Region:Global

Author(s):Shubham

Product Code:KRAC0577

Pages:98

Published On:August 2025

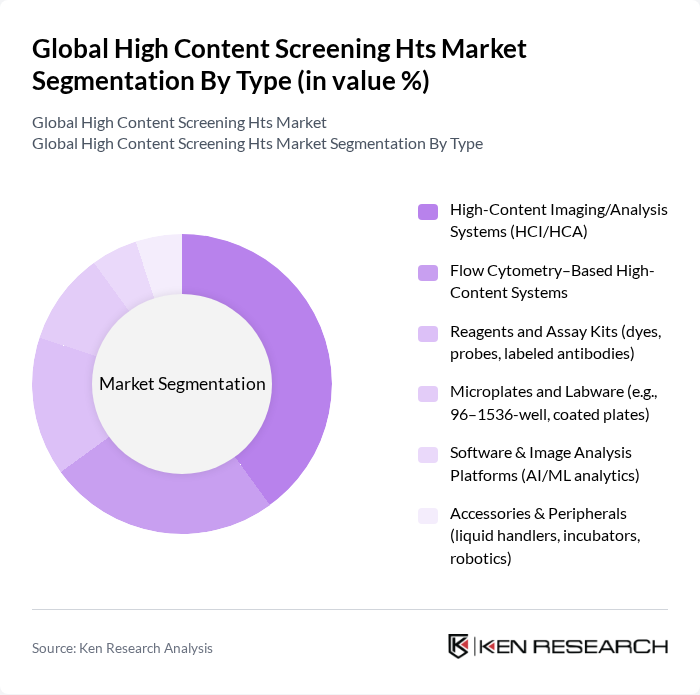

By Type:The market is segmented into various types, including High-Content Imaging/Analysis Systems (HCI/HCA), Flow Cytometry–Based High-Content Systems, Reagents and Assay Kits, Microplates and Labware, Software & Image Analysis Platforms, and Accessories & Peripherals. Among these, High-Content Imaging/Analysis Systems (HCI/HCA) dominate the market due to their advanced capabilities in analyzing cellular responses and drug interactions, which are crucial for drug discovery and development .

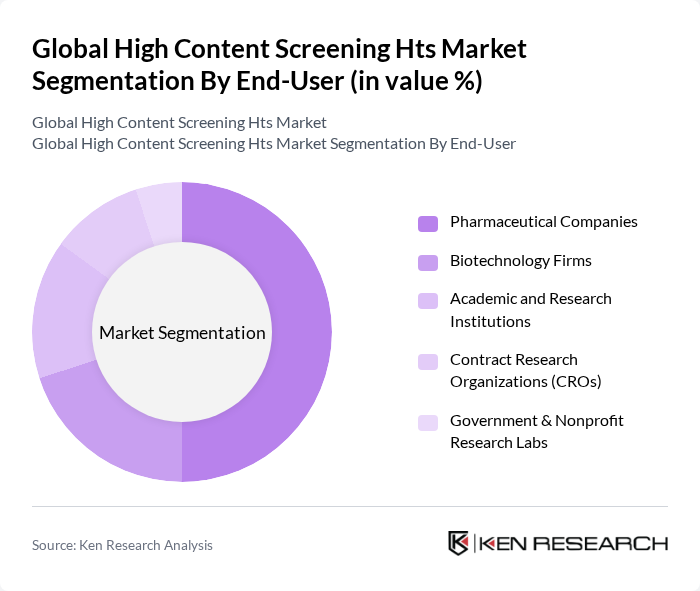

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Contract Research Organizations (CROs), and Government & Nonprofit Research Labs. Pharmaceutical Companies are the leading end-users, driven by their need for efficient drug discovery processes, increased investment in cell-based assays, and the expanding role of phenotypic screening and toxicology in preclinical workflows .

The Global High Content Screening Hts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Revvity, Inc. (formerly PerkinElmer Inc.), Becton, Dickinson and Company (BD), Merck KGaA (Merck Millipore), Cytiva (formerly GE Healthcare Life Sciences), Corning Incorporated, Agilent Technologies, Inc., Yokogawa Electric Corporation, Danaher Corporation (Molecular Devices, Inc.), Sartorius AG, Tecan Group Ltd., BioTek Instruments, Inc. (Agilent BioTek), Molecular Devices, LLC (Danaher), IntelliCyt (Sartorius IntelliCyt iQue), BMG LABTECH GmbH contribute to innovation, geographic expansion, and service delivery in this space .

The future of high content screening is poised for transformative growth, driven by technological advancements and increasing collaboration between academia and industry. As automation becomes more prevalent in laboratories, efficiency in screening processes will improve, allowing for faster drug discovery timelines. Additionally, the integration of artificial intelligence in data analysis will enhance the accuracy of results, paving the way for innovative therapeutic developments. These trends indicate a robust future for HCS technologies, with significant implications for personalized medicine and chronic disease management.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Content Imaging/Analysis Systems (HCI/HCA) Flow Cytometry–Based High-Content Systems Reagents and Assay Kits (dyes, probes, labeled antibodies) Microplates and Labware (e.g., 96–1536-well, coated plates) Software & Image Analysis Platforms (AI/ML analytics) Accessories & Peripherals (liquid handlers, incubators, robotics) |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Contract Research Organizations (CROs) Government & Nonprofit Research Labs |

| By Application | Drug Discovery and Development (primary/secondary screening, hit-to-lead) Toxicology and Safety Assessment (in vitro tox, ADMET) Target Identification & Validation Phenotypic Screening and Mechanism-of-Action Studies Disease Modeling (2D/3D organoids, spheroids) Biomarker Discovery and Quantification |

| By Component | Instruments (imagers, readers, cytometers) Reagents & Consumables Software & Analytics Services (installation, training, data analysis) |

| By Sales Channel | Direct Sales Authorized Distributors/Value-Added Resellers Online Sales/Manufacturer E-commerce |

| By Modality | D Cell-Based Screening D Cell Models and Organoid Screening Live-Cell vs. Fixed-Cell Imaging |

| By Price Tier (Instruments) | Premium (enterprise multi-mode, automated) Mid-Range (benchtop, modular) Entry-Level (core lab/shared facility focused) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Departments | 120 | R&D Managers, Lead Scientists |

| Biotechnology Firms | 100 | Laboratory Directors, Research Associates |

| Academic Research Institutions | 80 | Principal Investigators, Postdoctoral Researchers |

| High Content Screening Technology Providers | 70 | Product Managers, Sales Directors |

| Regulatory Bodies and Agencies | 50 | Regulatory Affairs Specialists, Compliance Officers |

The Global High Content Screening HTS Market is valued at approximately USD 1.5 billion, reflecting sustained growth driven by advancements in drug discovery technologies and increasing demand for personalized medicine.