Region:Global

Author(s):Dev

Product Code:KRAD0562

Pages:80

Published On:August 2025

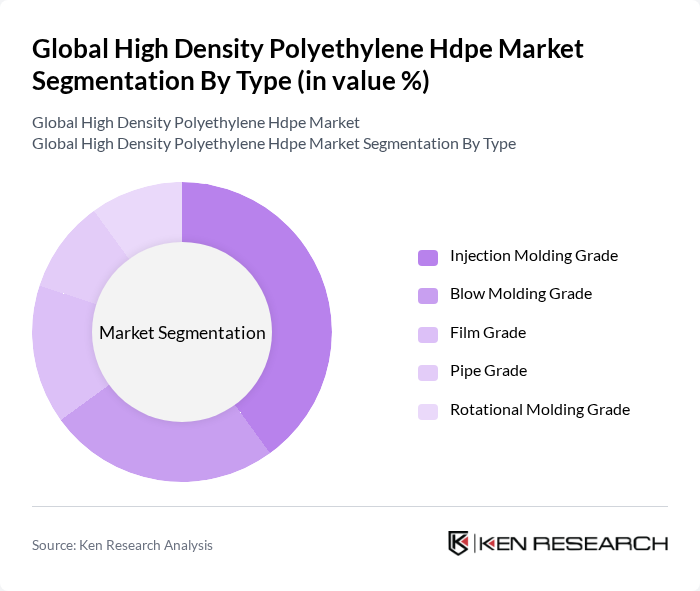

By Type:The HDPE market is segmented into various types, including Injection Molding Grade, Blow Molding Grade, Film Grade, Pipe Grade, and Rotational Molding Grade. Packaging-related grades (notably blow molding for bottles/containers and film grades) are widely used owing to HDPE’s strength-to-weight ratio and chemical resistance in consumer and industrial packaging. Pipe grade is structurally important in pressure pipes and conduits for water, gas, and industrial fluids, leveraging HDPE’s durability and corrosion resistance. Injection grades support caps/closures, housewares, crates, and technical components; rotational molding grades serve tanks and large hollow items .

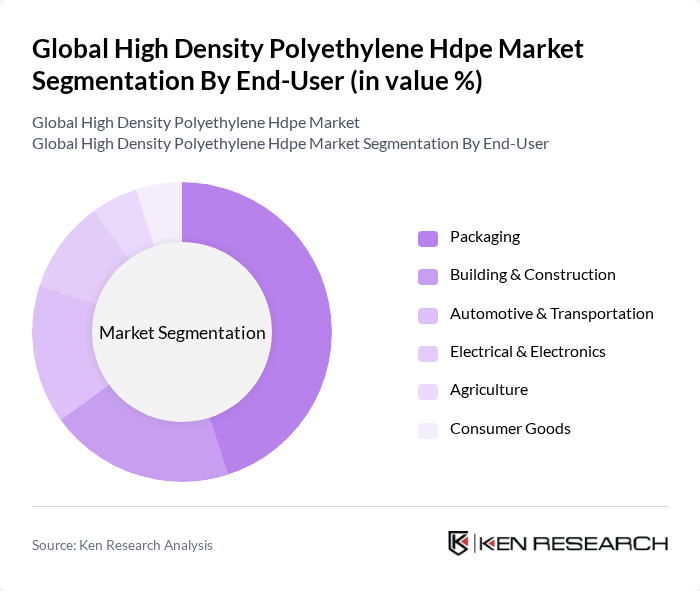

By End-User:The end-user segmentation of the HDPE market includes Packaging, Building & Construction, Automotive & Transportation, Electrical & Electronics, Agriculture, and Consumer Goods. The Packaging segment holds the largest share due to high use of HDPE in bottles, containers, closures, and films, reinforced by e-commerce growth, product safety needs, and recyclability focus. Building & construction demand is supported by pressure pipes, geomembranes, and cable protection; automotive uses include fuel tanks, ducts, and components benefitting from light-weighting; agriculture demand stems from irrigation pipes and films .

The Global High Density Polyethylene Hdpe Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, LyondellBasell Industries N.V., Dow Inc., INEOS Group Limited, SABIC (Saudi Basic Industries Corporation), Chevron Phillips Chemical Company LLC, TotalEnergies SE, Formosa Plastics Corporation, Braskem S.A., Reliance Industries Limited, NOVA Chemicals Corporation, Westlake Corporation, SINOPEC (China Petroleum & Chemical Corporation), PetroChina Company Limited, Mitsui Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the HDPE market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in recycling technologies are expected to enhance the circular economy, allowing for increased reuse of HDPE materials. Additionally, the expansion of HDPE applications in emerging markets, particularly in Asia and Africa, will likely create new growth avenues. As consumer preferences shift towards eco-friendly products, the market is poised for transformation, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Injection Molding Grade Blow Molding Grade Film Grade Pipe Grade Rotational Molding Grade |

| By End-User | Packaging Building & Construction Automotive & Transportation Electrical & Electronics Agriculture Consumer Goods |

| By Application | Pipes & Tubes Blow-Molded Bottles & Containers Films & Sheets Rigid Articles (Crates, Caps, Closures) Geomembranes & Liners |

| By Distribution Channel | Direct Sales (Producers to Converters/OEMs) Authorized Distributors/Resellers Online B2B Platforms Retail/Industrial Stockists Traders/Merchants |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grades Premium/Performance Grades Recycled/Blended Grades |

| By Product Form | Pellets/Granules Powders Sheets Compounds/Masterbatches |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Stakeholders | 120 | Product Managers, Procurement Specialists |

| Construction Material Suppliers | 100 | Sales Directors, Operations Managers |

| Automotive Component Manufacturers | 80 | Engineering Managers, Supply Chain Analysts |

| Consumer Goods Producers | 70 | Marketing Managers, Product Development Leads |

| Environmental Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

The Global High Density Polyethylene (HDPE) market is valued at approximately USD 8085 billion, reflecting strong demand across various sectors such as packaging, pipes, films, and molded products, according to multiple industry trackers.