Region:Global

Author(s):Shubham

Product Code:KRAC0725

Pages:100

Published On:August 2025

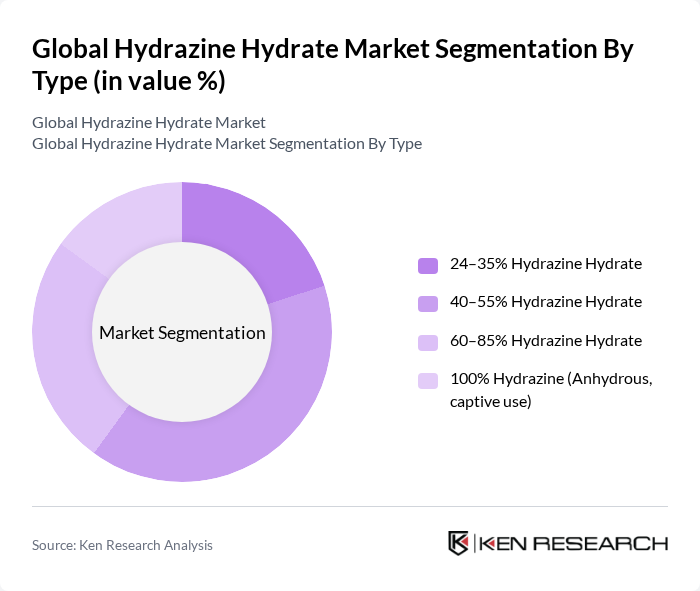

By Type:The market is segmented by concentration into 24–35% Hydrazine Hydrate, 40–55% Hydrazine Hydrate, 60–85% Hydrazine Hydrate, and 100% Hydrazine (Anhydrous, captive use). Commercial supply is commonly concentrated in the 40–55% and 60–85% bands for downstream uses such as polymerization/blowing agents, agrochemical intermediates, and boiler oxygen scavenging. The 40–55% Hydrazine Hydrate range is widely adopted in applications including water treatment and chemical synthesis due to handling practicality and cost-performance in typical industrial dosing regimes.

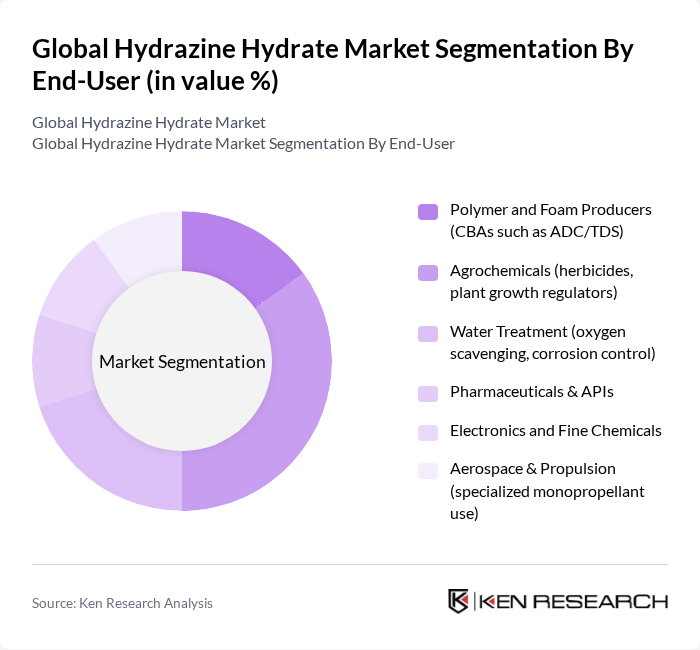

By End-User:End-use industries include Polymer and Foam Producers, Agrochemicals, Water Treatment, Pharmaceuticals & APIs, Electronics and Fine Chemicals, and Aerospace & Propulsion. Polymerization and blowing agents (e.g., azodicarbonamide derivatives), agrochemicals (triazoles and other intermediates), and water treatment as an oxygen scavenger are the principal demand pools cited across industry sources. Agrochemicals continue to be an important application area given ongoing demand for crop protection intermediates, while water treatment adoption is supported by corrosion control needs in industrial boilers.

