Region:Global

Author(s):Dev

Product Code:KRAB0411

Pages:100

Published On:August 2025

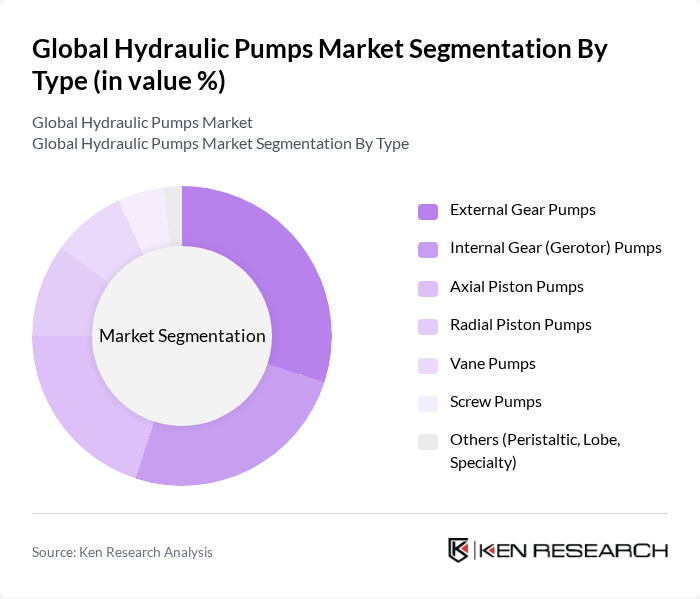

By Type:The hydraulic pumps market can be segmented into External Gear Pumps, Internal Gear (Gerotor) Pumps, Axial Piston Pumps, Radial Piston Pumps, Vane Pumps, Screw Pumps, and Others (Peristaltic, Lobe, Specialty). External Gear Pumps are widely used due to their simplicity, durability, and cost-effectiveness in a wide range of mobile and industrial applications. Internal Gear Pumps hold a significant role where smooth flow and handling of viscous fluids are required. Demand for Axial Piston Pumps is strong in mobile machinery and high-pressure applications due to efficiency and variable displacement options, while Vane Pumps are favored for balanced performance and lower noise in industrial settings.

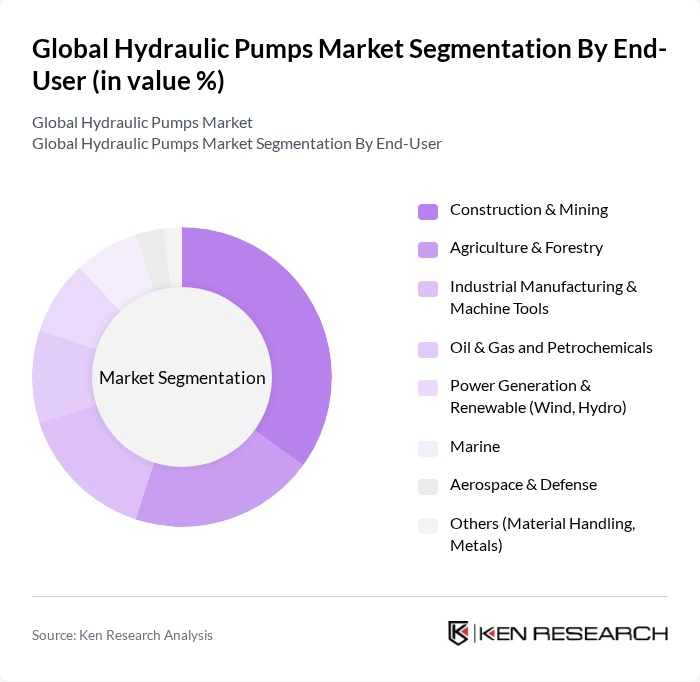

By End-User:The hydraulic pumps market is segmented by end-user industries, including Construction & Mining, Agriculture & Forestry, Industrial Manufacturing & Machine Tools, Oil & Gas and Petrochemicals, Power Generation & Renewable (Wind, Hydro), Marine, Aerospace & Defense, and Others (Material Handling, Metals). The Construction & Mining sector is a leading consumer owing to heavy equipment demand and infrastructure activity; Agriculture also contributes materially through tractors, harvesters, and implements; while Oil & Gas uses high-reliability pumps for drilling, production, and processing operations.

The Global Hydraulic Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Parker Hannifin Corporation, Bosch Rexroth AG, Eaton Corporation plc, Danfoss A/S (including Danfoss Power Solutions, formerly Eaton Hydraulics), HYDAC International GmbH, Kawasaki Heavy Industries, Ltd. (Kawasaki Precision Machinery), Yuken Kogyo Co., Ltd., SUN Hydraulics LLC (Helios Technologies), Moog Inc., Hawe Hydraulik SE, Bucher Hydraulics AG (Bucher Industries), Casappa S.p.A., Linde Hydraulics GmbH & Co. KG, Kawasaki Precision Machinery (U.K.) Ltd., KYB Corporation, NACHI-FUJIKOSHI CORP., ARGO-HYTOS Group AG, contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydraulic pumps market appears promising, driven by ongoing technological innovations and a shift towards sustainable practices. As industries increasingly adopt electric and hybrid hydraulic systems, the market is expected to witness a transformation in product offerings. Additionally, the integration of IoT technologies will enhance operational efficiency and predictive maintenance, further driving demand. Companies that invest in R&D and sustainable solutions are likely to gain a competitive edge in this evolving landscape, positioning themselves for long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | External Gear Pumps Internal Gear (Gerotor) Pumps Axial Piston Pumps Radial Piston Pumps Vane Pumps Screw Pumps Others (Peristaltic, Lobe, Specialty) |

| By End-User | Construction & Mining Agriculture & Forestry Industrial Manufacturing & Machine Tools Oil & Gas and Petrochemicals Power Generation & Renewable (Wind, Hydro) Marine Aerospace & Defense Others (Material Handling, Metals) |

| By Application | Mobile Hydraulics (Excavators, Loaders, Tractors) Industrial Hydraulics (Presses, Injection Molding, CNC) Hydraulic Power Units (HPUs) Steering/Transmission & Auxiliary Systems Others |

| By Distribution Channel | Direct (OEM) Authorized Distributors/Value-Added Resellers Online/Marketplace Industrial/MRO Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Fixed Displacement Variable Displacement Electro-Hydraulic & Smart (IoT-enabled) Hybrid Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Manufacturers | 100 | Product Managers, R&D Engineers |

| Agricultural Machinery Users | 80 | Farm Equipment Operators, Agricultural Engineers |

| Industrial Machinery Suppliers | 90 | Supply Chain Managers, Operations Directors |

| Hydraulic System Integrators | 70 | Technical Sales Representatives, System Designers |

| Maintenance and Repair Services | 60 | Service Managers, Field Technicians |

The Global Hydraulic Pumps Market is valued at approximately USD 10.9 billion, with estimates ranging between USD 10 billion and USD 12 billion based on recent analyses. This valuation reflects a robust demand driven by various industries, including construction and manufacturing.