Region:Global

Author(s):Dev

Product Code:KRAB0389

Pages:82

Published On:August 2025

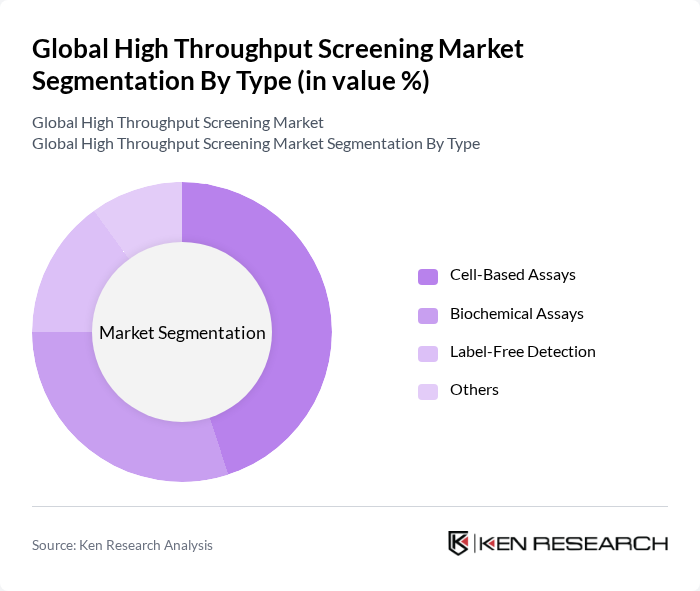

By Type:The high throughput screening market can be segmented into four main types: Cell-Based Assays, Biochemical Assays, Label-Free Detection, and Others. Among these, Cell-Based Assays are leading the market due to their ability to provide more physiologically relevant data, which is crucial for drug discovery. The demand for Biochemical Assays is also significant, as they are widely used for target identification and validation. Label-Free Detection is gaining traction due to its advantages in real-time monitoring without the need for labels, while the Others category includes various emerging technologies.

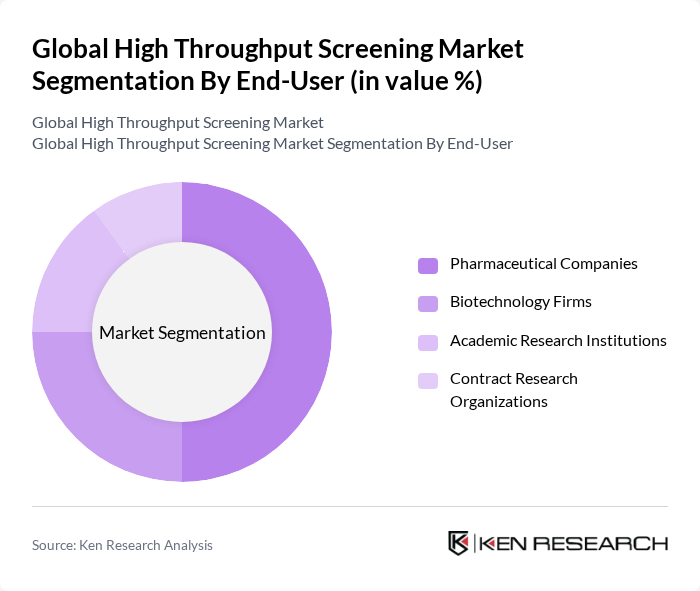

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic Research Institutions, and Contract Research Organizations. Pharmaceutical Companies dominate the market due to their extensive investment in drug discovery and development processes. Biotechnology Firms are also significant players, leveraging high throughput screening for innovative therapies. Academic Research Institutions contribute to the market by advancing research methodologies, while Contract Research Organizations provide essential services to pharmaceutical and biotech companies.

The Global High Throughput Screening Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Revvity, Inc. (formerly PerkinElmer, Inc.), Agilent Technologies, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., Tecan Group Ltd., Corning Incorporated, BMG LABTECH GmbH, Hudson Robotics, Inc., Sartorius AG, Charles River Laboratories International, Inc., Eppendorf SE, Promega Corporation, Enzo Biochem, Inc., 10x Genomics, Inc., Danaher Corporation (Beckman Coulter Life Sciences; Molecular Devices), Yokogawa Electric Corporation (High-Content Screening), Aurora Biomed Inc., Hamilton Company, SPT Labtech Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the high throughput screening market is poised for significant transformation, driven by technological advancements and evolving healthcare needs. As automation and artificial intelligence continue to integrate into screening processes, efficiency and accuracy will improve, enabling faster drug discovery. Additionally, the increasing emphasis on personalized medicine will further propel the demand for HTS technologies, ensuring that treatments are tailored to individual patient profiles, ultimately enhancing therapeutic outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Cell-Based Assays Biochemical Assays Label-Free Detection Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic Research Institutions Contract Research Organizations |

| By Application | Drug Discovery Toxicology Testing Target Identification Others |

| By Component | Instruments Reagents & Assay Kits Consumables & Accessories Software & Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America |

| By Research Type | Basic Research Applied Research Clinical Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Departments | 120 | R&D Directors, Lead Scientists |

| Biotechnology Firms | 90 | Laboratory Managers, Research Associates |

| Academic Research Institutions | 70 | Principal Investigators, Postdoctoral Researchers |

| High Throughput Screening Equipment Manufacturers | 60 | Product Managers, Sales Directors |

| Contract Research Organizations (CROs) | 80 | Operations Managers, Client Relationship Managers |

The Global High Throughput Screening Market is valued at approximately USD 2629 billion, with various studies indicating valuations in the low-to-high USD 20 billion range for the latest year available. This growth is driven by advancements in drug discovery and screening technologies.