The Global Hydrazine Hydrate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arkema S.A., LANXESS AG, Otsuka–MGC Chemical Company, Inc. (OMCC), Japan FineChem Co., Inc., Nippon Carbide Industries Co., Inc., Yibin Tianyuan Group Co., Ltd., Weifang Yaxing Chemical Co., Ltd., Hunan Zhuzhou Chemical Industry Group Co., Ltd., Jiangsu Yabang Chemical Group Co., Ltd., Jiangshan Chemical Co., Ltd. (Jiangshan Holdings), Taminco (Eastman Chemical Company), BASF SE, Huntsman Corporation, Solvay S.A., Lonza Group Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrazine hydrate market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production techniques are expected to enhance efficiency and reduce environmental impact, while the growing demand for specialty chemicals will further stimulate market growth. Additionally, as emerging markets continue to develop, the need for hydrazine hydrate in various applications will likely increase, presenting significant opportunities for industry players to expand their reach and enhance profitability.

| Segment | Sub-Segments |

|---|---|

| By Type | –35% Hydrazine Hydrate –55% Hydrazine Hydrate –85% Hydrazine Hydrate % Hydrazine (Anhydrous, captive use) |

| By End-User | Polymer and Foam Producers (CBAs such as ADC/TDS) Agrochemicals (herbicides, plant growth regulators) Water Treatment (oxygen scavenging, corrosion control) Pharmaceuticals & APIs Electronics and Fine Chemicals Aerospace & Propulsion (specialized monopropellant use) |

| By Application | Polymerization & Blowing Agents Water Treatment Chemicals Agrochemical Intermediates Pharmaceutical Intermediates Chemical Synthesis/Reducing Agent Rocket Propellant/Power Generation |

| By Distribution Channel | Direct/Captive Sales (producer to industrial buyers) Global Chemical Distributors Regional Traders/Blenders Online Procurement Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | HDPE Drums IBC Totes ISO Tank/Bulk Specialty Containers (stabilized/returnable) |

| By Price Range | Commodity Grades Mid-spec Industrial Grades High-Purity/Specialty Grades Contract/Spot Blended Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 100 | R&D Managers, Aerospace Engineers |

| Pharmaceutical Manufacturing | 90 | Production Supervisors, Quality Control Managers |

| Agricultural Chemicals | 80 | Product Development Managers, Agronomists |

| Industrial Applications | 100 | Operations Managers, Supply Chain Analysts |

| Research Institutions | 70 | Research Scientists, Chemical Engineers |

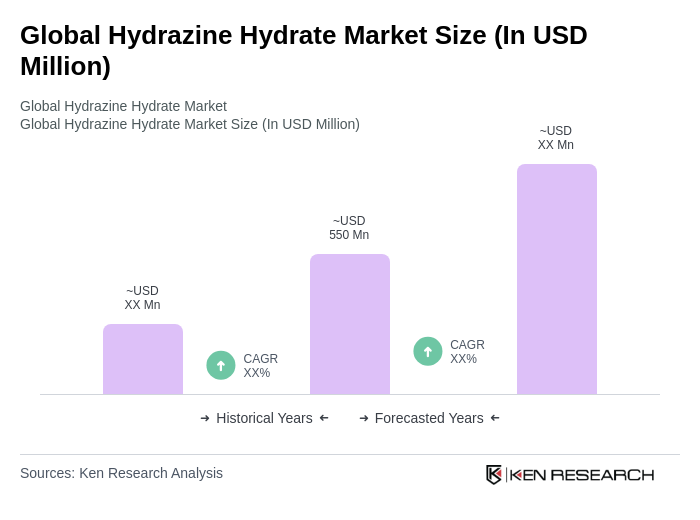

The Global Hydrazine Hydrate Market is valued at approximately USD 550 million, reflecting demand across various sectors such as agrochemicals, pharmaceuticals, and water treatment, based on a five-year historical analysis.