Region:Global

Author(s):Dev

Product Code:KRAA1651

Pages:89

Published On:August 2025

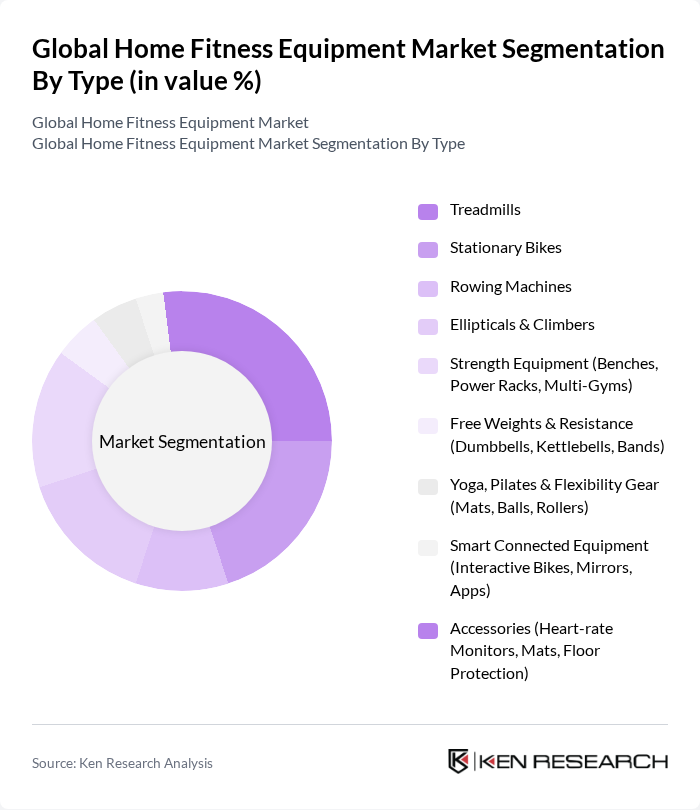

By Type:The market is segmented into various types of fitness equipment, including Treadmills, Stationary Bikes, Rowing Machines, Ellipticals & Climbers, Strength Equipment (Benches, Power Racks, Multi-Gyms), Free Weights & Resistance (Dumbbells, Kettlebells, Bands), Yoga, Pilates & Flexibility Gear (Mats, Balls, Rollers), Smart Connected Equipment (Interactive Bikes, Mirrors, Apps), and Accessories (Heart-rate Monitors, Mats, Floor Protection). Among these, Treadmills and Strength Equipment are particularly popular due to their versatility and effectiveness in home workouts.

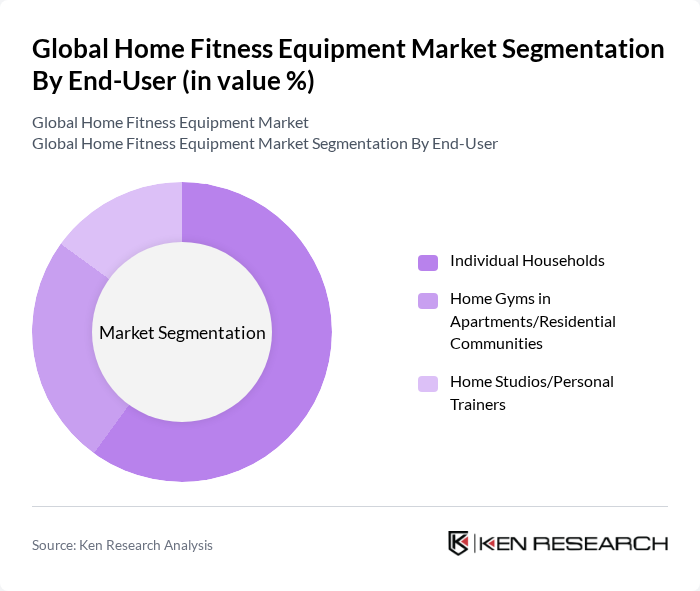

By End-User:The end-user segmentation includes Individual Households, Home Gyms in Apartments/Residential Communities, and Home Studios/Personal Trainers. Individual households represent the largest segment, driven by the increasing trend of home workouts and the convenience of having fitness equipment readily available. The rise of remote work has also contributed to the growth of home gyms, as more people seek to maintain their fitness routines without the need to travel to commercial gyms.

