Global Home Audio Market Overview

- The Global Home Audio Market is valued at USD 33 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-quality audio experiences in residential settings, advancements in audio technology, and the proliferation of smart home devices. The rise in disposable income, growing urbanization, and consumer preference for premium and wireless audio products have also significantly contributed to market expansion. The integration of AI, voice assistants, and IoT capabilities into home audio equipment is further accelerating adoption and market growth.

- Key players in this market include the United States, Japan, Germany, and the United Kingdom. These countries dominate the market due to their strong consumer electronics industries, high levels of disposable income, and a growing trend towards home entertainment systems. The presence of major audio brands and a robust distribution network further enhance their market leadership. Additionally, emerging economies such as India, China, and Brazil are witnessing rapid growth due to increasing urbanization and adoption of smart home technologies.

- In 2023, the European Union implemented regulations aimed at improving energy efficiency in electronic devices, including home audio systems. This regulation mandates that all audio products meet specific energy consumption standards, promoting the development of more energy-efficient technologies and encouraging manufacturers to innovate in line with sustainability goals.

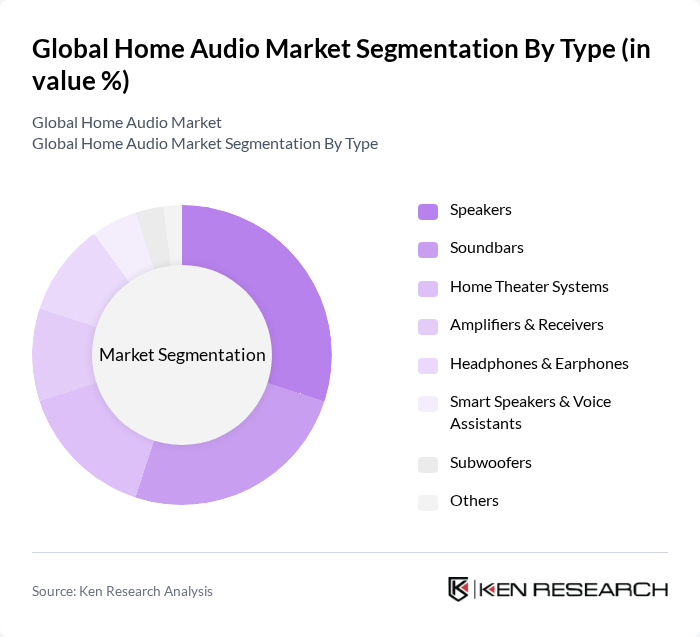

Global Home Audio Market Segmentation

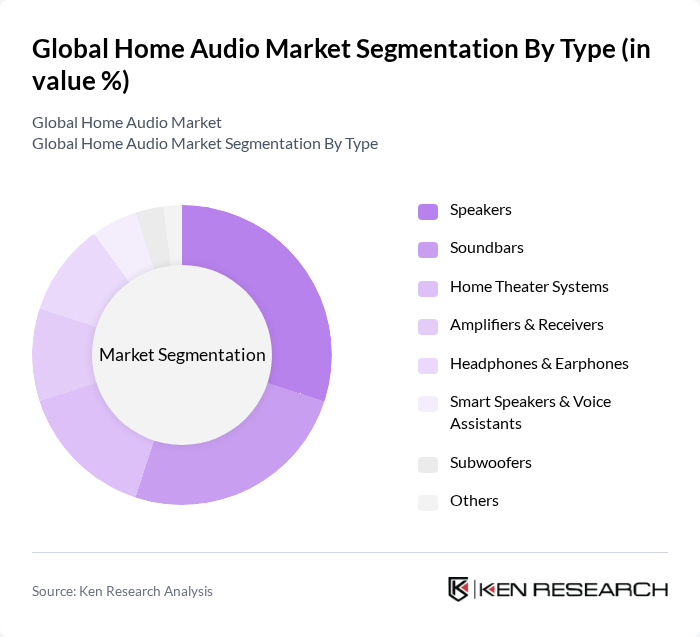

By Type:The market can be segmented into various types, including Speakers, Soundbars, Home Theater Systems, Amplifiers & Receivers, Headphones & Earphones, Smart Speakers & Voice Assistants, Subwoofers, and Others. Each of these subsegments caters to different consumer preferences and technological advancements. Speakers and soundbars remain the largest segments, driven by demand for wireless and compact solutions, while smart speakers and voice assistants are rapidly gaining traction due to integration with smart home ecosystems.

