Region:Global

Author(s):Shubham

Product Code:KRAD0748

Pages:96

Published On:August 2025

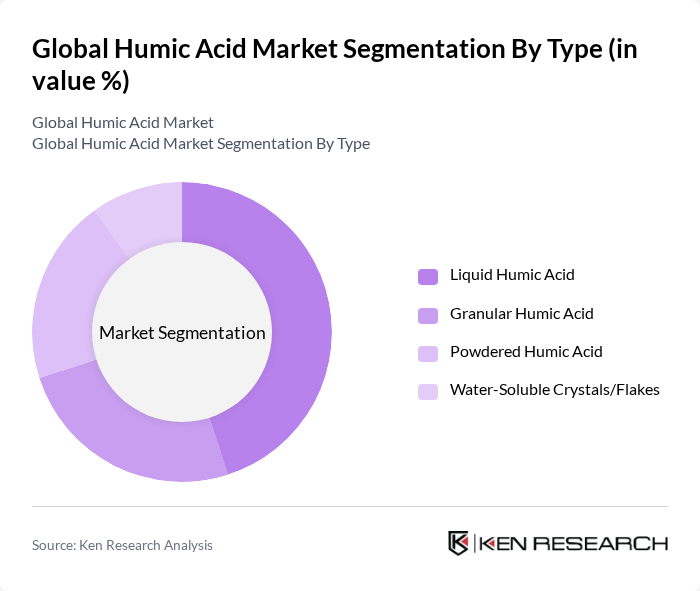

By Type:The humic acid market is segmented into four main types: Liquid Humic Acid, Granular Humic Acid, Powdered Humic Acid, and Water-Soluble Crystals/Flakes. Liquid Humic Acid maintains a leading position in many agricultural applications due to ease of application through fertigation and foliar routes and its role in enhancing nutrient uptake; growth in liquid fertilizer use and integrated nutrient management further supports demand.

By End-User:The end-user segmentation includes Agriculture (Row Crops, Fruits & Vegetables), Horticulture & Turf Management, Animal Feed & Aquaculture, and Environmental Remediation. The Agriculture segment holds the largest share, driven by the increasing adoption of organic farming practices and the need for soil health improvement. This trend is further supported by government initiatives promoting sustainable agriculture.

The Global Humic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Andersons, Inc., Humic Growth Solutions, Inc., Biolchim S.p.A., Black Earth Humic LP, Humintech GmbH, Omnia Specialities Australia Pty Ltd, Jiloca Industrial S.A. (JISA), CIFO S.r.l., Xian Shan Yuan Agriculture & Technology Co., Ltd., Desarrollo Agrícola y Minero S.A. (DAYMSA), Arctech, Inc., Agbest Technology Co., Ltd., Jiangxi Pingxiang Anhua Biotechnology Co., Ltd., BioAg, Inc., Nutrien Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the humic acid market in None appears promising, driven by increasing consumer demand for organic products and a shift towards sustainable agricultural practices. As awareness of soil health continues to grow, more farmers are likely to adopt humic acid as a key component of their farming strategies. Additionally, technological advancements in production methods are expected to enhance the quality and availability of humic acid, further supporting market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Humic Acid Granular Humic Acid Powdered Humic Acid Water-Soluble Crystals/Flakes |

| By End-User | Agriculture (Row Crops, Fruits & Vegetables) Horticulture & Turf Management Animal Feed & Aquaculture Environmental Remediation |

| By Application | Soil Amendment & Conditioner Fertilizer Additive/Chelating Agent Seed Treatment & Foliar Spray Water Treatment & Waste Management |

| By Distribution Channel | Direct Sales (B2B, Cooperatives) Online Retail & Marketplaces Distributors & Agro-Dealers OEM/Private Label Partnerships |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging (Super Sacks, Drums, IBCs) Retail Packaging (Bags, Bottles, Pouches) Custom/Contract Packaging |

| By Price Range | Economy/Low Price Standard/Mid Price Premium/High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Sector Users | 150 | Farmers, Agronomists, Agricultural Extension Officers |

| Horticultural Applications | 100 | Horticulturists, Landscape Architects, Nursery Managers |

| Environmental Remediation Projects | 80 | Environmental Scientists, Soil Remediation Specialists |

| Humic Acid Product Manufacturers | 70 | Production Managers, R&D Directors, Sales Executives |

| Research Institutions and Universities | 60 | Researchers, Professors, Graduate Students in Soil Science |

The Global Humic Acid Market is valued at approximately USD 0.70 billion, reflecting a growing demand for organic fertilizers and soil conditioners, as well as increased awareness of sustainable agricultural practices.