Region:Global

Author(s):Shubham

Product Code:KRAD0799

Pages:90

Published On:August 2025

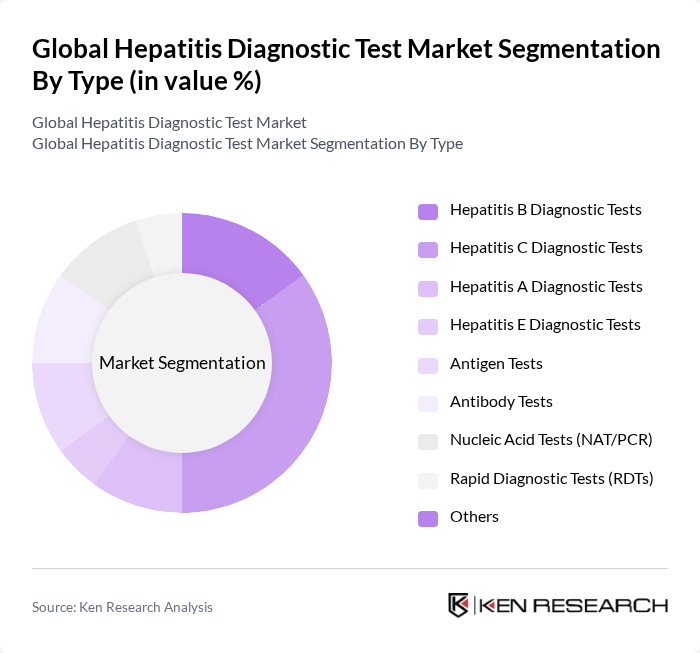

By Type:The market is segmented into various types of diagnostic tests, including Hepatitis B Diagnostic Tests, Hepatitis C Diagnostic Tests, Hepatitis A Diagnostic Tests, Hepatitis E Diagnostic Tests, Antigen Tests, Antibody Tests, Nucleic Acid Tests (NAT/PCR), Rapid Diagnostic Tests (RDTs), and Others. Among these, Hepatitis C Diagnostic Tests are currently leading the market due to the high prevalence of hepatitis C infections globally and the increasing focus on early detection and treatment. The growing awareness of hepatitis C's health implications and the availability of effective antiviral therapies further drive the demand for these tests.

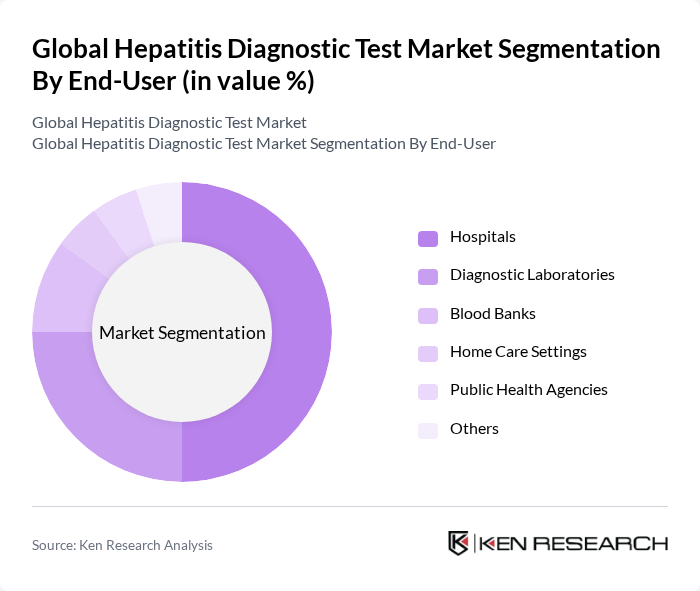

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Blood Banks, Home Care Settings, Public Health Agencies, and Others. Hospitals are the leading end-users of hepatitis diagnostic tests, primarily due to their capacity to provide comprehensive healthcare services, including testing, treatment, and follow-up care. The increasing number of hospital admissions for hepatitis-related complications and the growing emphasis on preventive healthcare measures contribute to the dominance of hospitals in this segment.

The Global Hepatitis Diagnostic Test Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories, Cepheid, Hologic, Inc., Ortho Clinical Diagnostics, Grifols S.A., DiaSorin S.p.A., Mylab Discovery Solutions, Fujirebio, GenMark Diagnostics, QuidelOrtho Corporation, Becton, Dickinson and Company, Thermo Fisher Scientific, bioMérieux SA, Qiagen GmbH, Beckman Coulter, Inc. (Danaher Corporation), MedMira Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hepatitis diagnostic test market in future appears promising, driven by ongoing technological advancements and increased government support for hepatitis elimination initiatives. As healthcare providers increasingly adopt point-of-care testing and rapid diagnostic kits, accessibility to testing will improve significantly. Furthermore, the integration of artificial intelligence in diagnostics is expected to enhance accuracy and efficiency, paving the way for personalized medicine approaches that cater to individual patient needs, ultimately transforming hepatitis management in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hepatitis B Diagnostic Tests Hepatitis C Diagnostic Tests Hepatitis A Diagnostic Tests Hepatitis E Diagnostic Tests Antigen Tests Antibody Tests Nucleic Acid Tests (NAT/PCR) Rapid Diagnostic Tests (RDTs) Others |

| By End-User | Hospitals Diagnostic Laboratories Blood Banks Home Care Settings Public Health Agencies Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Screening Diagnosis Monitoring Blood Donor Testing Others |

| By Test Format | Laboratory-based Tests Point-of-Care Tests Home Testing Kits Others |

| By Sample Type | Blood Samples Saliva Samples Urine Samples Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hepatitis B Diagnostic Testing | 100 | Laboratory Technologists, Infectious Disease Specialists |

| Hepatitis C Diagnostic Testing | 90 | Hepatologists, General Practitioners |

| Serological Testing Methods | 80 | Clinical Pathologists, Diagnostic Lab Managers |

| Molecular Testing Technologies | 60 | Research Scientists, Product Development Managers |

| Market Access and Reimbursement | 50 | Health Economists, Policy Analysts |

The Global Hepatitis Diagnostic Test Market is valued at approximately USD 4.6 billion, driven by the rising prevalence of hepatitis infections, increased awareness about early diagnosis, and advancements in diagnostic technologies.