Region:Global

Author(s):Shubham

Product Code:KRAD0708

Pages:99

Published On:August 2025

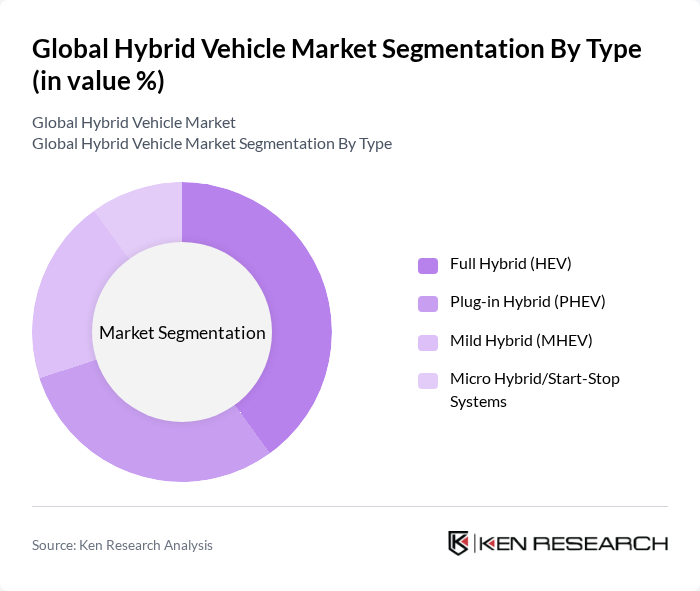

By Type:The hybrid vehicle market can be segmented into four main types: Full Hybrid (HEV), Plug-in Hybrid (PHEV), Mild Hybrid (MHEV), and Micro Hybrid/Start-Stop Systems. Each type serves different consumer needs and preferences, with Full Hybrids being popular for their efficiency and ease of use, while Plug-in Hybrids attract consumers looking for longer electric ranges.

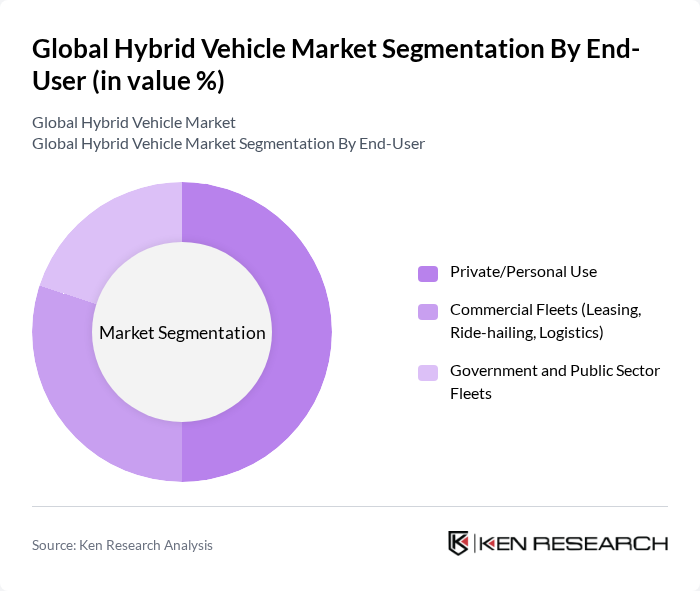

By End-User:The market can be categorized based on end-users into three segments: Private/Personal Use, Commercial Fleets (Leasing, Ride-hailing, Logistics), and Government and Public Sector Fleets. The Private/Personal Use segment is the largest, driven by individual consumers seeking fuel efficiency and lower emissions. Fleet electrification mandates and total-cost-of-ownership benefits are also increasing PHEV and HEV uptake in commercial and public-sector fleets.

The Global Hybrid Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, General Motors Company, BMW AG, Nissan Motor Co., Ltd., Hyundai Motor Company, Kia Corporation, Volkswagen AG, Mercedes-Benz Group AG, Subaru Corporation, Mitsubishi Motors Corporation, Volvo Car Corporation, Tata Motors Limited, BYD Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hybrid vehicle market in None appears promising, driven by technological advancements and increasing consumer demand for sustainable transport solutions. As battery technology continues to improve, hybrid vehicles will become more affordable and efficient, attracting a wider audience. Additionally, government policies aimed at reducing carbon emissions will likely bolster hybrid vehicle adoption. The integration of smart technologies and connectivity features will further enhance user experience, making hybrids a more appealing choice for environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Hybrid (HEV) Plug-in Hybrid (PHEV) Mild Hybrid (MHEV) Micro Hybrid/Start-Stop Systems |

| By End-User | Private/Personal Use Commercial Fleets (Leasing, Ride-hailing, Logistics) Government and Public Sector Fleets |

| By Fuel Type | Gasoline Hybrid Diesel Hybrid Alternative Fuel Hybrid (CNG/LPG/Ethanol) |

| By Vehicle Class | Hatchbacks & Compact Cars Sedans SUVs & Crossovers MPVs, Pickups, and Light Commercial Vehicles |

| By Sales Channel | OEM/Franchised Dealerships Direct-to-Consumer (Online/Factory Order) Fleet & Leasing Sales |

| By Region | North America (U.S., Canada) Europe (UK, Germany, France, Italy, Spain, Netherlands) Asia-Pacific (China, Japan, South Korea, India, Australia) Latin America (Brazil, Mexico, Argentina) Middle East & Africa (UAE, Saudi Arabia, South Africa) |

| By Price Range | Budget (Entry-level) Mid-Range (Mass Market) Premium/Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Adoption of Hybrid Vehicles | 120 | Car Owners, Prospective Buyers |

| Fleet Management Insights | 100 | Fleet Managers, Logistics Coordinators |

| Automotive Industry Experts | 80 | Automotive Engineers, Product Managers |

| Government Policy Impact | 60 | Regulatory Officials, Environmental Analysts |

| Consumer Preferences and Trends | 90 | Market Researchers, Consumer Behavior Analysts |

The Global Hybrid Vehicle Market is valued at approximately USD 290 billion, reflecting significant growth driven by consumer demand for fuel-efficient vehicles, government incentives, and advancements in hybrid technology.