Region:Global

Author(s):Shubham

Product Code:KRAB0543

Pages:93

Published On:August 2025

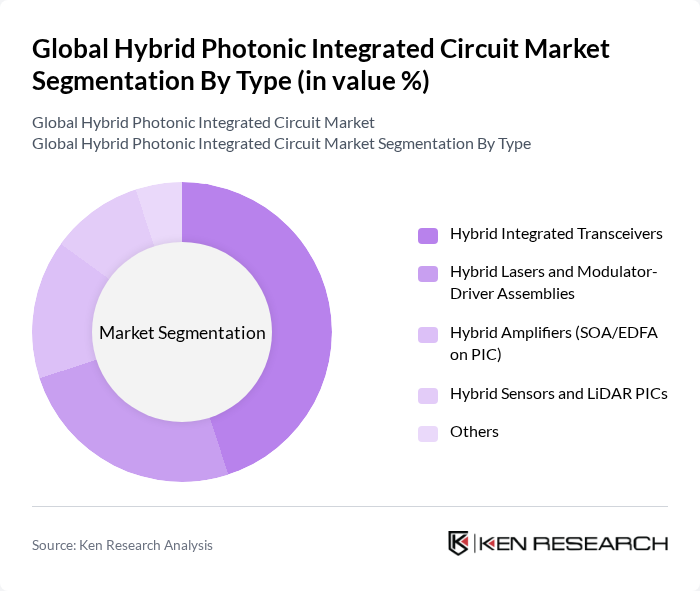

By Type:The market is segmented into various types, including Hybrid Integrated Transceivers, Hybrid Lasers and Modulator-Driver Assemblies, Hybrid Amplifiers (SOA/EDFA on PIC), Hybrid Sensors and LiDAR PICs, and Others. Among these, Hybrid Integrated Transceivers are leading the market due to their critical role in telecommunications and data centers, where high-speed data transfer is essential; rapid capacity growth for AI/ML clusters, co-packaged optics momentum, and 400G/800G/1.6T upgrades reinforce demand for integrated transceivers and modulators .

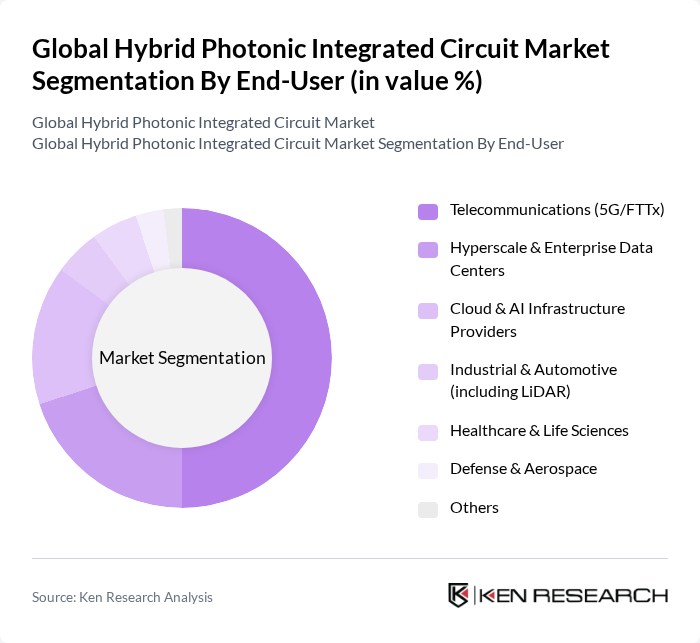

By End-User:The end-user segmentation includes Telecommunications (5G/FTTx), Hyperscale & Enterprise Data Centers, Cloud & AI Infrastructure Providers, Industrial & Automotive (including LiDAR), Healthcare & Life Sciences, Defense & Aerospace, and Others. The Telecommunications sector is the dominant end-user, driven by ongoing 5G/FTTx rollouts and the need for higher-capacity optical transport; simultaneously, hyperscale data centers and cloud/AI infrastructure show strong adoption of PIC-based transceivers and co-packaged optics to meet bandwidth and energy-efficiency targets .

The Global Hybrid Photonic Integrated Circuit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation (Silicon Photonics), Cisco Systems, Inc. (Acacia Communications), Infinera Corporation, Lumentum Holdings Inc., Coherent Corp. (formerly II-VI Incorporated), Broadcom Inc. (Silicon Photonics), Marvell Technology, Inc. (Inphi), NVIDIA Corporation (Mellanox/CPO ecosystem), Ayar Labs, Inc., NeoPhotonics Corporation (now part of Lumentum), Sicoya GmbH, DustPhotonics Ltd., NTT Electronics Corporation, Tyndall National Institute, EFFECT Photonics B.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the hybrid photonic integrated circuit market appears promising, driven by ongoing technological advancements and increasing demand across various sectors. As industries continue to embrace digital transformation, the integration of photonics with electronics will become more prevalent, enhancing performance and efficiency. Furthermore, the focus on sustainability and energy-efficient solutions will likely lead to innovative applications, positioning HPICs as a cornerstone of future technological developments in telecommunications, healthcare, and consumer electronics.

| Segment | Sub-Segments |

|---|---|

| By Type | Hybrid Integrated Transceivers Hybrid Lasers and Modulator-Driver Assemblies Hybrid Amplifiers (SOA/EDFA on PIC) Hybrid Sensors and LiDAR PICs Others |

| By End-User | Telecommunications (5G/FTTx) Hyperscale & Enterprise Data Centers Cloud & AI Infrastructure Providers Industrial & Automotive (including LiDAR) Healthcare & Life Sciences Defense & Aerospace Others |

| By Application | Optical Communication (DWDM, Coherent, CPO) Sensing & Metrology (LiDAR, spectroscopy) Computing & Switching (optical I/O, accelerators) Biomedical Imaging & Diagnostics (e.g., OCT) Quantum & Test Instruments Others |

| By Component/Platform | Lasers, Modulators, Detectors Waveguides, Multiplexers/Demultiplexers Hybrid Integration Platforms (Si, InP, SiN) Packaging & Co-Packaged Optics (CPO) Modules Others |

| By Sales Channel | Direct Sales to OEMs/ODMs Distributors/Value-Added Resellers Online/Platform Sales Others |

| By Integration/Material | Hybrid Integration (heterogeneous, hybrid bonding) Silicon Photonics with Heterogeneous InP/III-V Indium Phosphide-based Hybrid PICs Silicon Nitride-based Hybrid PICs Others |

| By Data Rate/Class | ?100G G–400G G–1.6T >1.6T |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Applications | 120 | Network Engineers, Telecom Product Managers |

| Data Center Solutions | 90 | Data Center Managers, IT Infrastructure Directors |

| Consumer Electronics Integration | 60 | Product Development Engineers, Electronics Designers |

| Medical Device Applications | 50 | Biomedical Engineers, Regulatory Affairs Specialists |

| Automotive Photonics | 80 | Automotive Engineers, R&D Managers |

The Global Hybrid Photonic Integrated Circuit Market is valued at approximately USD 12.5 billion, reflecting a robust demand driven by advancements in telecommunications and data center technologies, particularly for high-speed data transmission and energy-efficient optical communication systems.