Region:Global

Author(s):Dev

Product Code:KRAA3006

Pages:100

Published On:August 2025

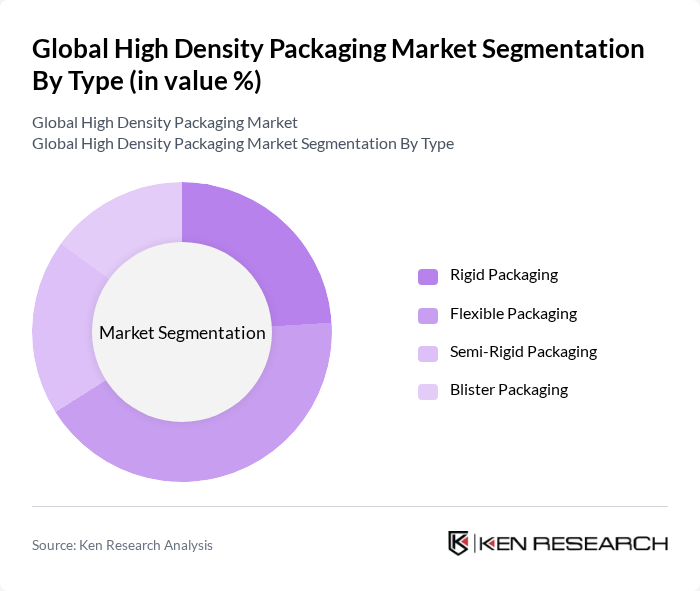

By Type:The high density packaging market is segmented into four main types: Rigid Packaging, Flexible Packaging, Semi-Rigid Packaging, and Blister Packaging. Flexible Packaging remains the leading sub-segment, attributed to its versatility, lightweight profile, and cost-effectiveness. This segment serves a broad range of applications, making it a preferred choice for manufacturers seeking to reduce material usage while maintaining product integrity. The growing emphasis on eco-friendly flexible packaging, such as recyclable films and compostable laminates, is further strengthening its market position .

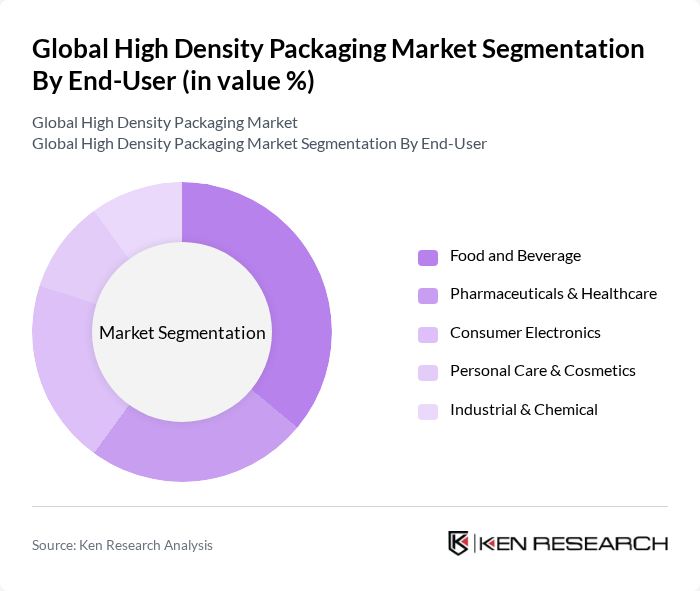

By End-User:The market is segmented by end-user into Food and Beverage, Pharmaceuticals & Healthcare, Consumer Electronics, Personal Care & Cosmetics, and Industrial & Chemical. The Food and Beverage sector is the largest segment, propelled by rising demand for packaged food products, extended shelf life requirements, and the popularity of convenience and ready-to-eat meals. Innovative packaging solutions that enhance product safety, freshness, and visual appeal are increasingly adopted by this sector to meet evolving consumer preferences .

The Global High Density Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, Smurfit Kappa Group, WestRock Company, DS Smith Plc, Huhtamaki Oyj, Sonoco Products Company, International Paper Company, Tetra Pak International S.A., Graphic Packaging Holding Company, ProAmpac LLC, Pregis LLC, Constantia Flexibles Group GmbH, Reynolds Group Holdings Limited, Uflex Ltd., Alpla Werke Alwin Lehner GmbH & Co KG, RPC Group Plc, and Gerresheimer AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high density packaging market appears promising, driven by ongoing trends in sustainability and technological innovation. As consumer awareness of environmental issues continues to rise, companies are increasingly adopting eco-friendly materials and practices. Furthermore, advancements in automation and smart packaging technologies are expected to enhance operational efficiency and consumer engagement. These trends will likely create a dynamic market landscape, fostering competition and encouraging new entrants to innovate and meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Packaging Flexible Packaging Semi-Rigid Packaging Blister Packaging |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Consumer Electronics Personal Care & Cosmetics Industrial & Chemical |

| By Material | Plastic (including HDPE, PET, PP) Paperboard Metal Glass |

| By Application | Retail Packaging Industrial Packaging Medical Packaging Electronics Packaging Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Innovations | 100 | Product Managers, Quality Assurance Specialists |

| Electronics Packaging Solutions | 60 | Supply Chain Managers, Packaging Engineers |

| Pharmaceutical Packaging Compliance | 50 | Regulatory Affairs Managers, Production Supervisors |

| Sustainable Packaging Initiatives | 70 | Sustainability Officers, R&D Managers |

| Consumer Goods Packaging Trends | 90 | Marketing Directors, Brand Managers |

The Global High Density Packaging Market is valued at approximately USD 32 billion, driven by increasing demand for compact and efficient packaging solutions across various sectors, including food and beverage, pharmaceuticals, and consumer electronics.