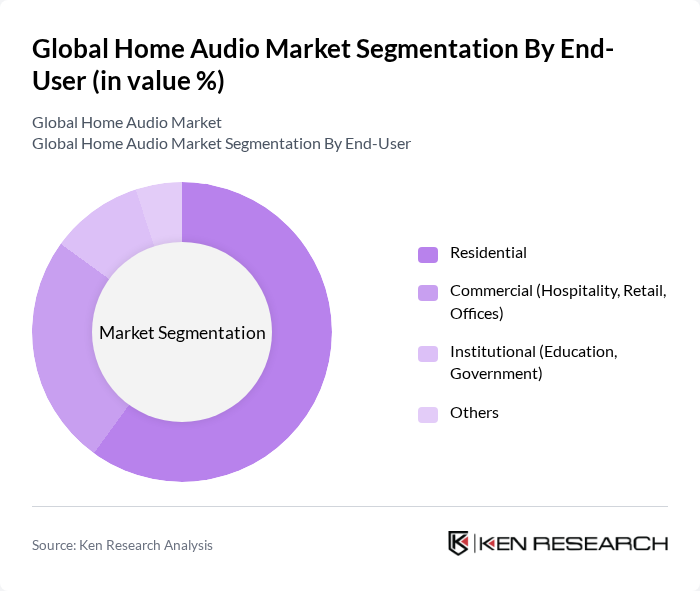

By End-User:The end-user segmentation includes Residential, Commercial (Hospitality, Retail, Offices), Institutional (Education, Government), and Others. Each segment reflects the diverse applications of home audio systems across different environments. The residential segment dominates, driven by rising adoption of smart home devices and home entertainment systems, while commercial and institutional segments are expanding due to increased demand for integrated audio solutions in public and business spaces.

Global Home Audio Market Competitive Landscape

The Global Home Audio Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Bose Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Harman International Industries, Inc. (a Samsung Company), Panasonic Corporation, Yamaha Corporation, Pioneer Corporation, Denon (D&M Holdings Inc.), JVCKENWOOD Corporation, Sennheiser electronic GmbH & Co. KG, Klipsch Group, Inc., Onkyo Corporation, Audio-Technica Corporation, Bang & Olufsen A/S, VIZIO, Inc., Sonos, Inc., Bowers & Wilkins (B&W Group Ltd.), Polk Audio (DEI Holdings, Inc.), Cambridge Audio (Audio Partnership Plc) contribute to innovation, geographic expansion, and service delivery in this space.

Global Home Audio Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for High-Quality Audio Experiences:The global home audio market is witnessing a surge in consumer demand for high-fidelity audio systems, driven by a growing appreciation for sound quality. In future, the average consumer is expected to spend approximately $345 on audio equipment, reflecting a 15% increase from previous years. This trend is supported by the rise of high-resolution audio formats and the proliferation of premium audio streaming services, which collectively enhance the consumer's audio experience.

- Rise in Disposable Income and Spending on Home Entertainment:As global economies recover, disposable income levels are projected to rise significantly. In future, the average household income in developed regions is expected to reach $80,000, facilitating increased spending on home entertainment systems. This economic uplift is encouraging consumers to invest in high-quality audio solutions, with a notable 20% increase in sales of premium audio products anticipated, reflecting a shift towards enhancing home entertainment experiences.

- Technological Advancements in Audio Equipment:The home audio market is benefiting from rapid technological innovations, including advancements in wireless technology and sound processing. In future, the market for wireless audio devices is expected to exceed $12 billion, driven by innovations such as Bluetooth 5.2 and Wi-Fi 6, which enhance connectivity and sound quality. These advancements are making high-quality audio more accessible, encouraging consumers to upgrade their existing systems for improved performance and convenience.

Market Challenges

- Intense Competition Among Established Brands:The home audio market is characterized by fierce competition, with major brands like Bose, Sonos, and Sony vying for market share. In future, the combined market share of the top five brands is projected to be around 62%, leading to aggressive pricing strategies and marketing campaigns. This competitive landscape poses challenges for new entrants and smaller companies, making it difficult to establish a foothold in the market.

- Rapid Technological Changes Leading to Obsolescence:The fast-paced nature of technological advancements in audio equipment presents a significant challenge. In future, it is estimated that nearly 28% of audio products will become obsolete within two years of their release due to continuous innovation. This rapid turnover can lead to increased costs for manufacturers and dissatisfaction among consumers who may feel pressured to frequently upgrade their systems to keep up with the latest technology.

Global Home Audio Market Future Outlook

The future of the home audio market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As wireless audio solutions gain traction, the market is expected to see a shift towards more integrated and user-friendly systems. Additionally, the increasing popularity of subscription-based audio services is likely to reshape consumer spending habits, encouraging investments in high-quality audio equipment that enhances the overall listening experience. This dynamic environment presents opportunities for innovation and growth in the sector.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for home audio manufacturers. With a projected increase in middle-class households in future, estimated at approximately 1.7 billion, companies can tap into this expanding consumer base eager for quality audio solutions, driving sales and brand loyalty in these regions.

- Development of Eco-Friendly Audio Products:The growing consumer awareness regarding environmental sustainability is creating a demand for eco-friendly audio products. In future, it is anticipated that 30% of consumers will prioritize sustainable materials and energy-efficient technologies in their purchasing decisions, prompting manufacturers to innovate and develop products that align with these values, thus capturing a niche market segment.