Region:Global

Author(s):Dev

Product Code:KRAB0363

Pages:93

Published On:August 2025

By Product Type:The product type segmentation includes various categories such as mobile devices, mobile applications, enterprise mobility platforms, remote patient monitoring devices, and other mobile health solutions. Among these, mobile applications are currently leading the market due to their widespread adoption by healthcare providers and patients alike. The increasing demand for telehealth services and patient engagement tools has significantly contributed to the growth of mobile applications, making them a crucial component of healthcare mobility solutions. The adoption of mobile devices such as smartphones, tablets, and wearables is also substantial, as these devices facilitate real-time data access, remote monitoring, and improved communication among healthcare professionals .

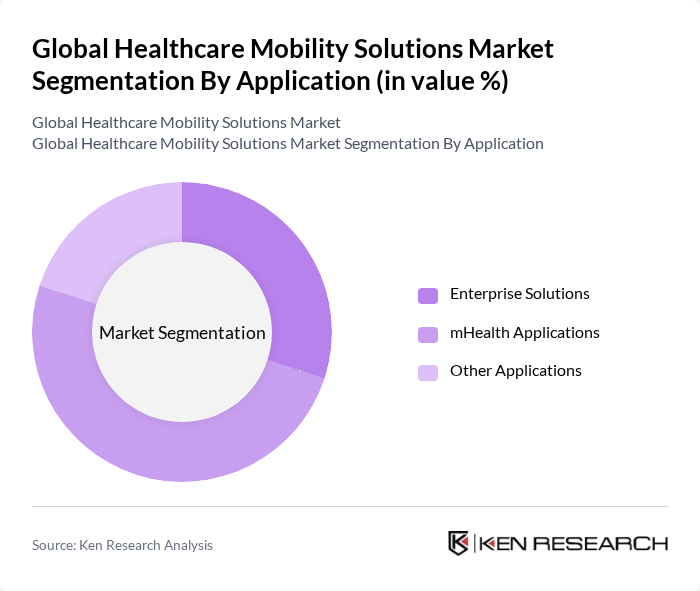

By Application:The application segmentation encompasses enterprise solutions, mHealth applications, and other applications. The mHealth applications segment is currently the most dominant, driven by the increasing use of smartphones and the growing trend of self-monitoring among patients. These applications facilitate better communication between patients and healthcare providers, enhancing overall healthcare delivery and patient satisfaction. Enterprise solutions also play a significant role by streamlining clinical workflows and supporting data management in healthcare organizations .

The Global Healthcare Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Cerner Corporation, McKesson Corporation, Allscripts Healthcare Solutions, IBM Watson Health, Qualcomm Life, GE Healthcare, Siemens Healthineers, Medtronic, Epic Systems Corporation, Oracle Health Sciences, Health Catalyst, Teladoc Health, Zocdoc, Doximity, OMRON Healthcare, Inc., Apple Inc., Wipro Limited, Samsung Electronics Co., Ltd., Cisco Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of healthcare mobility solutions is poised for transformative growth, driven by technological advancements and evolving patient expectations. As telehealth services expand, healthcare providers will increasingly leverage mobile solutions to enhance patient engagement and streamline care delivery. The integration of artificial intelligence and machine learning will further optimize healthcare processes, enabling personalized treatment plans. Additionally, the focus on interoperability will facilitate seamless data exchange, improving care coordination and patient outcomes across the healthcare continuum.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Mobile Devices (Smartphones, Tablets, Wearable Devices) Mobile Applications (Patient Engagement Apps, Clinical Workflow Apps, Telehealth Apps) Enterprise Mobility Platforms (MDM, MAM Solutions) Remote Patient Monitoring Devices Other Product Types (Mobile Health Solutions, etc.) |

| By Application | Enterprise Solutions mHealth Applications Other Applications |

| By End-User | Healthcare Providers (Hospitals, Clinics, Laboratories) Payers Patients (Individual Consumers, Home Healthcare Providers) Others |

| By Care Setting | Hospitals & Clinics Home-Care / Hospital-at-Home Emergency & Ambulatory Services |

| By Deployment Mode | Cloud-based On-premise |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Solutions | 100 | Healthcare IT Managers, Telehealth Coordinators |

| Remote Patient Monitoring | 80 | Clinical Managers, Home Health Care Providers |

| Mobile Health Applications | 70 | App Developers, Healthcare Marketing Specialists |

| Healthcare Mobility Infrastructure | 60 | Facility Managers, IT Infrastructure Specialists |

| Patient Engagement Tools | 50 | Patient Experience Officers, Healthcare Consultants |

The Global Healthcare Mobility Solutions Market is valued at approximately USD 135 billion, driven by the increasing adoption of mobile health applications, the rise in chronic diseases, and the demand for remote patient monitoring solutions.