Global High Fructose Corn Syrup Market Overview

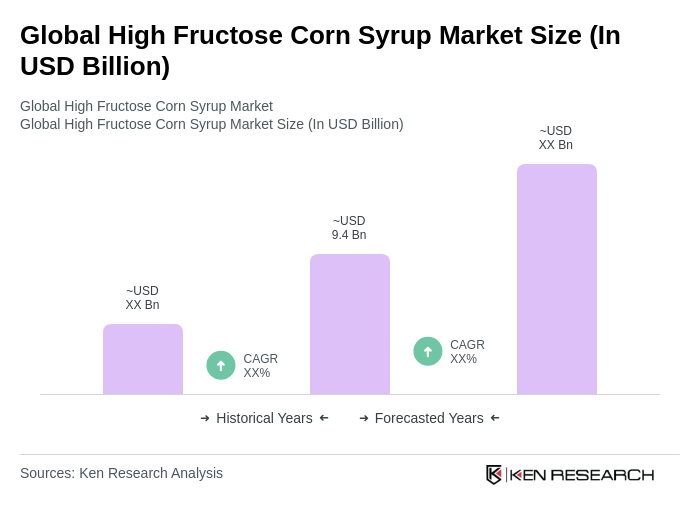

- The Global High Fructose Corn Syrup Market is valued at USD 9.4 billion, driven by the increasing demand for sweeteners in the food and beverage industry, coupled with the rising consumption of processed foods. The market has seen a steady growth trajectory due to the versatility of high fructose corn syrup as a sweetening agent, which is favored for its cost-effectiveness and functional properties in various applications. Recent trends include the introduction of non-GMO and organic HFCS varieties to meet the needs of health-conscious consumers, and ongoing innovation in concentrated formulations for specialized applications in confectionery and pharmaceuticals .

- The United States and Mexico dominate the Global High Fructose Corn Syrup Market, primarily due to their extensive corn production and established processing facilities. The U.S. is a leading producer and exporter, benefiting from favorable agricultural policies and a robust food manufacturing sector, while Mexico's proximity to the U.S. market enhances its competitive edge in HFCS production. North America accounts for the largest share of the global market, with the U.S. holding a significant portion of total revenue .

- In recent years, the U.S. government has implemented regulatory measures affecting the use of high fructose corn syrup in certain food products, particularly in response to health concerns regarding sugar consumption. For example, the U.S. Department of Agriculture’s National School Lunch Program (NSLP) and the Supplemental Nutrition Assistance Program (SNAP) have introduced guidelines that restrict added sugars, including HFCS, in school meals and federally supported nutrition programs. These regulations encourage manufacturers to reformulate products and promote healthier alternatives, impacting overall demand and market dynamics for HFCS .

