Region:Global

Author(s):Dev

Product Code:KRAB0454

Pages:82

Published On:August 2025

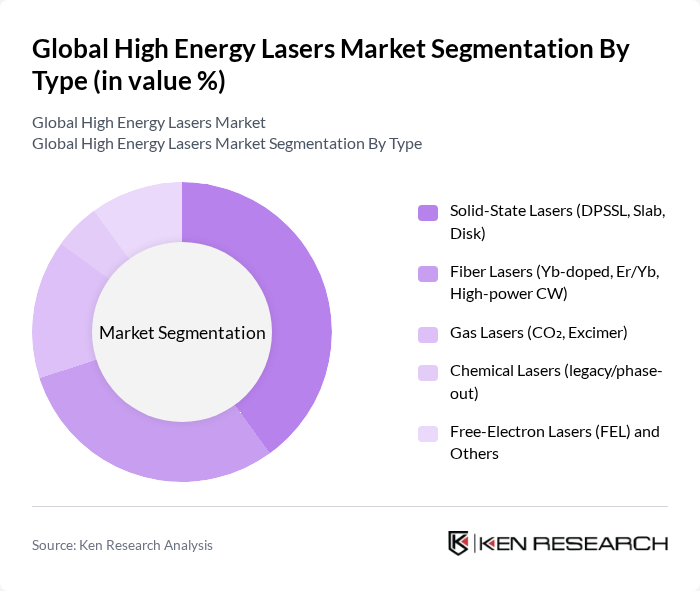

By Type:The market is segmented into various types of lasers, each with unique characteristics and applications. The primary types include Solid-State Lasers, Fiber Lasers, Gas Lasers, Chemical Lasers, and Free-Electron Lasers. Solid-State Lasers are widely used due to their efficiency and versatility, while Fiber Lasers are gaining traction for their compact size and high power output. Gas Lasers, although traditional, still find applications in specific industrial processes. Chemical Lasers are being phased out, and Free-Electron Lasers are emerging as a cutting-edge technology .

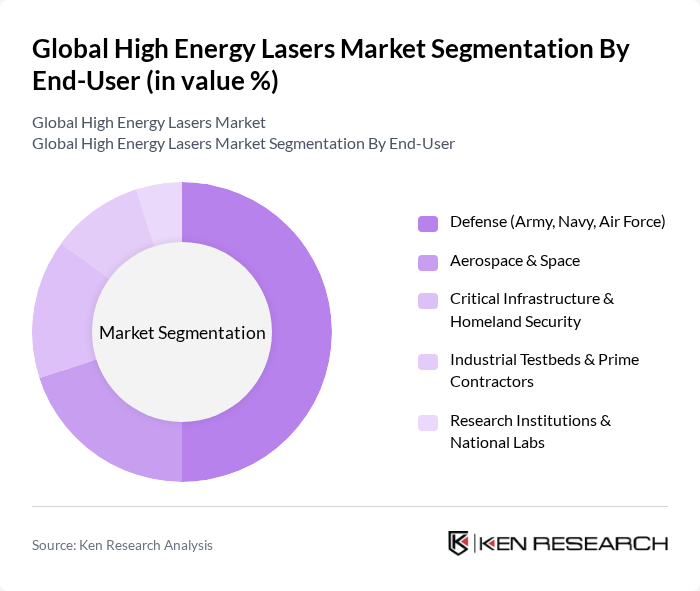

By End-User:The end-user segmentation includes Defense, Aerospace & Space, Critical Infrastructure & Homeland Security, Industrial Testbeds & Prime Contractors, and Research Institutions & National Labs. The Defense sector is the largest consumer of high-energy lasers, driven by the need for advanced weaponry and defense systems. Aerospace applications are also growing, particularly in satellite and space exploration technologies. The increasing focus on homeland security and critical infrastructure protection further boosts demand across various sectors .

The Global High Energy Lasers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, The Boeing Company, Thales Group, BAE Systems plc, L3Harris Technologies, Inc., General Dynamics Corporation, Coherent Corp., IPG Photonics Corporation, TRUMPF GmbH + Co. KG, Han’s Laser Technology Industry Group Co., Ltd., Leonardo S.p.A., Rheinmetall AG, Rafael Advanced Defense Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high energy lasers market appears promising, driven by technological advancements and increasing military applications. As nations continue to invest in defense capabilities, the integration of high energy lasers into military strategies will likely expand. Furthermore, the growing interest in sustainable energy solutions may lead to innovative applications in commercial sectors. The collaboration between defense contractors and research institutions will also foster new developments, enhancing the overall market landscape and creating opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid-State Lasers (DPSSL, Slab, Disk) Fiber Lasers (Yb-doped, Er/Yb, High-power CW) Gas Lasers (CO?, Excimer) Chemical Lasers (legacy/phase-out) Free-Electron Lasers (FEL) and Others |

| By End-User | Defense (Army, Navy, Air Force) Aerospace & Space Critical Infrastructure & Homeland Security Industrial Testbeds & Prime Contractors Research Institutions & National Labs |

| By Application | Directed Energy Weapons (C-UAS, SHORAD, CRAM, cruise missile defense) Air and Missile Defense (naval, ground, airborne) Target Illumination, Dazzling, and ISR Support Range Testing, Range Safety, and High-Energy Experimentation Industrial High-Power Materials Processing and R&D |

| By Component | Laser Source & Gain Media Beam Control & Beam Director (optics, fast steering mirrors) Power & Thermal Management (power conditioning, batteries, HVAC) Targeting, Fire Control & C2 Integration Sensors & Tracking (EO/IR, RF cueing) Safety, Enclosures & Integration Kits |

| By Platform | Ground-Based (tactical vehicles, fixed sites) Naval/Shipborne Airborne (manned, UAV) Space and High-Altitude Platforms |

| By Power Class | –49 kW –99 kW –299 kW ?300 kW |

| By Procurement Mode | RDT&E Contracts Low-Rate Initial Production (LRIP) Full-Rate Production & Sustainment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Defense Applications of High Energy Lasers | 120 | Defense Contractors, Military Technology Experts |

| Medical Laser Technologies | 80 | Healthcare Professionals, Medical Device Manufacturers |

| Industrial Laser Applications | 90 | Manufacturing Engineers, Production Managers |

| Research and Development in Laser Technology | 70 | Academic Researchers, R&D Directors |

| Emerging Markets for High Energy Lasers | 60 | Market Analysts, Business Development Managers |

The Global High Energy Lasers Market is valued at approximately USD 10.3 billion, driven by advancements in laser technology, increased defense budgets, and the growing demand for directed energy weapons across various sectors.