Region:Global

Author(s):Shubham

Product Code:KRAA1906

Pages:86

Published On:August 2025

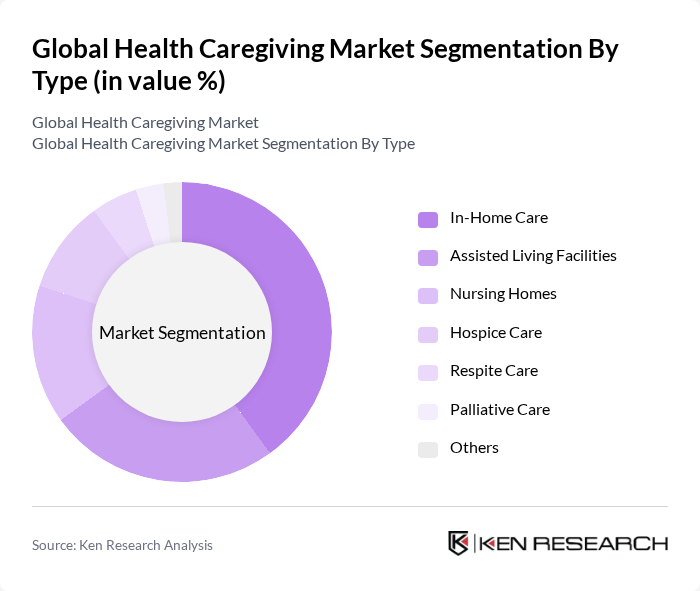

By Type:The market is segmented into various types of caregiving services, including In-Home Care, Assisted Living Facilities, Nursing Homes, Hospice Care, Respite Care, Palliative Care, and Others. Each of these segments caters to different needs and preferences of individuals requiring care, with In-Home Care being the most sought-after option due to its personalized approach, cost-effectiveness versus institutional settings, and technology-enabled remote monitoring that supports care at home.

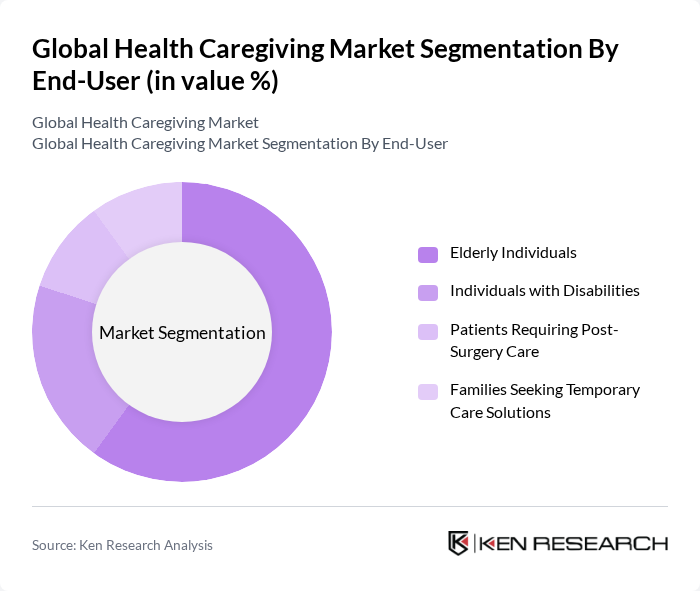

By End-User:The end-user segmentation includes Elderly Individuals, Individuals with Disabilities, Patients Requiring Post-Surgery Care, and Families Seeking Temporary Care Solutions. The elderly population is the largest segment, driven by the increasing number of seniors requiring assistance with activities of daily living, chronic disease management, and supportive services to age in place.

The Global Health Caregiving Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amedisys, Inc., LHC Group, Inc. (now part of Optum/UnitedHealth Group), Brookdale Senior Living Inc., Kindred at Home (CenterWell Home Health, Humana Inc.), Visiting Angels, Comfort Keepers (Sodexo), Home Instead (an Honor Company), BrightStar Care, Encompass Health Corporation, Genesis HealthCare, Right at Home, Senior Helpers, Maxim Healthcare Services, Addus HomeCare Corporation, TCARE, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the caregiving market in None is poised for transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and telehealth solutions is expected to enhance service delivery, making care more efficient and accessible. Additionally, the emphasis on personalized care will likely reshape service models, catering to individual needs. As the market adapts to these trends, it will create new opportunities for innovation and collaboration among stakeholders in the healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Home Care Assisted Living Facilities Nursing Homes Hospice Care Respite Care Palliative Care Others |

| By End-User | Elderly Individuals Individuals with Disabilities Patients Requiring Post-Surgery Care Families Seeking Temporary Care Solutions |

| By Service Model | Private Pay Insurance-Based Government-Funded Programs |

| By Caregiver Type | Professional Caregivers Family Caregivers Volunteer Caregivers |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas |

| By Payment Model | Fee-for-Service Subscription-Based Pay-as-You-Go |

| By Duration of Care | Short-Term Care Long-Term Care Temporary Care |

| By Service Type (Industry-Standard) | Home Care (Personal Care, Homemaker, Companion Care) Nursing Care (Skilled Home Health) Assisted Living Services Hospice & Palliative Care Telehealth & Remote Monitoring Care Coordination & Care Management Daily Essential Activities Support Transition Support & Respite Care |

| By Care Type | Medical Care Non-Medical Care |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Caregiving Services | 140 | Healthcare Administrators, Care Facility Managers |

| Family Caregiver Insights | 150 | Family Caregivers, Patient Advocates |

| Technology in Caregiving | 100 | Health Tech Product Managers, IT Managers in Healthcare |

| Policy Impact on Caregiving | 80 | Healthcare Policy Makers, NGO Representatives |

| Regional Caregiving Trends | 120 | Regional Health Officials, Community Health Workers |

The Global Health Caregiving Market is valued between USD 210 billion and USD 240 billion, driven by factors such as an aging population, chronic disease prevalence, and a shift towards home-based care solutions, including technology-enabled services.