Region:Global

Author(s):Dev

Product Code:KRAB0614

Pages:96

Published On:August 2025

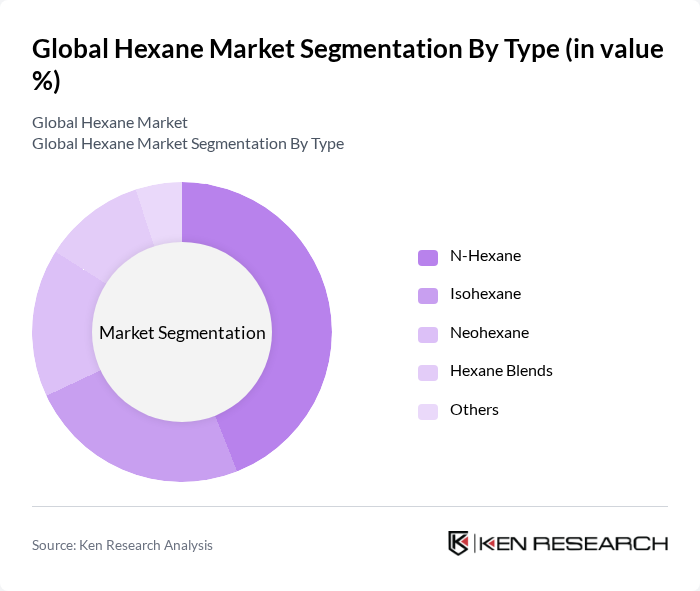

By Type:The hexane market is segmented into N-Hexane, Isohexane, Neohexane, Hexane Blends, and Others. N-Hexane remains the most widely used due to its high efficiency in edible oil extraction and industrial solvent applications. Isohexane and Neohexane are gaining traction for their roles in specialty chemical synthesis and polymerization processes .

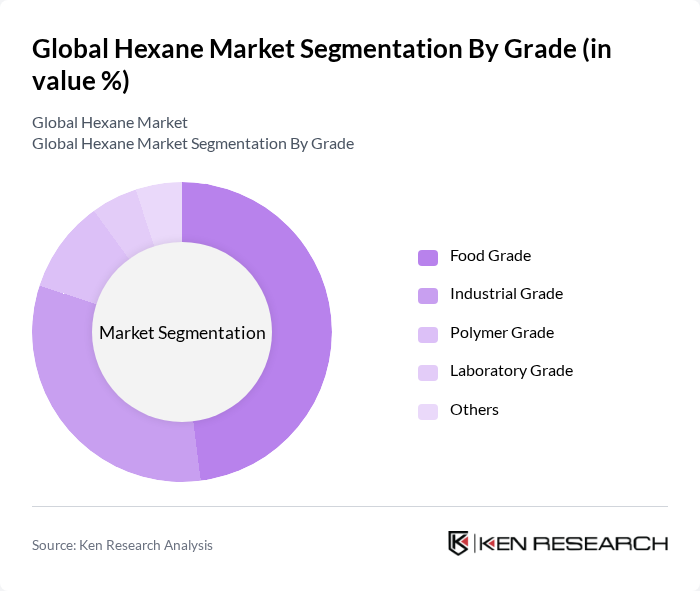

By Grade:The market is segmented by grade into Food Grade, Industrial Grade, Polymer Grade, Laboratory Grade, and Others. Food Grade hexane leads due to stringent purity requirements in edible oil extraction, while Industrial Grade is significant for adhesives, coatings, and chemical manufacturing .

The Global Hexane Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Shell plc, Chevron Phillips Chemical Company LLC, Phillips 66 Company, TotalEnergies SE, BASF SE, LyondellBasell Industries N.V., China Petroleum & Chemical Corporation (Sinopec), INEOS Group Limited, Reliance Industries Limited, Formosa Plastics Corporation, Eastman Chemical Company, Huntsman Corporation, SK geo centric Co., Ltd., TPC Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hexane market appears promising, driven by increasing industrial applications and technological advancements. As sustainability becomes a priority, companies are likely to invest in eco-friendly production methods, aligning with global trends. Additionally, the rising demand for bio-based hexane presents a significant opportunity for innovation. Strategic partnerships among industry players will further enhance market resilience, enabling adaptation to regulatory changes and consumer preferences while fostering growth in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | N-Hexane Isohexane Neohexane Hexane Blends Others |

| By Grade | Food Grade Industrial Grade Polymer Grade Laboratory Grade Others |

| By Application | Edible Oil Extraction Industrial Solvents Adhesives and Sealants Paints and Coatings Pharmaceuticals Cleaning Agent Fuel Additive Others |

| By End-User | Chemical Manufacturing Food Processing Pharmaceuticals Adhesives & Rubber Paints & Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Drums IBC Totes Bulk Others |

| By Price Range | Low Price Medium Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hexane Production Facilities | 100 | Plant Managers, Production Supervisors |

| Hexane Distribution Networks | 80 | Logistics Coordinators, Supply Chain Managers |

| End-User Industries (e.g., Food, Pharmaceuticals) | 70 | Procurement Managers, Quality Assurance Officers |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Environmental Compliance Officers |

| Research and Development Departments | 50 | R&D Managers, Chemical Engineers |

The Global Hexane Market is valued at approximately USD 2.25 billion, driven by increasing demand in sectors such as edible oil extraction, industrial solvents, and pharmaceuticals, which utilize hexane as a crucial solvent.