Global High Performance Computing Market Overview

- The Global High Performance Computing Market is valued at USD 59 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for advanced computing solutions across sectors such as government, healthcare, finance, and scientific research, where complex data processing and simulations are essential. The rapid expansion of artificial intelligence, machine learning, and big data analytics has further accelerated the adoption of high-performance computing systems, as organizations require robust infrastructure to process and analyze massive datasets in real time. The proliferation of cloud-based HPC services is also enabling broader access to these capabilities for small and medium-sized enterprises, fueling additional market growth.

- Key players in this market include the United States, China, and Germany, which dominate due to their advanced technological infrastructure, substantial investments in research and development, and strong ecosystems of technology companies. The presence of leading universities and research institutions in these countries further contributes to their leadership in high-performance computing innovations. North America, in particular, holds the largest market share, driven by the concentration of technology giants and aggressive adoption of HPC systems by both large enterprises and SMEs.

- In 2023, the European Union implemented the Digital Europe Programme, which allocates EUR 7.5 billion to enhance the EU's supercomputing capabilities. This initiative, established by Regulation (EU) 2021/694 of the European Parliament and of the Council, aims to support the development of advanced computing technologies and ensure that European businesses and researchers have access to high-performance computing resources, thereby fostering innovation and competitiveness in the global market. The Programme covers investment in supercomputing infrastructure, skills development, and industry collaboration.

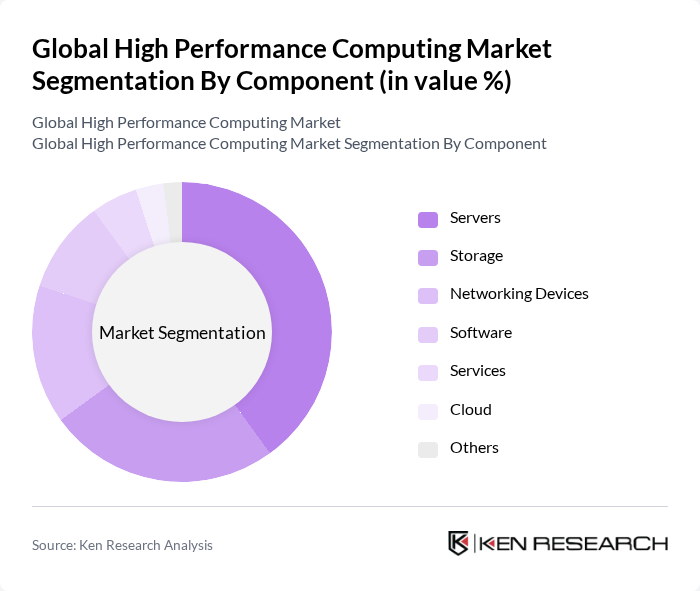

Global High Performance Computing Market Segmentation

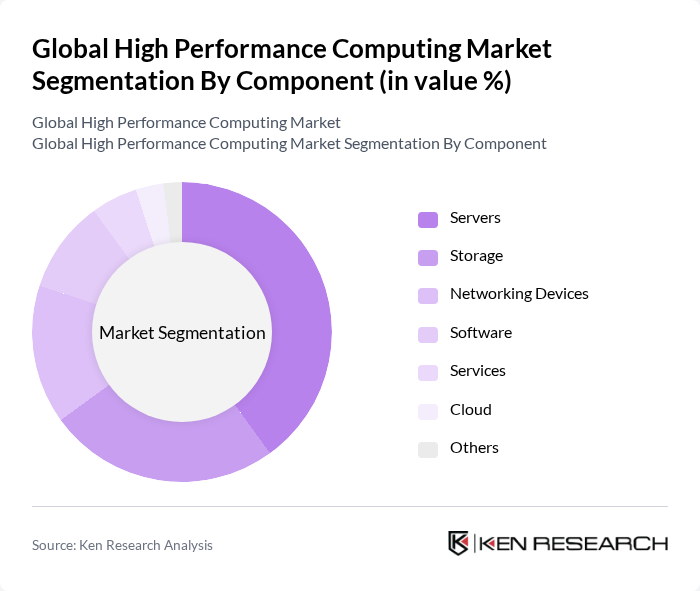

By Component:The components of high-performance computing systems include servers, storage, networking devices, software, services, cloud solutions, and others. Among these, servers remain the most critical component, providing the processing power required for complex computations and simulations. The demand for advanced storage solutions continues to rise, driven by the exponential growth of data generated by AI, genomics, and scientific research. Networking devices are essential for high-speed data transfer and low-latency communication within HPC clusters. Software and services play a vital role in optimizing system performance, workload management, and security, while cloud solutions are increasingly adopted for their scalability and flexibility.

