Region:Global

Author(s):Dev

Product Code:KRAD0551

Pages:94

Published On:August 2025

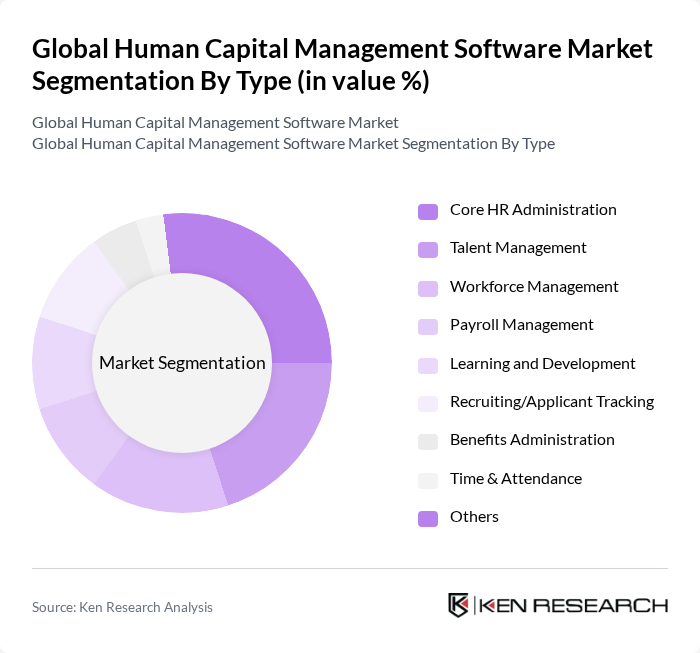

By Type:The market is segmented into various types, including Core HR Administration, Talent Management, Workforce Management, Payroll Management, Learning and Development, Recruiting/Applicant Tracking, Benefits Administration, Time & Attendance, and Others. Each of these sub-segments plays a crucial role in addressing specific HR needs and enhancing overall organizational efficiency.

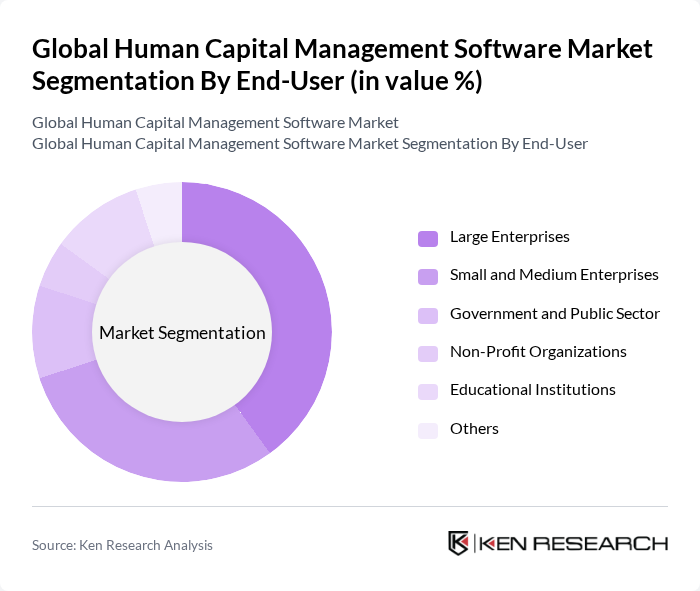

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Enterprises, Government and Public Sector, Non-Profit Organizations, Educational Institutions, and Others. Each segment has unique requirements and challenges, influencing the adoption of HCM solutions tailored to their specific needs.

The Global Human Capital Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE (SAP SuccessFactors), Oracle Corporation (Oracle Fusion Cloud HCM), Workday, Inc., ADP, Inc., UKG Inc. (Ultimate Kronos Group), Ceridian HCM Holding Inc. (Dayforce), Cornerstone OnDemand, Inc., BambooHR LLC, Paycor HCM, Inc., TriNet Group, Inc. (Zenefits), Gusto, Inc., Namely, Inc., Infor (Infor CloudSuite HCM), PeopleSoft (Oracle PeopleSoft HCM), Talentsoft (Cegid Talentsoft), Rippling, Personio SE & Co. KG, Paychex, Inc., Sage Group plc (Sage People), Zoho Corporation (Zoho People) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the HCM software market in None is poised for significant transformation, driven by technological advancements and evolving workforce dynamics. As organizations increasingly prioritize employee-centric solutions, the integration of AI and advanced analytics will become essential for optimizing talent management. Additionally, the focus on diversity and inclusion initiatives will shape product development, ensuring that HCM solutions align with contemporary workforce expectations and regulatory requirements, fostering a more inclusive workplace environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Core HR Administration Talent Management Workforce Management Payroll Management Learning and Development Recruiting/Applicant Tracking Benefits Administration Time & Attendance Others |

| By End-User | Large Enterprises Small and Medium Enterprises Government and Public Sector Non-Profit Organizations Educational Institutions Others |

| By Deployment Model | On-Premises Cloud Hybrid Others |

| By Functionality | Recruiting and Onboarding Performance and Goal Management Compensation and Benefits Learning Management Employee Engagement & Experience Workforce Planning & Analytics Compliance & Reporting Others |

| By Industry Vertical | IT and Telecom Healthcare Retail and E-Commerce Manufacturing BFSI Government and Public Sector Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Pricing Model | Subscription (Per Employee/Per Month) One-Time License Usage-Based (Pay-Per-Use/Module) Tiered/Bundled Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise HCM Software Adoption | 120 | HR Directors, IT Managers |

| SME HCM Solutions | 100 | Business Owners, HR Managers |

| Performance Management Systems | 80 | Talent Management Specialists, HR Analysts |

| Recruitment Software Utilization | 70 | Recruitment Officers, Staffing Agency Managers |

| Payroll and Compliance Solutions | 90 | Payroll Managers, Compliance Officers |

The Global Human Capital Management Software Market is valued at approximately USD 30 billion, reflecting a significant increase due to the accelerated adoption of cloud HCM solutions, AI-enabled HR workflows, and integrated HR platforms.