Region:Global

Author(s):Geetanshi

Product Code:KRAA2742

Pages:84

Published On:August 2025

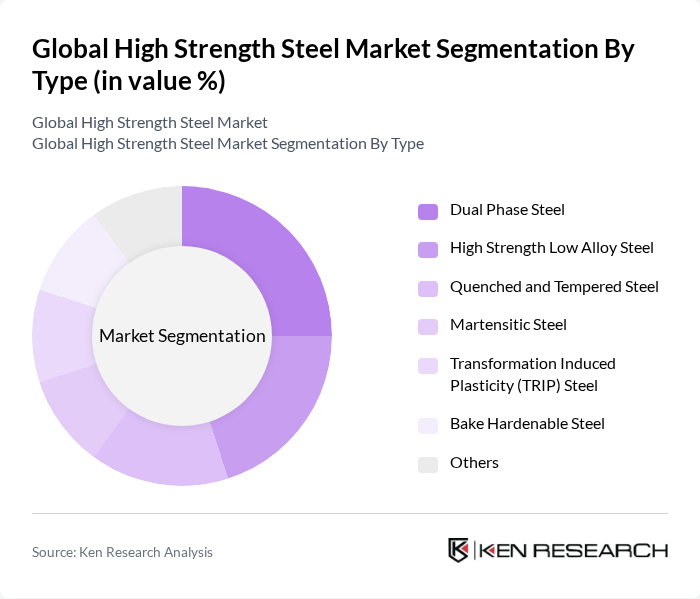

By Type:The high strength steel market is segmented into Dual Phase Steel, High Strength Low Alloy Steel, Quenched and Tempered Steel, Martensitic Steel, Transformation Induced Plasticity (TRIP) Steel, Bake Hardenable Steel, and Others. Each type offers distinct properties for applications in automotive, construction, heavy machinery, and other sectors, with advanced grades increasingly adopted for their strength-to-weight advantages and formability .

The Dual Phase Steel segment leads the market due to its optimal balance of strength and ductility, making it highly suitable for automotive structural components and safety applications. The growing adoption of advanced high-strength steels in vehicle manufacturing is driven by regulatory requirements for crash safety and emissions, as well as consumer demand for lighter, fuel-efficient vehicles. The transition to electric vehicles, which require lightweight yet robust materials, further accelerates demand for Dual Phase Steel .

By End-User:The high strength steel market is segmented by end-user industries, including Automotive, Construction, Heavy Machinery & Equipment, Shipbuilding, Aerospace & Aviation, Energy & Power, Packaging, Consumer Goods, and Others. Each sector leverages high strength steel for its unique mechanical properties, supporting market expansion across diverse applications .

The Automotive sector remains the dominant end-user of high strength steel, accounting for the largest market share. This is attributed to the sector’s focus on vehicle safety, emissions reduction, and fuel efficiency, with high strength steel increasingly used in body structures, chassis, and safety components. The rapid growth of electric vehicles and stricter regulatory standards worldwide further drive high strength steel adoption in automotive applications .

The Global High Strength Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as ArcelorMittal, Tata Steel Limited, Nippon Steel Corporation, POSCO Holdings Inc., United States Steel Corporation, SSAB AB, JFE Steel Corporation, thyssenkrupp AG, Nucor Corporation, Cleveland-Cliffs Inc., Hyundai Steel Company, China Baowu Steel Group Corporation Limited, JSW Steel Limited, Steel Authority of India Limited (SAIL), and Essar Steel (now AM/NS India) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high strength steel market appears promising, driven by ongoing trends in sustainability and technological innovation. As industries increasingly prioritize eco-friendly practices, the demand for high strength steel is expected to grow, particularly in automotive and construction sectors. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, making high strength steel more accessible. The integration of digital technologies will further streamline operations, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dual Phase Steel High Strength Low Alloy Steel Quenched and Tempered Steel Martensitic Steel Transformation Induced Plasticity (TRIP) Steel Bake Hardenable Steel Others |

| By End-User | Automotive Construction Heavy Machinery & Equipment Shipbuilding Aerospace & Aviation Energy & Power Packaging Consumer Goods Others |

| By Application | Structural Components Automotive Body & Closure Suspensions Bumper and Intrusion Beams Machinery and Equipment Shipbuilding Others |

| By Distribution Channel | Direct Sales Distributor Sales Online Sales Retail Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, GCC, Rest of MEA) |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Sheets Plates Bars and Rods Tubes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 120 | Product Engineers, Procurement Managers |

| Construction Sector Utilization | 90 | Project Managers, Structural Engineers |

| Aerospace Component Manufacturing | 60 | Quality Assurance Managers, R&D Directors |

| Energy Sector Steel Usage | 50 | Operations Managers, Supply Chain Analysts |

| High Strength Steel Innovations | 70 | Research Scientists, Technical Sales Representatives |

The Global High Strength Steel Market is valued at approximately USD 37 billion, driven by the increasing demand for lightweight and high-strength materials in industries such as automotive and construction, where safety and sustainability are critical.