The Global Home Fitness Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Peloton Interactive, Inc., Nautilus, Inc. (BowFlex Inc.), Technogym S.p.A., Life Fitness, iFIT Health & Fitness Inc. (ICON Health & Fitness), Johnson Health Tech Co., Ltd. (Horizon Fitness, Matrix), Precor (a Peloton company), NordicTrack (iFIT), ProForm (iFIT), Echelon Fitness, Tonal Systems, Inc., Mirror (Lululemon Studio), Hydrow, Inc., Sunny Health & Fitness, Rogue Fitness contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home fitness equipment market appears promising, driven by ongoing trends in health awareness and technological integration. As consumers increasingly seek personalized fitness solutions, the demand for innovative and smart equipment is expected to rise. Additionally, the growth of online fitness communities will further enhance engagement and motivation, encouraging more individuals to invest in home fitness solutions. This evolving landscape presents significant opportunities for manufacturers and retailers to capitalize on emerging consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Treadmills Stationary Bikes Rowing Machines Ellipticals & Climbers Strength Equipment (Benches, Power Racks, Multi-Gyms) Free Weights & Resistance (Dumbbells, Kettlebells, Bands) Yoga, Pilates & Flexibility Gear (Mats, Balls, Rollers) Smart Connected Equipment (Interactive Bikes, Mirrors, Apps) Accessories (Heart-rate Monitors, Mats, Floor Protection) |

| By End-User | Individual Households Home Gyms in Apartments/Residential Communities Home Studios/Personal Trainers |

| By Sales Channel | Online Marketplaces (Amazon, Brand D2C) Specialty Sports & Fitness Retail Mass Merchandisers & Hypermarkets Direct-to-Consumer Subscriptions/Bundles |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Global Established Brands Emerging & Digital-First Brands Private Labels/Retailer Brands |

| By Product Features | Connectivity & App Integration Compact/Foldable Design Multi-functionality/All-in-One Systems Low-Noise & Energy Efficiency |

| By Distribution Mode | Direct-to-Consumer Third-Party Retailers Subscription/Connected Fitness Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Gym Equipment Purchasers | 120 | Homeowners, Fitness Enthusiasts |

| Commercial Gym Equipment Buyers | 100 | Gym Owners, Fitness Center Managers |

| Online Fitness Equipment Shoppers | 100 | eCommerce Managers, Digital Marketing Specialists |

| Fitness Equipment Retailers | 80 | Store Managers, Sales Representatives |

| Fitness Trainers and Coaches | 90 | Personal Trainers, Group Fitness Instructors |

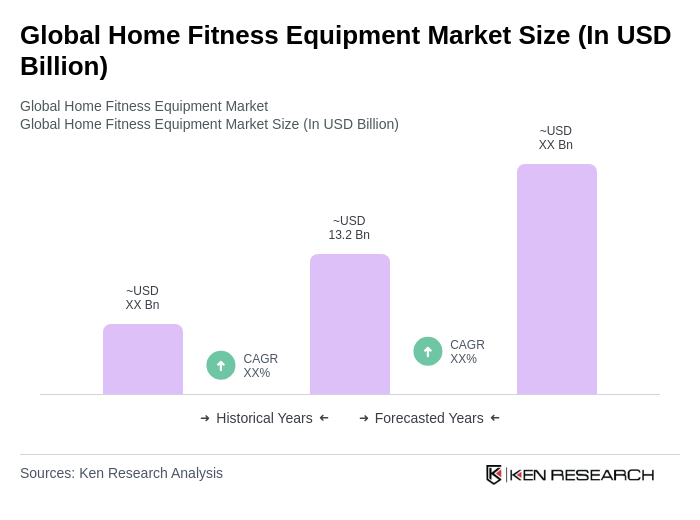

The Global Home Fitness Equipment Market is valued at approximately USD 13.2 billion, reflecting a significant growth trend driven by increasing health consciousness and the rise of home workouts, particularly accelerated by the COVID-19 pandemic.