Region:Global

Author(s):Geetanshi

Product Code:KRAC0033

Pages:80

Published On:August 2025

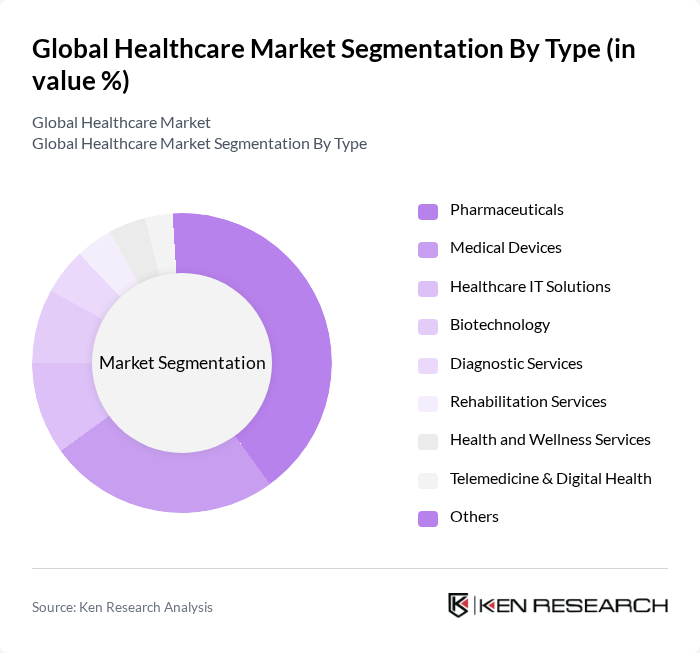

By Type:The healthcare market is segmented into Pharmaceuticals, Medical Devices, Healthcare IT Solutions, Biotechnology, Diagnostic Services, Rehabilitation Services, Health and Wellness Services, Telemedicine & Digital Health, and Others. Among these, Pharmaceuticals and Medical Devices are the most significant contributors to market growth. The increasing demand for innovative drugs, advanced medical technologies, and the adoption of digital health platforms are driving the expansion of these segments. The integration of artificial intelligence, personalized medicine, and remote patient monitoring are also accelerating growth in Healthcare IT Solutions and Telemedicine & Digital Health.

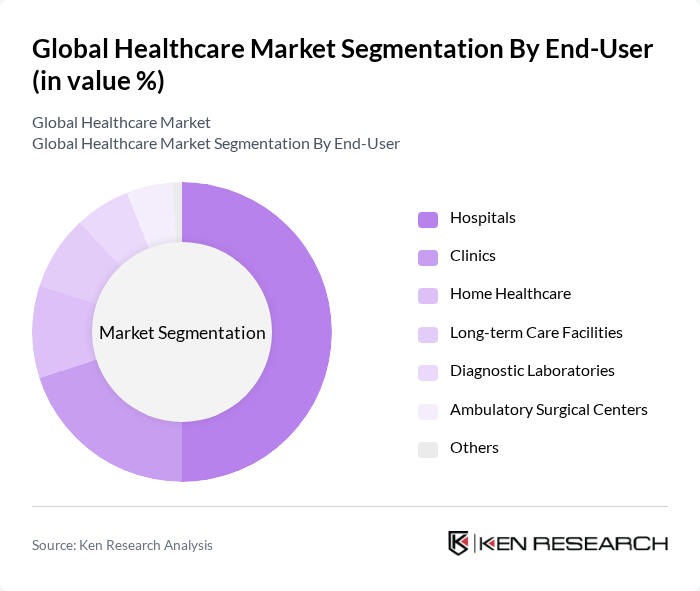

By End-User:The healthcare market is also segmented by end-users, which include Hospitals, Clinics, Home Healthcare, Long-term Care Facilities, Diagnostic Laboratories, Ambulatory Surgical Centers, and Others. Hospitals and Clinics are the primary end-users, driven by the increasing patient population, demand for advanced medical services, and the growing adoption of digital and remote care technologies. Home Healthcare and Telemedicine are experiencing accelerated growth due to the shift toward outpatient and remote care models.

The Global Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Pfizer Inc., Roche Holding AG, Merck & Co., Inc., Abbott Laboratories, Medtronic plc, Siemens Healthineers AG, GE HealthCare Technologies Inc., Novartis AG, Bayer AG, Philips Healthcare (Koninklijke Philips N.V.), Gilead Sciences, Inc., Stryker Corporation, Thermo Fisher Scientific Inc., Cardinal Health, Inc., UnitedHealth Group Incorporated, McKesson Corporation, Cigna Group, CVS Health Corporation, and HCA Healthcare, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare market is poised for transformative changes driven by technological advancements and evolving patient expectations. As telehealth services expand, more patients will access care remotely, improving convenience and reducing costs. Additionally, the integration of artificial intelligence in diagnostics and treatment planning will enhance decision-making processes, leading to better patient outcomes. These trends indicate a shift towards more efficient, patient-centered care models that prioritize accessibility and quality in healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceuticals Medical Devices Healthcare IT Solutions Biotechnology Diagnostic Services Rehabilitation Services Health and Wellness Services Telemedicine & Digital Health Others |

| By End-User | Hospitals Clinics Home Healthcare Long-term Care Facilities Diagnostic Laboratories Ambulatory Surgical Centers Others |

| By Service Type | Inpatient Services Outpatient Services Emergency Services Palliative Care Preventive Care Others |

| By Distribution Channel | Direct Sales Online Sales Retail Pharmacies Hospitals E-commerce Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Insurance Type | Private Insurance Public Insurance Uninsured Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Administration Insights | 100 | Hospital Administrators, CFOs, and Department Heads |

| Pharmaceutical Market Trends | 80 | Pharmaceutical Executives, Product Managers, and Regulatory Affairs Specialists |

| Telehealth Adoption Rates | 60 | Healthcare IT Managers, Telehealth Coordinators, and Clinicians |

| Patient Experience and Satisfaction | 90 | Patients, Caregivers, and Patient Advocacy Group Representatives |

| Healthcare Technology Utilization | 70 | Healthcare Technology Officers, IT Specialists, and Clinical Staff |

The Global Healthcare Market is valued at approximately USD 9 trillion, driven by increasing healthcare expenditure, advancements in medical technology, and the rising prevalence of chronic diseases. This growth reflects the demand for innovative healthcare solutions and improved patient care.