Region:Global

Author(s):Rebecca

Product Code:KRAA1442

Pages:96

Published On:August 2025

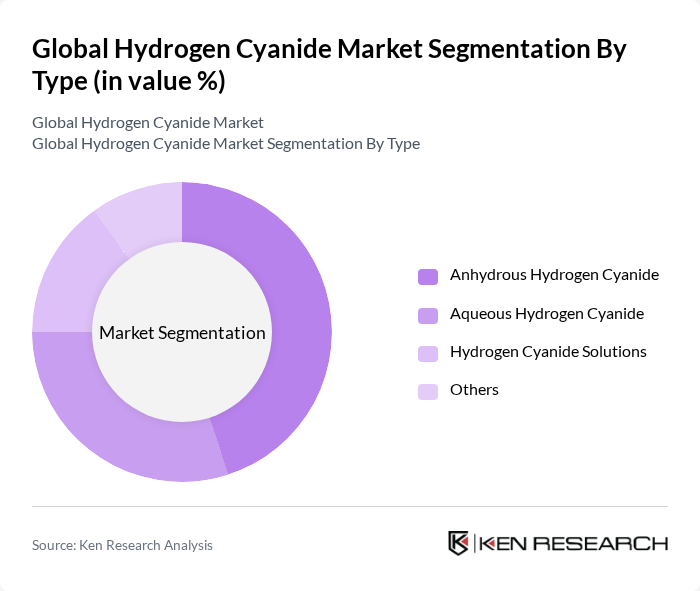

By Type:The hydrogen cyanide market is segmented into four main types: Anhydrous Hydrogen Cyanide, Aqueous Hydrogen Cyanide, Hydrogen Cyanide Solutions, and Others. Among these, Anhydrous Hydrogen Cyanide is the leading sub-segment due to its extensive use in the production of various chemicals and its high purity level, which is essential for industrial applications. Aqueous Hydrogen Cyanide is also significant, primarily used in agricultural and pharmaceutical applications, while Hydrogen Cyanide Solutions cater to specialized industrial needs.

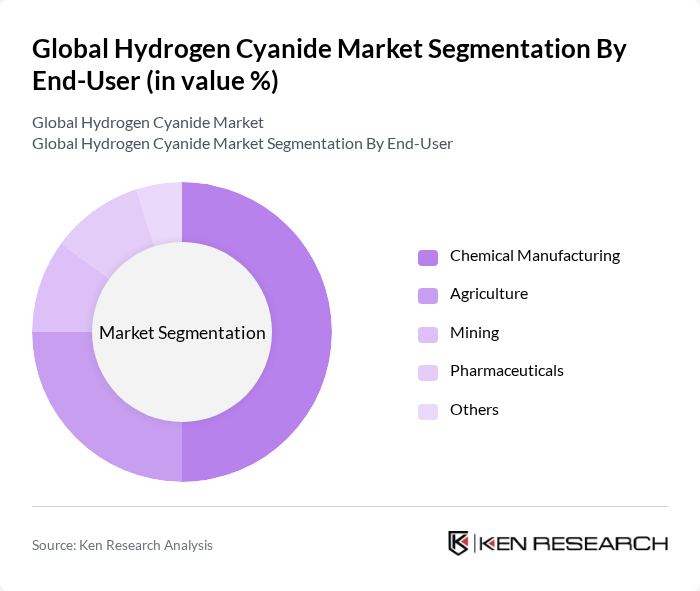

By End-User:The market is categorized into Chemical Manufacturing, Agriculture, Mining, Pharmaceuticals, and Others. The Chemical Manufacturing sector is the dominant end-user, driven by the high demand for hydrogen cyanide in producing various chemicals, including plastics, synthetic fibers, and specialty intermediates. Agriculture follows closely, as hydrogen cyanide is crucial for pesticide production and crop protection chemicals. The mining and pharmaceutical sectors also contribute significantly, utilizing hydrogen cyanide for gold extraction and as a precursor in pharmaceutical synthesis.

The Global Hydrogen Cyanide Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, DuPont de Nemours, Inc., AkzoNobel N.V., Mitsubishi Gas Chemical Company, Inc., Huntsman Corporation, AdvanSix Inc., Solvay S.A., Evonik Industries AG, INEOS Group Holdings S.A., Taminco Corporation (now part of Eastman Chemical Company), Chemtura Corporation (now part of Lanxess AG), Lanxess AG, Eastman Chemical Company, LyondellBasell Industries N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrogen cyanide market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production methods, such as bio-based synthesis, are gaining traction, potentially reducing environmental impacts. Additionally, the increasing focus on circular economy principles is likely to create new applications for hydrogen cyanide in specialty chemicals, enhancing its market relevance. As industries adapt to these trends, the hydrogen cyanide market in None is expected to evolve, presenting new growth avenues.

| Segment | Sub-Segments |

|---|---|

| By Type | Anhydrous Hydrogen Cyanide Aqueous Hydrogen Cyanide Hydrogen Cyanide Solutions Others |

| By End-User | Chemical Manufacturing Agriculture Mining Pharmaceuticals Others |

| By Application | Pesticides Plastics (e.g., Acrylonitrile, Nylon) Dyes and Pigments Adiponitrile Production Acetone Cyanohydrin DL-Methionine Sodium Cyanide Cyanuric Chloride Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, France, Italy, Spain, Russia, Benelux, Nordics, Turkey, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Saudi Arabia, South Africa, GCC, North Africa, Rest of Middle East & Africa) |

| By Packaging Type | Cylinders Drums Bulk Containers Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agrochemical Applications | 60 | Product Managers, Agronomists |

| Pharmaceutical Manufacturing | 50 | Quality Control Managers, R&D Scientists |

| Mining and Metallurgy | 40 | Process Engineers, Operations Managers |

| Chemical Synthesis | 45 | Production Supervisors, Chemical Engineers |

| Environmental Safety Compliance | 40 | Regulatory Affairs Specialists, Safety Officers |

The Global Hydrogen Cyanide Market is valued at approximately USD 2.7 billion, driven by its demand in chemical manufacturing, agriculture, and pharmaceuticals, among other applications. This valuation is based on a five-year historical analysis of market trends.