Region:Global

Author(s):Shubham

Product Code:KRAB0732

Pages:88

Published On:August 2025

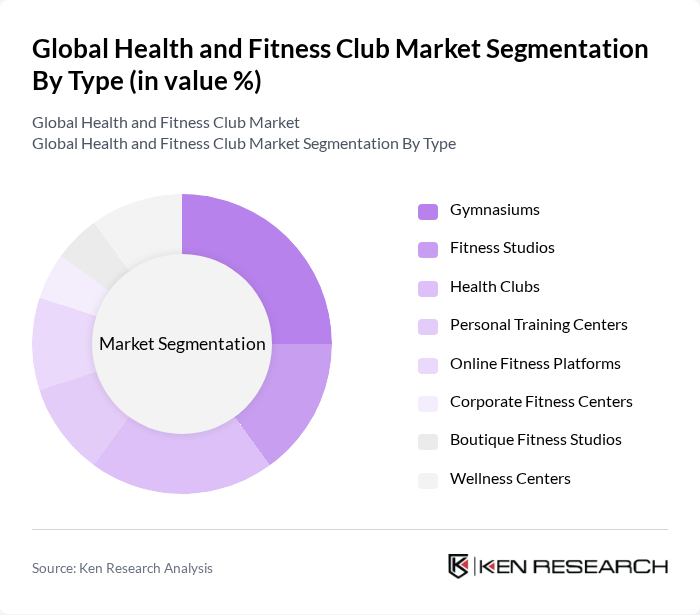

By Type:The market is segmented into various types, including gymnasiums, fitness studios, health clubs, personal training centers, online fitness platforms, corporate fitness centers, boutique fitness studios, and wellness centers. Each type caters to different consumer preferences and fitness needs, contributing to the overall growth of the market. The rise of online fitness platforms and boutique studios reflects a shift toward personalized and flexible fitness solutions, while traditional gymnasiums and health clubs continue to serve a broad membership base .

By End-User:The end-user segmentation includes individuals, corporates, educational institutions, and government organizations. Each segment has unique requirements and preferences, influencing the types of services and memberships offered in the market. Individuals remain the largest segment, driven by personal health goals, while corporates are increasingly investing in employee wellness programs. Educational institutions and government organizations are expanding fitness offerings to promote overall well-being .

The Global Health and Fitness Club Market is characterized by a dynamic mix of regional and international players. Leading participants such as Planet Fitness, Inc., Anytime Fitness, LLC, Gold's Gym International, Inc., 24 Hour Fitness Worldwide, Inc., Life Time, Inc., Equinox Holdings, Inc., Snap Fitness, LLC, LA Fitness International, LLC, Virgin Active Group Ltd., Fitness First Ltd., Curves International, Inc., PureGym Limited, F45 Training Holdings Inc., SoulCycle Inc., Barry's Bootcamp LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the health and fitness club market appears promising, driven by technological advancements and a growing emphasis on holistic wellness. As clubs increasingly adopt digital platforms and personalized training programs, member engagement is expected to rise. Additionally, the integration of mental health initiatives into fitness offerings will likely attract a broader audience, enhancing overall participation rates. Clubs that adapt to these trends will be well-positioned to thrive in a competitive landscape, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Gymnasiums Fitness Studios Health Clubs Personal Training Centers Online Fitness Platforms Corporate Fitness Centers Boutique Fitness Studios Wellness Centers |

| By End-User | Individuals Corporates Educational Institutions Government Organizations |

| By Membership Type | Monthly Memberships Annual Memberships Pay-Per-Visit Family Packages Corporate Memberships |

| By Service Offered | Group Classes (Aerobics, Yoga, Pilates, Cycling) Personal Training Nutrition Counseling Wellness Programs Virtual/Online Classes Swimming Pool Access |

| By Pricing Model | Premium Pricing Mid-Range Pricing Budget Pricing |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Technology Integration | Mobile Apps Virtual Classes Fitness Trackers Smart Gym Equipment Artificial Intelligence/Personalized Recommendations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Traditional Fitness Clubs | 120 | Club Owners, General Managers |

| Boutique Fitness Studios | 80 | Studio Managers, Instructors |

| Online Fitness Platforms | 60 | Product Managers, Marketing Directors |

| Corporate Wellness Programs | 50 | HR Managers, Wellness Coordinators |

| Fitness Equipment Retailers | 70 | Sales Managers, Product Development Teams |

The Global Health and Fitness Club Market is valued at approximately USD 101 billion, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and urbanization, alongside the influence of social media on wellness trends.