Region:Global

Author(s):Shubham

Product Code:KRAD0781

Pages:92

Published On:August 2025

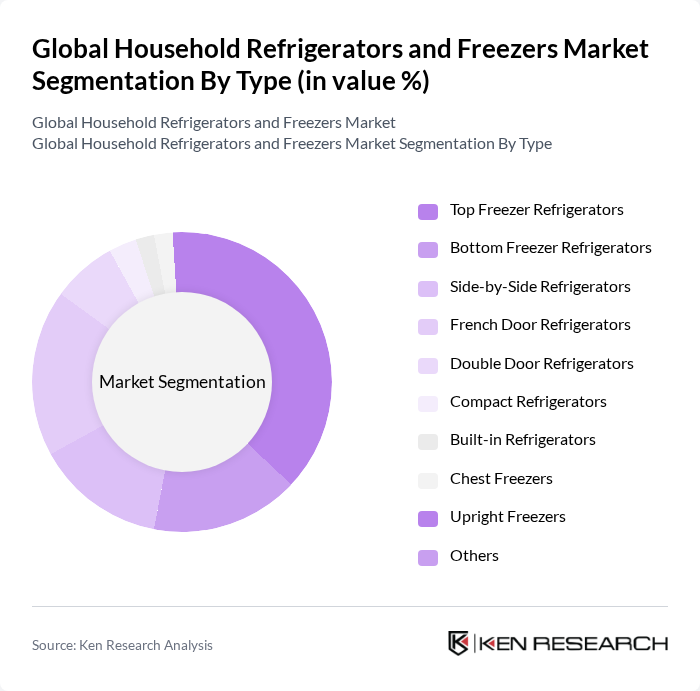

By Type:The market is segmented into various types of refrigerators and freezers, each catering to distinct consumer needs and preferences. The most popular types include Top Freezer Refrigerators, Bottom Freezer Refrigerators, Side-by-Side Refrigerators, French Door Refrigerators, Double Door Refrigerators, Compact Refrigerators, Built-in Refrigerators, Chest Freezers, Upright Freezers, and Others. Top Freezer Refrigerators are particularly favored for their traditional design, affordability, and high storage capacity, while French Door Refrigerators are gaining traction due to their modern aesthetics, convenience, and advanced features .

By Structure:The market is also segmented by structure into Freestanding and Built-in models. Freestanding refrigerators are popular due to their flexibility in placement, variety of designs, and ease of installation, making them suitable for a wide range of kitchen layouts. Built-in refrigerators, while typically more expensive, are favored for their seamless integration into kitchen cabinetry and premium aesthetic appeal. The Freestanding segment dominates the market due to its practicality and broad consumer adoption .

The Global Household Refrigerators and Freezers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Haier Group Corporation, Electrolux AB, Bosch Home Appliances (BSH Hausgeräte GmbH), Panasonic Corporation, Miele & Cie. KG, Frigidaire (a subsidiary of Electrolux), GE Appliances (a Haier company), Sharp Corporation, Sub-Zero Group, Inc., Danby Products Ltd., Hisense Group, Smeg S.p.A., Dacor Inc. (a subsidiary of Samsung Electronics), Liebherr Group, Gorenje Group (a Hisense company), Arçelik A.?., Godrej Appliances contribute to innovation, geographic expansion, and service delivery in this space.

The future of the household refrigerators and freezers market appears promising, driven by technological innovations and evolving consumer preferences. As smart home technology continues to gain traction, manufacturers are likely to invest heavily in developing connected appliances that enhance user experience. Additionally, the growing emphasis on sustainability will push companies to innovate eco-friendly products, aligning with consumer demand for energy-efficient solutions. This dynamic landscape presents opportunities for growth and adaptation in an increasingly competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Top Freezer Refrigerators Bottom Freezer Refrigerators Side-by-Side Refrigerators French Door Refrigerators Double Door Refrigerators Compact Refrigerators Built-in Refrigerators Chest Freezers Upright Freezers Others |

| By Structure | Freestanding Built-in |

| By End-User | Residential Commercial (Small Businesses, Hospitality) |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets/Supermarkets) Direct Sales Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Energy Efficiency Rating | A+++ Rating A++ Rating A+ Rating B Rating |

| By Size (Capacity) | Less than 15 cu. ft. –25 cu. ft. More than 25 cu. ft. |

| By Feature | Smart Features (Wi-Fi, IoT-enabled) Water Dispenser Ice Maker Adjustable Shelves Inverter Compressor Frost-Free Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Refrigerators | 100 | Store Managers, Sales Representatives |

| Consumer Preferences for Freezers | 80 | Homeowners, Apartment Dwellers |

| Energy Efficiency Trends | 60 | Energy Consultants, Environmental Analysts |

| Market Trends in Smart Refrigerators | 50 | Tech Enthusiasts, Early Adopters |

| Impact of Pricing on Purchase Decisions | 70 | Budget-Conscious Consumers, Middle-Income Families |

The Global Household Refrigerators and Freezers Market is valued at approximately USD 127 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and technologically advanced appliances.