Region:Global

Author(s):Dev

Product Code:KRAD0573

Pages:90

Published On:August 2025

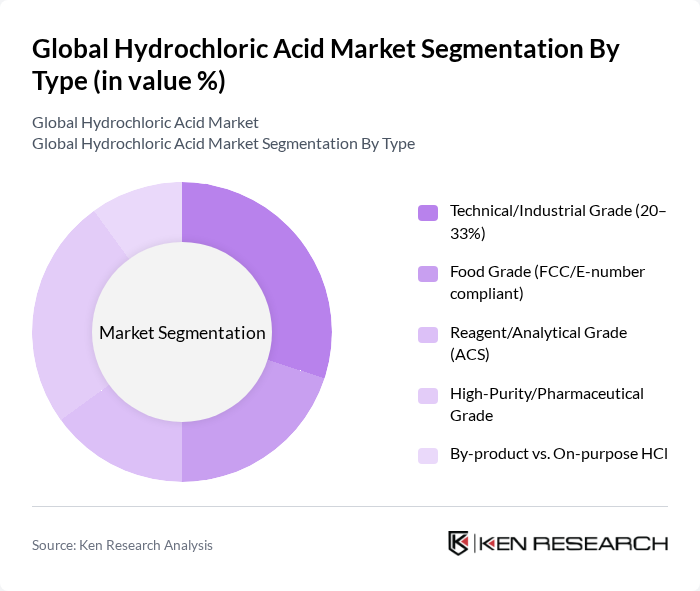

By Type:The hydrochloric acid market can be segmented into various types, including Technical/Industrial Grade, Food Grade, Reagent/Analytical Grade, High-Purity/Pharmaceutical Grade, and By-product vs. On-purpose HCl. Each type serves distinct applications across industries, influencing market dynamics.

By End-User:The end-user segmentation includes Chemical Manufacturing, Metal & Steel Processing, Oil & Gas, Food & Beverage Processing, Water & Wastewater Treatment, Pharmaceuticals & Healthcare, and Others. Each sector utilizes hydrochloric acid for specific applications, driving demand and shaping market trends.

The Global Hydrochloric Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Olin Corporation, Westlake Corporation, INEOS Group Holdings S.A., Solvay S.A., Occidental Petroleum Corporation (OxyChem), Covestro AG, Shin-Etsu Chemical Co., Ltd., Formosa Plastics Corporation, Tata Chemicals Limited, Univar Solutions Inc., Aarti Industries Limited, Aditya Birla Chemicals (Grasim Industries), Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrochloric acid market appears promising, driven by technological advancements and increasing applications across various industries. The shift towards sustainable production practices is expected to gain momentum, with companies investing in eco-friendly technologies. Additionally, the demand for specialty hydrochloric acid is likely to rise, catering to niche markets such as electronics and pharmaceuticals. These trends indicate a dynamic market landscape, with opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Technical/Industrial Grade (20–33%) Food Grade (FCC/E-number compliant) Reagent/Analytical Grade (ACS) High-Purity/Pharmaceutical Grade By-product vs. On-purpose HCl |

| By End-User | Chemical Manufacturing (chlorides, organics, fertilizers) Metal & Steel Processing Oil & Gas (well acidizing/stimulation) Food & Beverage Processing Water & Wastewater Treatment Pharmaceuticals & Healthcare Others (textiles, electronics, leather) |

| By Application | pH Control & Neutralization Pickling of Steel & Descaling Calcium Chloride and Other Inorganic Chlorides Production Oil Well Acidizing Water Treatment (ion exchange regeneration) Food Processing (pH adjuster, processing aid) Others (latex coagulation, ore processing) |

| By Distribution Channel | Direct/Bulk Contracts (producers to end-users) Chemical Distributors Online Procurement Platforms Retail/Industrial Suppliers Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Packaging Type | Drums IBC Totes Bulk Tankers/Railcars ISO Containers Others |

| By Purity Level | –33% Concentration –25% Concentration –37% Concentration >37% (high-purity/anhydrous streams) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Metal Processing Industry | 110 | Production Managers, Quality Control Supervisors |

| Water Treatment Facilities | 85 | Environmental Engineers, Operations Managers |

| Pharmaceutical Manufacturing | 70 | Regulatory Affairs Specialists, Production Leads |

| Food Processing Sector | 60 | Quality Assurance Managers, Supply Chain Coordinators |

| Chemical Distribution Networks | 90 | Sales Managers, Logistics Coordinators |

The Global Hydrochloric Acid Market is valued at approximately USD 2.6 billion, based on a five-year historical analysis. This valuation reflects the increasing demand from various end-user industries, including chemical manufacturing, metal processing, and oil & gas.