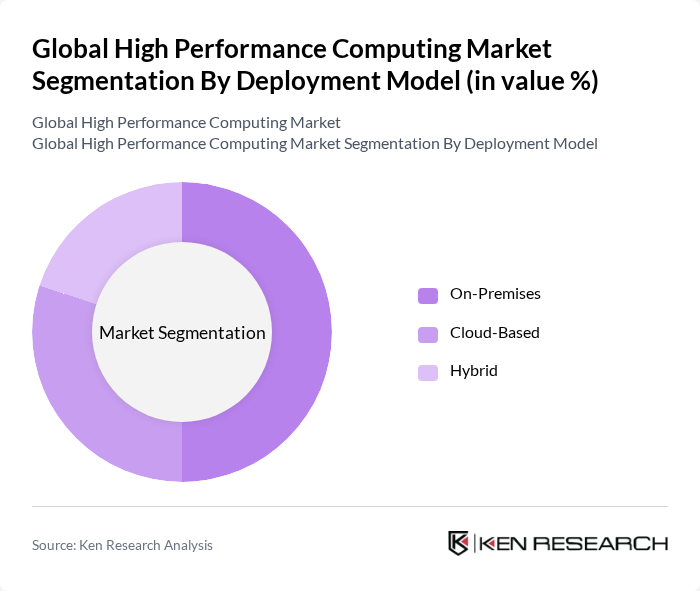

By Deployment Model:The deployment models for high-performance computing include on-premises, cloud-based, and hybrid solutions. On-premises models are preferred by organizations with stringent data security and compliance requirements, as well as those needing dedicated performance for mission-critical workloads. Cloud-based solutions are rapidly gaining traction due to their scalability, cost-effectiveness, and ability to provide on-demand access to advanced computing resources. Hybrid models, which integrate on-premises infrastructure with cloud platforms, offer organizations the flexibility to optimize workload distribution, manage costs, and ensure business continuity.

Global High Performance Computing Market Competitive Landscape

The Global High Performance Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Cray Inc. (now part of Hewlett Packard Enterprise), NVIDIA Corporation, Intel Corporation, Atos SE, Fujitsu Limited, Lenovo Group Limited, Microsoft Corporation, Amazon Web Services, Inc. (AWS), Google Cloud (Alphabet Inc.), Oracle Corporation, Advanced Micro Devices, Inc. (AMD), and T-Systems International GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Global High Performance Computing Market Industry Analysis

Growth Drivers

- Increasing Demand for Data Analytics:The global data analytics market is projected to reach $274 billion in future, driven by the need for businesses to leverage data for strategic decision-making. This surge in demand for data-driven insights is pushing organizations to adopt high-performance computing (HPC) solutions, which can process vast amounts of data efficiently. As companies increasingly rely on data analytics, the HPC market is expected to benefit significantly, with investments in advanced computing technologies rising to support this trend.

- Advancements in AI and Machine Learning:The AI market is anticipated to grow to $190 billion in future, with machine learning applications becoming integral to various sectors. These advancements require substantial computational power, which HPC systems provide. As organizations implement AI-driven solutions, the demand for HPC infrastructure will increase, leading to a greater focus on developing systems that can handle complex algorithms and large datasets, thereby enhancing overall operational efficiency.

- Growth in Cloud Computing Services:The cloud computing market is expected to reach $832 billion in future, with a significant portion attributed to HPC services. This growth is driven by the flexibility and scalability that cloud-based HPC solutions offer to businesses. As organizations migrate to cloud environments, the demand for HPC capabilities will rise, enabling them to perform high-level computations without the need for extensive on-premises infrastructure, thus fostering innovation and efficiency.

Market Challenges

- High Initial Investment Costs:The initial capital required for implementing HPC systems can be substantial, often exceeding $1 million for advanced setups. This financial barrier can deter smaller organizations from adopting HPC technologies, limiting market growth. Additionally, ongoing maintenance and operational costs can further strain budgets, making it essential for companies to evaluate the long-term return on investment before committing to HPC solutions.

- Complexity of Integration with Existing Systems:Integrating HPC solutions into existing IT infrastructures can be a daunting task, often requiring specialized knowledge and resources. Many organizations face challenges in ensuring compatibility with legacy systems, which can lead to increased downtime and operational disruptions. This complexity can hinder the adoption of HPC technologies, as companies may be reluctant to invest in solutions that disrupt their current workflows and processes.

Global High Performance Computing Market Future Outlook

The future of the high-performance computing market appears promising, driven by technological advancements and increasing demand across various sectors. As organizations continue to embrace hybrid computing environments, the integration of edge computing and quantum technologies will likely reshape the landscape. Furthermore, the focus on enhancing cybersecurity measures will be critical as HPC systems become more interconnected, ensuring data integrity and protection against emerging threats. This evolving environment presents significant opportunities for innovation and growth in the HPC sector.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing rapid digital transformation. With investments in technology infrastructure projected to exceed $500 billion in future, there is a significant opportunity for HPC providers to cater to these regions, offering tailored solutions that meet local demands and drive economic growth.

- Development of Energy-Efficient Solutions:As energy costs rise, the demand for energy-efficient HPC solutions is increasing. The global market for energy-efficient computing is expected to reach $50 billion in future. Companies that innovate in this area can capitalize on the growing need for sustainable computing practices, appealing to environmentally conscious organizations and reducing operational costs.