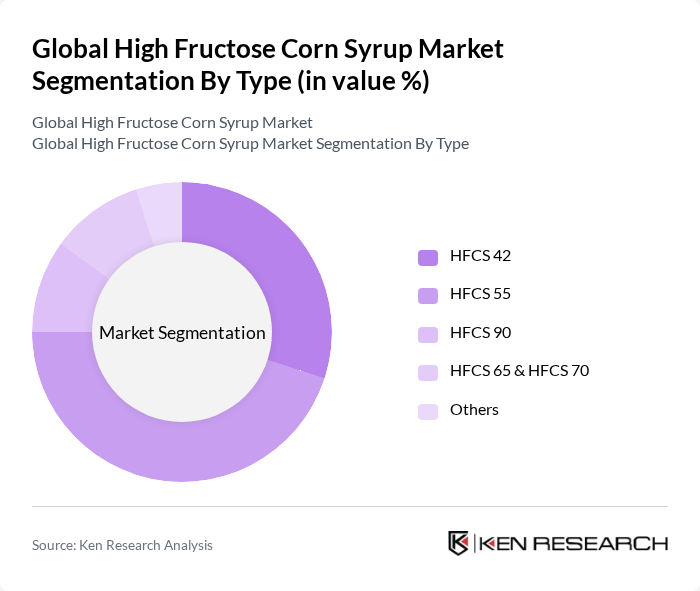

Global High Fructose Corn Syrup Market Segmentation

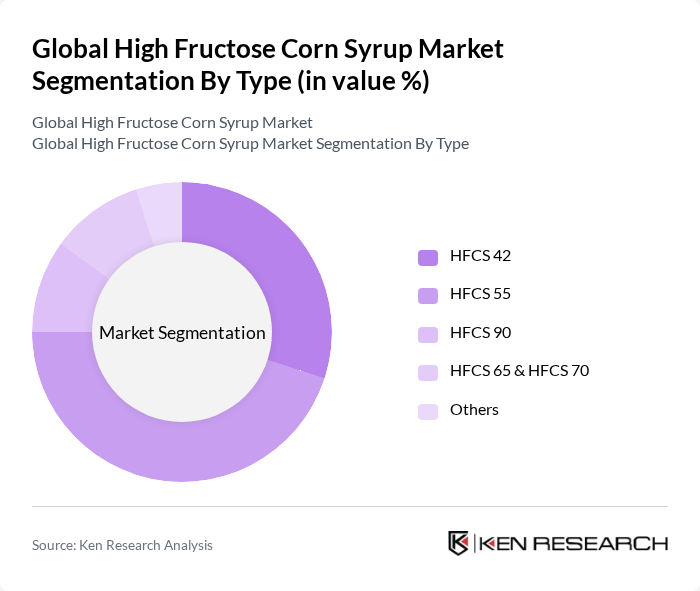

By Type:The market is segmented into various types of high fructose corn syrup, including HFCS 42, HFCS 55, HFCS 90, HFCS 65 & HFCS 70, and others. HFCS 55 is the most widely used type due to its high sweetness level, making it a preferred choice for soft drink manufacturers and other food products. HFCS 42 is also significant, particularly in the food industry, where it is utilized in various applications. The emergence of HFCS 65 and HFCS 70 reflects ongoing innovation for specialized applications in confectionery and pharmaceuticals .

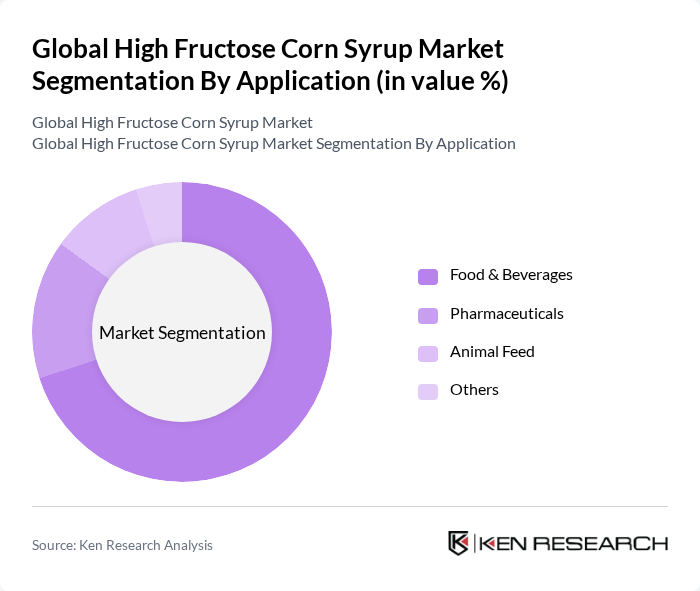

By Application:The applications of high fructose corn syrup are diverse, including food & beverages, pharmaceuticals, animal feed, and others. The food and beverage sector is the largest consumer, utilizing HFCS for its sweetness and preservation properties. The pharmaceutical industry also employs HFCS in formulations, while the animal feed sector uses it as a carbohydrate source. There is a growing trend toward reformulation and the use of alternative sweeteners in response to health concerns .

