Region:Global

Author(s):Geetanshi

Product Code:KRAB0159

Pages:87

Published On:August 2025

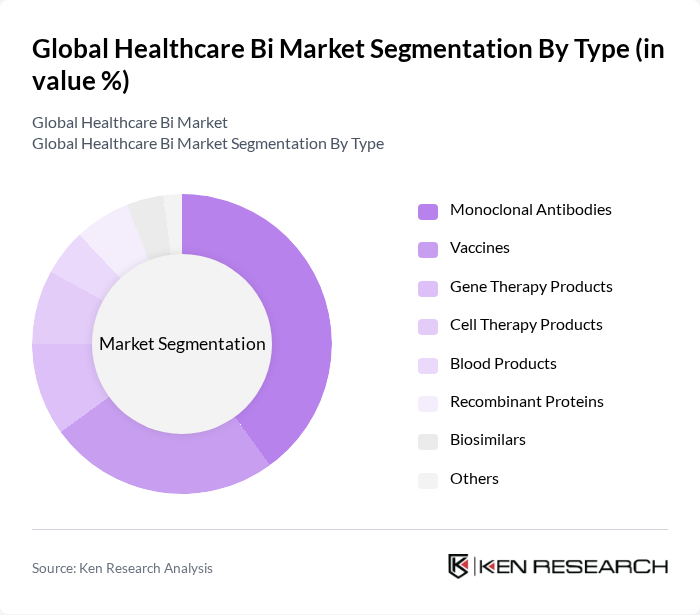

By Type:The market is segmented into Monoclonal Antibodies, Vaccines, Gene Therapy Products, Cell Therapy Products, Blood Products, Recombinant Proteins, Biosimilars, and Others. Among these, Monoclonal Antibodies lead the market due to their effectiveness in treating various diseases, particularly cancers and autoimmune disorders. The increasing prevalence of these conditions and the growing demand for targeted therapies are driving the growth of this sub-segment .

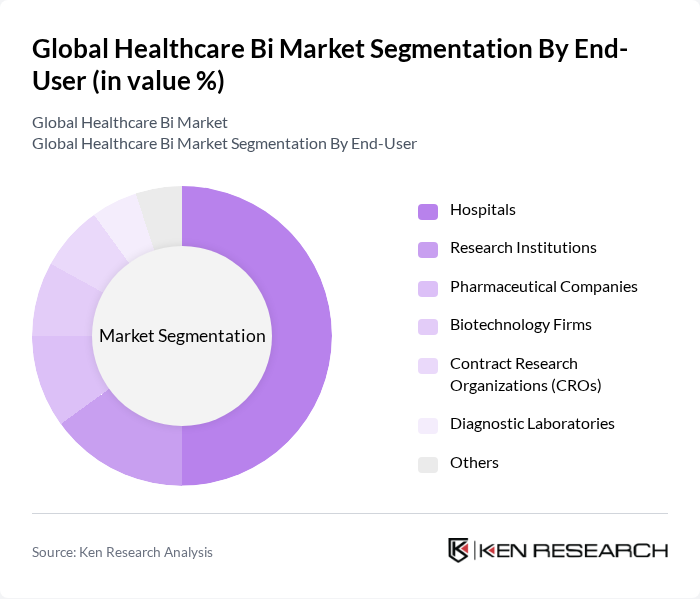

By End-User:The end-user segmentation includes Hospitals, Research Institutions, Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations (CROs), Diagnostic Laboratories, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of patients requiring advanced biologic therapies and the growing adoption of personalized medicine in clinical settings .

The Global Healthcare Bi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Genentech, Inc. (a member of the Roche Group), AbbVie Inc., Gilead Sciences, Inc., Regeneron Pharmaceuticals, Inc., Biogen Inc., Merck & Co., Inc., Johnson & Johnson, Pfizer Inc., Novartis AG, Sanofi S.A., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Bayer AG, AstraZeneca PLC, Roche Holding AG, Bristol Myers Squibb, CSL Limited, BioNTech SE, Moderna, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare bi market appears promising, driven by ongoing advancements in biotechnology and the increasing focus on personalized medicine. As the demand for biologics continues to rise, companies are likely to invest heavily in research and development, fostering innovation. Additionally, the integration of digital health technologies is expected to enhance patient engagement and treatment outcomes, further propelling market growth. The emphasis on sustainability and ethical practices will also shape the industry's trajectory, ensuring long-term viability and acceptance.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Vaccines Gene Therapy Products Cell Therapy Products Blood Products Recombinant Proteins Biosimilars Others |

| By End-User | Hospitals Research Institutions Pharmaceutical Companies Biotechnology Firms Contract Research Organizations (CROs) Diagnostic Laboratories Others |

| By Application | Oncology Infectious Diseases Autoimmune Disorders Cardiovascular Diseases Neurological Disorders Rare Diseases Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales Retail Pharmacies Hospital Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Cost-Plus Pricing Others |

| By Regulatory Compliance | FDA Compliance EMA Compliance WHO Guidelines Local Regulatory Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Hospital Administrators, Clinic Managers |

| Pharmaceutical Companies | 80 | R&D Directors, Regulatory Affairs Managers |

| Biotechnology Firms | 60 | Product Development Managers, Business Development Executives |

| Healthcare Consumers | 90 | Patients, Caregivers, Health Advocates |

| Insurance Providers | 70 | Underwriters, Claims Managers |

The Global Healthcare Bi Market is valued at approximately USD 483 billion, driven by advancements in biotechnology, the rising prevalence of chronic diseases, and increased investments in research and development.