Region:Global

Author(s):Shubham

Product Code:KRAA1744

Pages:95

Published On:August 2025

By Type:The home remodeling market can be segmented into various types, including kitchen remodeling, bathroom remodeling, basement finishing, room additions, exterior/outdoor remodeling, whole-house renovation, and energy-efficient upgrades. Kitchen remodeling is widely cited as one of the most popular and value-accretive projects due to its impact on home value and everyday use, while bathroom remodeling also remains a priority as homeowners seek comfort, accessibility, and upgraded fixtures. Energy-efficient upgrades—such as HVAC replacements, heat pumps, insulation, and high-performance windows/doors—are increasingly emphasized, supported by incentives and consumer focus on lowering energy bills.

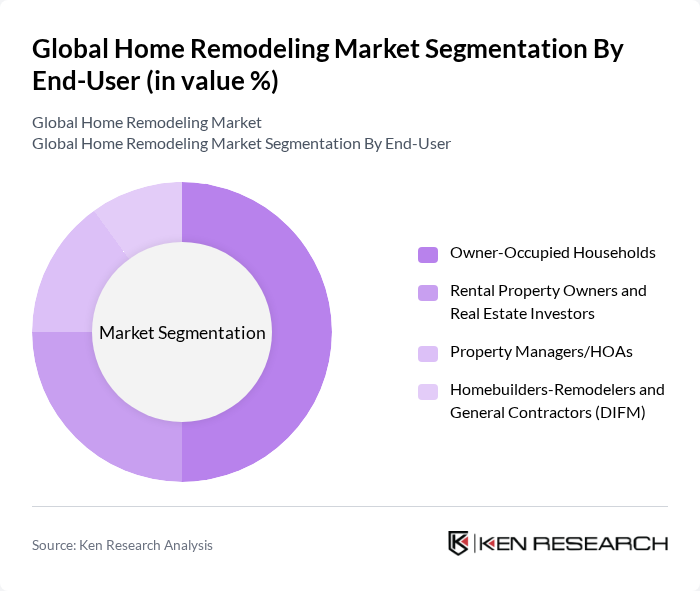

By End-User:The end-user segmentation includes owner-occupied households, rental property owners and real estate investors, property managers/HOAs, and homebuilders-remodelers and general contractors. Owner-occupied households represent the largest segment as households continue to invest to enhance livability and property value, while rental property owners emphasize upgrades that improve rentability and operating efficiency. Broader market momentum is supported by strong North American participation across both DIY and contractor-led projects.

The Global Home Remodeling Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Home Depot, Inc., Lowe's Companies, Inc., Masco Corporation, Fortune Brands Innovations, Inc., The Sherwin-Williams Company, Mohawk Industries, Inc., Shaw Industries Group, Inc. (Berkshire Hathaway), Andersen Corporation, Pella Corporation, JELD-WEN Holding, Inc., Cornerstone Building Brands, Inc. (includes Ply Gem), Trex Company, Inc., James Hardie Industries plc, Mohawk’s Daltile (flooring/tiles), Ferguson plc (trade/wholesale distribution) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home remodeling market in the None region appears promising, driven by a combination of technological advancements and evolving consumer preferences. The integration of smart home technologies is expected to enhance the appeal of remodeling projects, while sustainability trends will push for eco-friendly materials and practices. Additionally, as urbanization continues, the demand for innovative space-saving solutions will rise, creating new opportunities for contractors and homeowners alike in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Kitchen Remodeling Bathroom Remodeling Basement Finishing Room Additions Exterior/Outdoor Remodeling (decks, siding, roofing, windows, landscaping) Whole-House Renovation Energy-Efficient Upgrades (insulation, HVAC, solar, smart home) |

| By End-User | Owner-Occupied Households Rental Property Owners and Real Estate Investors Property Managers/HOAs Homebuilders-Remodelers and General Contractors (DIFM) |

| By Sales Channel | Direct-to-Consumer (Contractor-led/DIFM) DIY/Online Retail Home Improvement Stores (Big-box) Trade/Wholesale Distributors (Pro channels) |

| By Material Used | Wood and Engineered Wood Metals (steel, aluminum) Glass and Glazing Composites and Synthetics (vinyl, fiber cement, WPC) |

| By Design Style | Modern/Contemporary Traditional/Transitional Rustic/Farmhouse Minimalist/Scandinavian |

| By Project Size | Small-Scale (cosmetic, <$10k) Medium-Scale ($10k–$50k) Large-Scale (>$50k, structural) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kitchen Remodeling Projects | 120 | Homeowners, Kitchen Designers |

| Bathroom Renovation Trends | 100 | Contractors, Interior Designers |

| Outdoor Living Spaces | 80 | Landscape Architects, Homeowners |

| Energy-Efficient Upgrades | 70 | Home Improvement Specialists, Sustainability Consultants |

| Smart Home Technology Integration | 90 | Smart Home Installers, Homeowners |

The Global Home Remodeling Market is valued at approximately USD 950 billion, driven by factors such as rising disposable incomes, aging housing stock, and a growing interest in home personalization and sustainability.