Region:Global

Author(s):Rebecca

Product Code:KRAC0301

Pages:80

Published On:August 2025

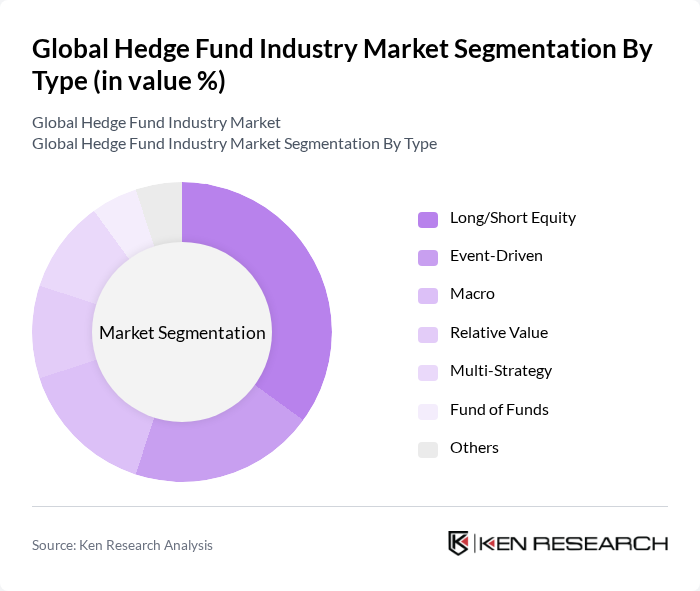

By Type:The hedge fund market is segmented into various types, including Long/Short Equity, Event-Driven, Macro, Relative Value, Multi-Strategy, Fund of Funds, and Others. Among these,Long/Short Equityremains a dominant strategy due to its flexibility in taking both long and short positions, allowing fund managers to capitalize on market inefficiencies. This strategy appeals to investors seeking risk-adjusted returns, especially in volatile market conditions.

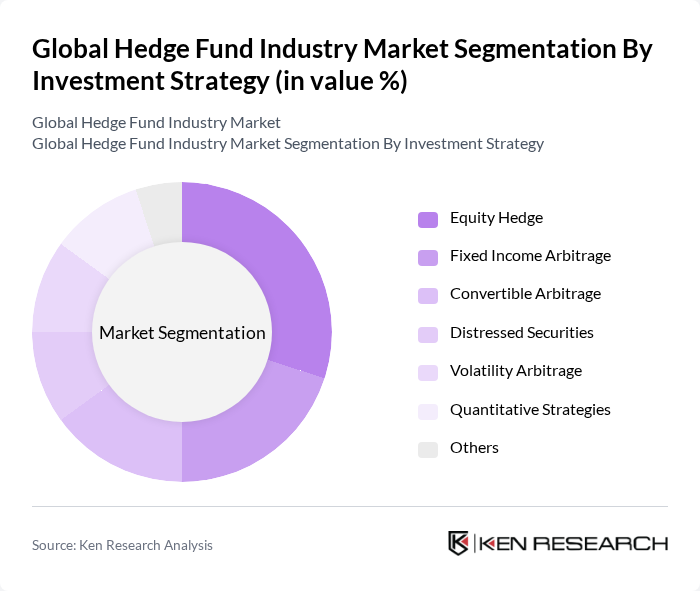

By Investment Strategy:The investment strategies employed by hedge funds include Equity Hedge, Fixed Income Arbitrage, Convertible Arbitrage, Distressed Securities, Volatility Arbitrage, Quantitative Strategies, and Others. TheEquity Hedgestrategy is particularly prominent, as it allows managers to invest in long positions while hedging against market downturns. This strategy has gained traction among investors looking for a balanced approach to risk and return.

The Global Hedge Fund Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as BlackRock, Inc., Bridgewater Associates, LP, Man Group plc, AQR Capital Management, LLC, Renaissance Technologies LLC, Two Sigma Investments, LP, Citadel LLC, Winton Group, Limited, Millennium Management LLC, Point72 Asset Management, L.P., Marshall Wace LLP, Capula Investment Management LLP, Highfields Capital Management, LP, CQS, Element Capital Management, LLC, DE Shaw & Co., L.P., Elliott Management Corporation, Baupost Group, LLC, Pershing Square Capital Management, L.P., Lone Pine Capital LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hedge fund industry appears promising, driven by increasing institutional investments and a growing demand for innovative financial products. As hedge funds adapt to market dynamics, the integration of technology will enhance trading strategies and operational efficiencies. Furthermore, the rise of ESG investing is expected to reshape investment approaches, attracting a broader range of investors. Overall, the industry is poised for growth, with a focus on sustainability and technological advancement shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Long/Short Equity Event-Driven Macro Relative Value Multi-Strategy Fund of Funds Others |

| By Investment Strategy | Equity Hedge Fixed Income Arbitrage Convertible Arbitrage Distressed Securities Volatility Arbitrage Quantitative Strategies Others |

| By Fund Size | Small Cap (<$500M AUM) Mid Cap ($500M–$2B AUM) Large Cap ($2B–$10B AUM) Mega Cap (>$10B AUM) |

| By Investor Type | Institutional Investors High Net-Worth Individuals Family Offices Retail Investors Sovereign Wealth Funds |

| By Geographic Focus | Domestic Focus International Focus Global Focus |

| By Performance Fee Structure | Fixed Fee Performance-Based Fee Hybrid Fee |

| By Liquidity Profile | Daily Liquidity Monthly Liquidity Quarterly Liquidity Lock-Up Periods |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long/Short Equity Hedge Funds | 100 | Portfolio Managers, Equity Analysts |

| Event-Driven Hedge Funds | 80 | Investment Analysts, Risk Managers |

| Global Macro Hedge Funds | 60 | Macro Strategists, Economic Analysts |

| Quantitative Hedge Funds | 50 | Data Scientists, Quantitative Analysts |

| Multi-Strategy Hedge Funds | 70 | Fund Managers, Operations Directors |

The Global Hedge Fund Industry Market is valued at approximately USD 4.7 trillion, driven by increasing institutional investments and the demand for alternative investment vehicles. This growth reflects a robust interest in hedge funds' ability to generate returns across various market conditions.