Global High Fructose Corn Syrup Market Competitive Landscape

The Global High Fructose Corn Syrup Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, Showa Sangyo Co., Ltd., Global Sweeteners Holdings Limited, Sunar Misir Sanayi A.?., Tereos S.A., American Crystal Sugar Company, Südzucker AG, COFCO Corporation, Bunge Limited, Emsland Group, Tereos Starch & Sweeteners contribute to innovation, geographic expansion, and service delivery in this space.

Global High Fructose Corn Syrup Market Industry Analysis

Growth Drivers

- Increasing Demand for Processed Foods:The processed food sector is projected to reach a value of $5.0 trillion in future, driven by urbanization and changing lifestyles. This surge in demand is significantly boosting the high fructose corn syrup (HFCS) market, as HFCS is a preferred sweetener due to its cost-effectiveness and functional properties. The U.S. Department of Agriculture reported that HFCS consumption in processed foods has increased by 3.0 million metric tons in future, indicating a robust growth trajectory.

- Cost-Effectiveness Compared to Sugar:HFCS remains a more affordable alternative to cane sugar, with a price difference of approximately $0.25 per pound. In future, the average price of sugar was $0.70 per pound, while HFCS was around $0.45. This cost advantage is crucial for manufacturers aiming to maintain profit margins amid rising production costs. The economic landscape in future suggests that this trend will continue, as sugar prices are expected to remain volatile due to climatic impacts on sugarcane production.

- Expanding Beverage Industry:The global beverage industry is anticipated to grow to $2.1 trillion in future, with non-alcoholic beverages leading the charge. HFCS is widely used in soft drinks and energy drinks, accounting for approximately 60% of sweeteners used in this sector. The International Council of Beverages reported a 4% annual increase in HFCS usage in beverages in future, driven by consumer preferences for sweeter flavors and innovative product formulations.

Market Challenges

- Health Concerns Related to HFCS:Growing health concerns regarding HFCS, particularly its association with obesity and metabolic disorders, pose significant challenges. The World Health Organization reported that countries with high HFCS consumption have seen a 35% increase in obesity rates over the past decade. This has led to a shift in consumer preferences towards natural sweeteners, impacting HFCS demand. As health awareness rises, manufacturers are pressured to reformulate products, which may affect HFCS usage.

- Regulatory Scrutiny:Increasing regulatory scrutiny on HFCS is a notable challenge. In future, the U.S. Food and Drug Administration proposed stricter labeling requirements for sweeteners, including HFCS, which could impact market dynamics. Additionally, several countries are implementing taxes on sugary products, further complicating the landscape for HFCS producers. The European Union has also initiated discussions on potential restrictions, which could limit HFCS imports and affect global trade.

Global High Fructose Corn Syrup Market Future Outlook

The future of the high fructose corn syrup market appears promising, driven by ongoing innovations in food technology and a growing emphasis on sustainability. As manufacturers adapt to consumer preferences for healthier options, the development of HFCS alternatives that maintain sweetness while reducing health risks is likely to gain traction. Furthermore, the expansion of e-commerce channels will facilitate broader distribution, allowing HFCS products to reach a wider audience, particularly in emerging markets where demand is surging.

Market Opportunities

- Growth in Emerging Markets:Emerging markets, particularly in Asia and Africa, are experiencing rapid urbanization and rising disposable incomes. This trend is expected to drive demand for processed foods and beverages, creating significant opportunities for HFCS producers. The Asian Development Bank projects a 6% annual growth in food consumption in these regions, indicating a favorable environment for HFCS market expansion.

- Innovations in Food Technology:Advances in food technology are paving the way for new HFCS applications, particularly in non-food sectors such as pharmaceuticals and cosmetics. The global market for food technology is projected to reach $1.2 trillion in future, with innovations enhancing the versatility of HFCS. This diversification presents opportunities for HFCS producers to tap into new revenue streams and reduce dependency on traditional markets.