see a 25% rise in headwear demand in future. Brands can capitalize on this trend by tailoring products to local preferences and leveraging regional e-commerce platforms to enhance market penetration.

- Customization and Personalization Trends:The trend towards customization and personalization in headwear is gaining traction. In future, 40% of consumers express interest in personalized products, indicating a shift towards unique offerings. Brands that provide customizable options, such as embroidery or design choices, can tap into this demand, enhancing customer loyalty and driving sales growth in a competitive market.