Region:Global

Author(s):Dev

Product Code:KRAD0568

Pages:96

Published On:August 2025

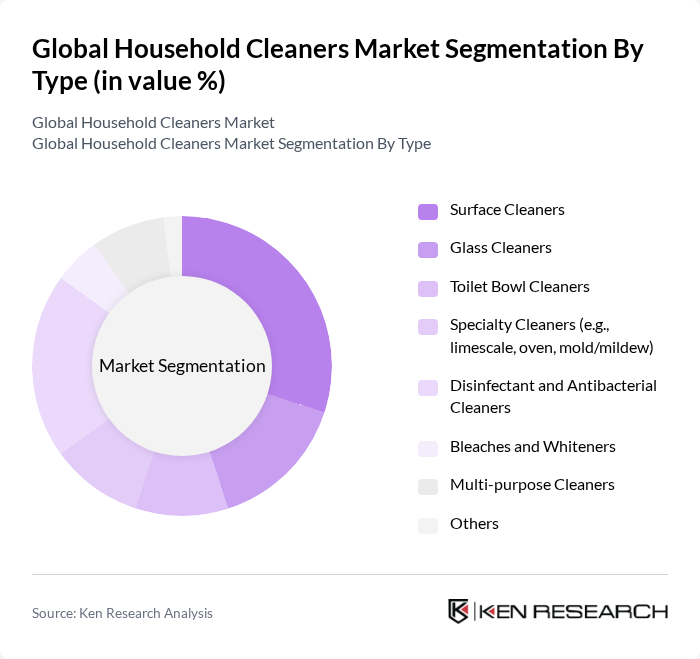

By Type:The market is segmented into various types of household cleaners, including Surface Cleaners, Glass Cleaners, Toilet Bowl Cleaners, Specialty Cleaners (e.g., limescale, oven, mold/mildew), Disinfectant and Antibacterial Cleaners, Bleaches and Whiteners, Multi-purpose Cleaners, and Others. Among these, Surface Cleaners dominate usage owing to versatility across high-touch areas and floors, with demand reinforced by hygiene focus and the shift toward greener, low-VOC, and biodegradable ingredients in ready-to-use sprays and wipes.

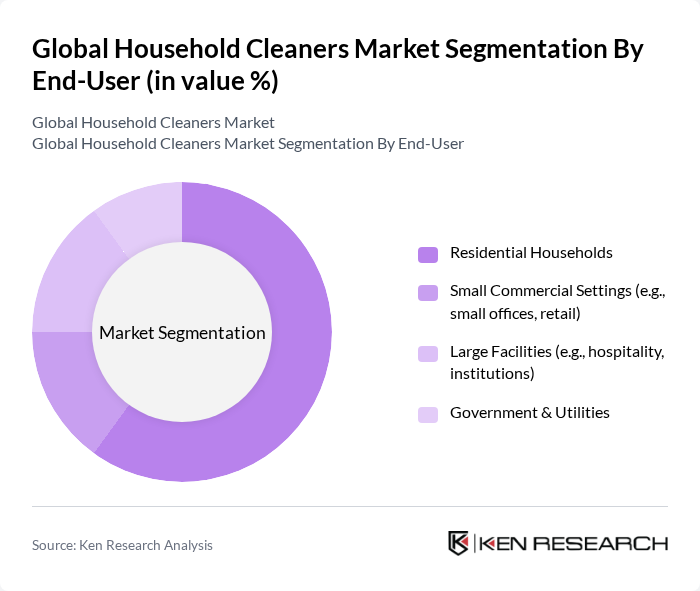

By End-User:The market is segmented by end-users into Residential Households, Small Commercial Settings (e.g., small offices, retail), Large Facilities (e.g., hospitality, institutions), and Government & Utilities. Residential Households lead due to the large installed base of homes and continuous replenishment needs; purchasing behavior is increasingly influenced by convenience formats, online subscriptions, and sustainability claims (plant-based, recyclable packaging).

The Global Household Cleaners Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Procter & Gamble Company, Unilever PLC, Reckitt Benckiser Group plc, SC Johnson & Son, Inc., Henkel AG & Co. KGaA, Colgate-Palmolive Company, The Clorox Company, Ecolab Inc., Church & Dwight Co., Inc., Diversey Holdings, Ltd., Kao Corporation, 3M Company, Reckitt’s Lysol & Dettol Brands, Method Products, PBC, Seventh Generation, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the household cleaners market appears promising, driven by evolving consumer preferences and technological advancements. The shift towards eco-friendly products is expected to accelerate, with a projected 20% increase in demand for sustainable cleaning solutions in future. Additionally, innovations in product formulations will likely enhance efficacy and safety, appealing to health-conscious consumers. As e-commerce continues to grow, brands that effectively leverage digital platforms will gain a competitive edge, ensuring sustained market relevance.

| Segment | Sub-Segments |

|---|---|

| By Type | Surface Cleaners Glass Cleaners Toilet Bowl Cleaners Specialty Cleaners (e.g., limescale, oven, mold/mildew) Disinfectant and Antibacterial Cleaners Bleaches and Whiteners Multi-purpose Cleaners Others |

| By End-User | Residential Households Small Commercial Settings (e.g., small offices, retail) Large Facilities (e.g., hospitality, institutions) Government & Utilities |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Direct Sales Wholesale/Club Stores Others |

| By Packaging Type | Bottles Pouches and Refill Packs Aerosol Cans Tubs and Canisters (e.g., wipes) Boxes (e.g., powders, sheets) Others |

| By Price Range | Economy Mid-range Premium |

| By Brand Type | National Brands Private Labels/Store Brands Indie and Niche Brands |

| By Product Formulation | Chemical/Synthetic Natural/Plant-based Biodegradable/Low-VOC Refillable/Concentrate Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Surface Cleaners Market | 120 | Product Managers, Brand Managers |

| Disinfectants Segment | 100 | Retail Buyers, Category Managers |

| Specialty Cleaners Insights | 80 | R&D Managers, Marketing Managers |

| Consumer Preferences Study | 120 | Household Decision Makers, Trend Analysts |

| Online Purchase Behavior | 90 | E-commerce Managers, Digital Marketing Specialists |

The Global Household Cleaners Market is valued at approximately USD 3740 billion, driven by factors such as increased consumer hygiene awareness, rising disposable incomes, and urbanization, alongside a sustained demand for disinfecting products post-pandemic.