Region:Global

Author(s):Rebecca

Product Code:KRAA2145

Pages:87

Published On:August 2025

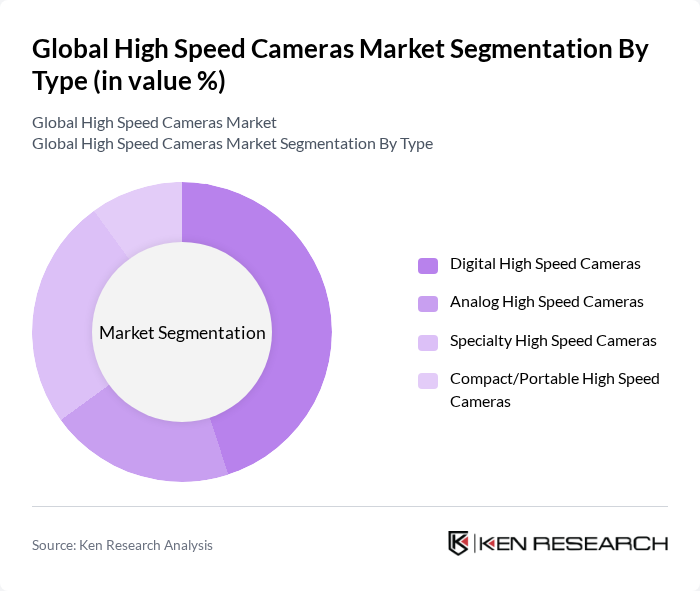

By Type:The high-speed cameras market is segmented into four main types:Digital High Speed Cameras, Analog High Speed Cameras, Specialty High Speed Cameras, and Compact/Portable High Speed Cameras. Digital High Speed Cameras are increasingly preferred due to superior image quality, advanced features, and integration with AI-based analytics. Analog High Speed Cameras, while still present, are being phased out in favor of digital models. Specialty High Speed Cameras serve niche applications such as scientific research and defense, while Compact/Portable High Speed Cameras are valued for their mobility and ease of deployment in field operations.

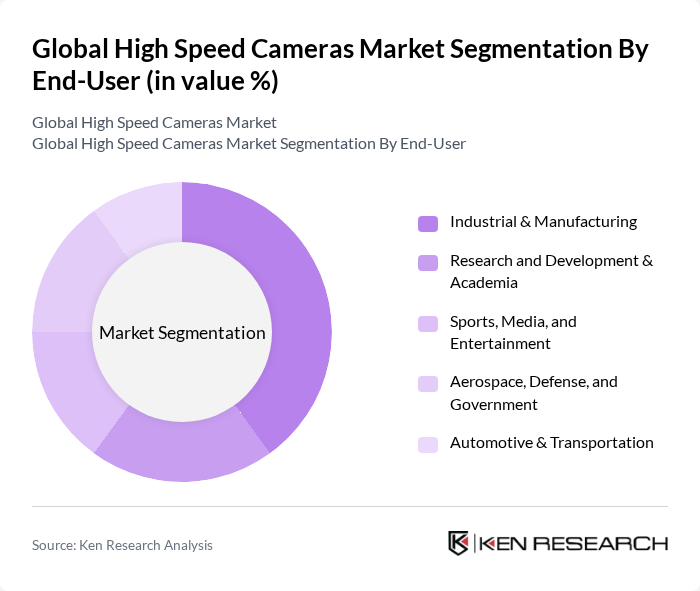

By End-User:The end-user segmentation includesIndustrial & Manufacturing, Research and Development & Academia, Sports, Media, and Entertainment, Aerospace, Defense, and Government, and Automotive & Transportation. The Industrial & Manufacturing sector remains the largest consumer, driven by the need for precision, quality control, and process optimization. Research and Development & Academia utilize high-speed cameras for scientific experiments and innovation. Sports, Media, and Entertainment sectors leverage these cameras for slow-motion and high-action capture. Aerospace and Defense require high-speed imaging for testing, diagnostics, and analysis, while Automotive uses them for crash testing and safety validation.

The Global High Speed Cameras Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vision Research Inc. (AMETEK Inc.), Photron Limited (IMAGICA GROUP Inc.), AOS Technologies AG, Optronis GmbH, NAC Image Technology Inc., Mikrotron GmbH, PCO AG, Olympus Corporation, DEL Imaging Systems, LLC, iX Cameras Ltd., Fastec Imaging Corporation (RDI Technologies Inc.), Baumer Holding AG, Weisscam GmbH, Motion Capture Technologies, SVS-Vistek GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high-speed camera market appears promising, driven by ongoing technological advancements and increasing demand across various sectors. As industries continue to prioritize high-quality imaging for research and development, the integration of artificial intelligence and machine learning is expected to enhance camera functionalities. Furthermore, the trend towards compact and portable models will likely attract a broader user base, facilitating greater adoption in both professional and consumer markets, thereby expanding the overall market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital High Speed Cameras Analog High Speed Cameras Specialty High Speed Cameras Compact/Portable High Speed Cameras |

| By End-User | Industrial & Manufacturing Research and Development & Academia Sports, Media, and Entertainment Aerospace, Defense, and Government Automotive & Transportation |

| By Application | Motion Analysis & Crash Testing Quality Control & Inspection Scientific Research & Biomechanics Medical & Life Sciences Imaging Particle Image Velocimetry (PIV) |

| By Distribution Channel | Direct Sales Online Retail Distributors/Value-Added Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium |

| By Technology | CMOS Technology CCD Technology Hybrid & Other Sensor Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports and Motion Analysis | 60 | Sports Coaches, Athletic Trainers |

| Industrial Applications | 50 | Quality Control Managers, Production Engineers |

| Scientific Research | 40 | Research Scientists, Laboratory Technicians |

| Film and Video Production | 45 | Directors, Cinematographers |

| Educational Institutions | 40 | Professors, Media Studies Instructors |

The Global High Speed Cameras Market is valued at approximately USD 750 million, driven by advancements in imaging technology and increasing demand across various sectors such as industrial, automotive, aerospace, and entertainment applications.