Region:Global

Author(s):Shubham

Product Code:KRAC0709

Pages:96

Published On:August 2025

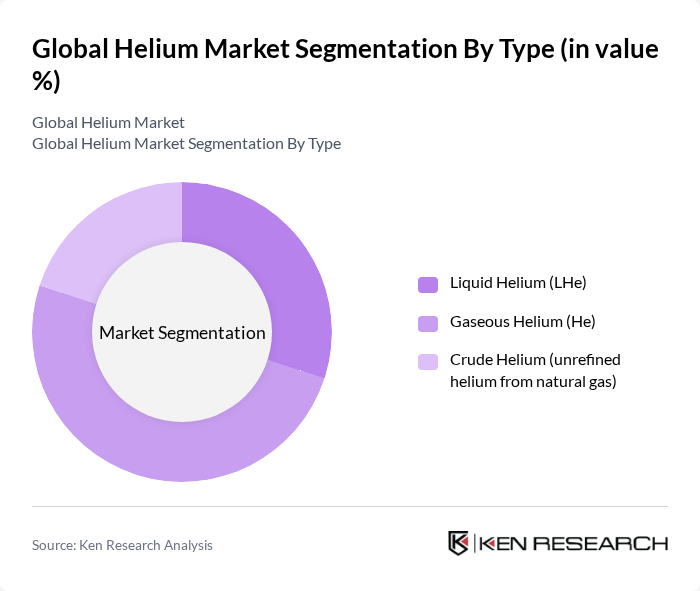

By Type:

The helium market is segmented into three main types: Liquid Helium (LHe), Gaseous Helium (He), and Crude Helium (unrefined helium from natural gas). Gaseous Helium holds a significant share due to widespread use as an inert purge, carrier, and shielding gas in semiconductors, fiber optics, and leak detection. Liquid Helium is critical for cryogenics—especially MRI magnets—owing to its ultra-low boiling point. Crude Helium from natural gas streams is gaining attention as producers invest in refining/liquefaction to improve recovery yields and cost efficiency .

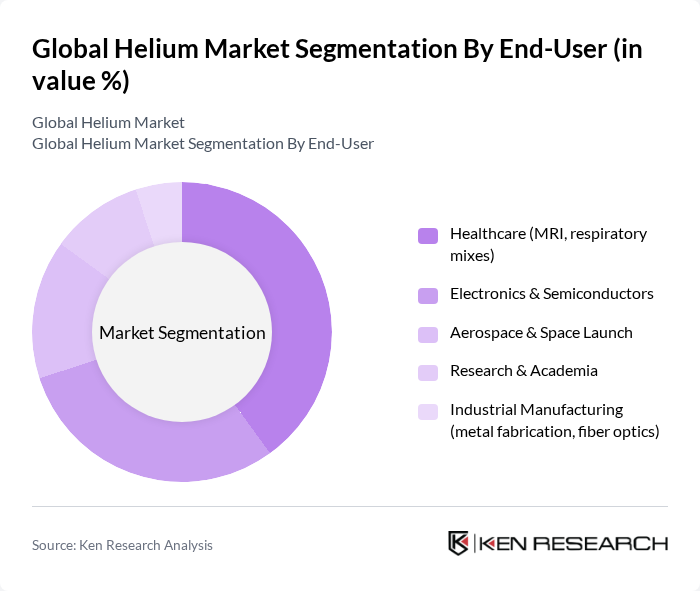

By End-User:

The end-user segmentation includes Healthcare, Electronics & Semiconductors, Aerospace & Space Launch, Research & Academia, and Industrial Manufacturing. Healthcare is a leading end-user because MRI systems require continuous liquid helium for superconducting magnets; conservation technologies reduce but do not eliminate helium use. Electronics & Semiconductors are another major end-user where helium supports wafer fabrication, purge, heat transfer, and leak testing. Aerospace and space launch operations rely on helium for pressurizing and purging rocket systems, while research institutions use helium for cryogenics and experimental physics. Industrial manufacturing applies helium for shielding in specialty welding, fiber optics, and other precision processes .

The Global Helium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Linde plc, Air Liquide S.A., Messer SE & Co. KGaA, Taiyo Nippon Sanso Corporation (a Nippon Sanso Holdings company), Iwatani Corporation, ExxonMobil Corporation, QatarEnergy (QatarEnergy LNG – Ras Laffan Helium), Gazprom (Amur Helium Project), Sonatrach, Renergen Limited, Helium One Global Ltd., Global Helium Corp., Avanti Helium Corp., Matheson Tri-Gas, Inc. (MATHESON) contribute to innovation, geographic expansion, and service delivery in this space .

The helium market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt helium recycling and recovery technologies, the market is expected to stabilize supply and reduce environmental impacts. Additionally, the growing focus on supply security will encourage investments in local production capabilities, particularly in None, where emerging technologies can enhance extraction efficiency and sustainability, ensuring a more resilient helium supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Helium (LHe) Gaseous Helium (He) Crude Helium (unrefined helium from natural gas) |

| By End-User | Healthcare (MRI, respiratory mixes) Electronics & Semiconductors Aerospace & Space Launch Research & Academia Industrial Manufacturing (metal fabrication, fiber optics) |

| By Application | Cryogenics (including MRI) Leak Detection & Trace Gas Pressurizing & Purging (rocket propulsion, pipelines) Welding & Shielding Gas Controlled/Shielded Atmospheres (semiconductor, fiber optics) Lifting/Ballooning |

| By Distribution Channel | Direct Offtake/Long-term Contracts Industrial Gas Distributors Spot/On-demand Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Mechanism | Index-linked/Contract Pricing Spot Pricing Tolling/Processing Fees |

| By Others | Helium Recovery & Recycling Onsite Supply (Bulk, Microbulk, cylinders, dewars) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Applications of Helium | 100 | Healthcare Administrators, Medical Equipment Suppliers |

| Industrial Helium Usage | 80 | Manufacturing Managers, Process Engineers |

| Aerospace Sector Demand | 70 | Aerospace Engineers, Procurement Specialists |

| Research and Development Applications | 60 | Lab Managers, Research Scientists |

| Emerging Markets for Helium | 90 | Market Analysts, Business Development Managers |

The Global Helium Market is valued at approximately USD 4.1 billion, driven by demand from sectors such as healthcare, electronics, aerospace, and research. This valuation reflects a robust consumption pattern, particularly in MRI cooling and semiconductor applications.